NextEra Energy Partners (NYSE: NEP) is currently offering a monstrous dividend yield. The renewable energy company’s payout yields more than 14%which is about 10 times higher than the S&P 500‘S dividend yield. Furthermore, the company plans to continue increasing its payout in the future.

As attractive as this is, dividend shares renewable energy it seems that those looking for a sustainable income stream, forget it now. Instead, income-oriented investors should buy Brookfield Renewable (NYSE: BEPC)(NYSE: BEP)Although it has a lower return (more than 5%), it is based on a much more sustainable basis.

Low power

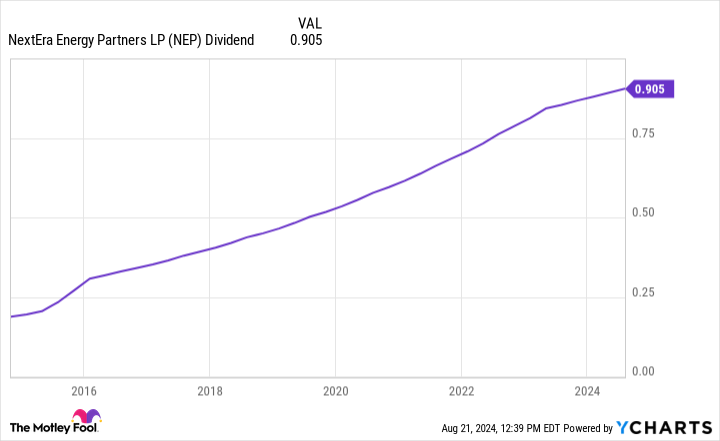

NextEra Energy Partners currently has a great dividend paying record. renewable energy The producer has increased its payout every quarter since going public more than a decade ago.

The company expects that steady upward trend to continue. It plans to increase its payment by 5% to 8% per year through 2026, with a target of 6% per year. While that is a much slower pace than initially expected (12% to 15% per year), it is a solid pace, especially for such a high yield dividend stocks.

NextEra Energy Partners had to put the brakes on its growth plans due to rising demand for energy. costs of capital. Rising interest rates and falling stock prices have made it too expensive to borrow money to refinance maturing loans and finance new acquisitions at attractive rates because of the junk-rated credit. That forced the company to change its strategy. It is selling its natural gas pipeline business to cover its upcoming financing acquisitions. It is also relying on organic expansion projects (mainly wind repowering projects) to increase its cash flow to support its dividend growth plan.

The company expects that its dividend payout ratio will be in the mid 90% range until 2026, which is far too high. That’s why there is a high risk that the company will have to reduce its benefits in the coming yearsThat makes it too risky at this point for investors looking for income.

Enough power to keep growing

Brookfield Renewable’s financial profile is built on a much more sustainable foundation these daysUnlike NextEra Energy Partners, Brookfield Renewable a strong investment grade creditworthiness. In the meantime the company does not trust on short-term financing to finance acquisitions. It primarily uses equity and cheap, long-term, fixed-rate debt, so higher interest rates are not had some influence on its growth strategy.

Instead of hitting the brakes, Brookfield Renewable has hit the gas pedal. The company expects its Funds from operations (FFO) per share at an annual rate of more than 10% through at least 2028. The company sees several factors driving growth, including inflation-related contractual rate increases, margin improvement activities, the development pipeline and acquisitions.

While NextEra Energy Partners has primarily based itself on on acquisitions to stimulate growth (mainly drop-down transactions from the parent company, NextEra Energy), Brookfield focuses on organic development projects with higher returns. The company has a huge backlog of projects that should fuel growth for years to come to come.

Meanwhile, the company is pursuing a very different strategy for financing acquisitions: capital recycling. Brookfield routinely sells mature assets to fund new investments with higher returns. For example, the company expects to generate $1.3 billion this year from capital recycling activities, which will help it fund the $970 million it has committed to invest in several accretive acquisitions.

Brookfield expects its growing cash flows to support annual dividend growth of 5% to 9%, which is in line with its expected organic growth rate of 6% to 9%. That would continue its trend of increasing its payout by at least 5% per year, something it has done for 13 consecutive years. Meanwhile, with earnings growing faster than its dividend, Brookfield’s payout ratio will steadily decline from its already comfortable level of less than 75%.

A much more sustainable income stream

NextEra Energy Partners Double-Digit Dividend Yield might seem tempting. However, that payout is is not on a solid foundation these days due to the weak financial profile. Therefore, investors looking for income should forget about the company until it fixes its problems.

They should buy Brookfield Renewable instead. The company has a long history of growing its high-yield payout, which should continue. It supports its dividend with a a lot of stronger financial profile and very visible growth prospects. As a result, it offers a much more sustainable revenue stream that should increase steadily in the future.

Should You Invest $1,000 In NextEra Energy Partners Now?

Before you buy NextEra Energy Partners stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and NextEra Energy Partners wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $758,227!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 22, 2024

Matt DiLallo has positions in Brookfield Renewable, Brookfield Renewable Partners, NextEra Energy, and NextEra Energy Partners. The Motley Fool has positions in and recommends Brookfield Renewable and NextEra Energy. The Motley Fool recommends Brookfield Renewable Partners. The Motley Fool has a disclosure policy.

Forget NextEra Energy Partners: Buy This Top-Notch Ultra-High Yield Stock Instead was originally published by The Motley Fool