Dividend investing is a proven strategy for building long-term wealth. It may not be as sexy as buying the hottest hyper-growth stocks or cutting-edge technology companies, but dividend stocks can be the turtle that powers stable portfolio wealth over multi-decade periods. And it takes time. For example, if you buy a dividend stock that yields 2% and the dividend per share grows at 6% per year, it will only yield 3.6% over ten years. But if that same compounding continues for thirty years, your initial investment will return over 11% at the end of the period.

This may not seem like much to investors used to high-speed tech stocks, but you have to remember that dividend growth stocks pay you a cash payment every year that you can choose to keep in cash or reinvest in a dividend reinvestment program (DRIP). This is the steady compounding that can turn a boring stock into an investment for millionaires.

Perhaps the perfect dividend growth stock Lockheed Martin (NYSE:LMT). The aerospace and defense contractor has steadily increased its dividend payout, resulting in a total return (including dividends) of almost 5,000% over the past 30 years. Here’s why you should buy these dividend growth stocks and never sell them.

Lockheed Martin: the premier aerospace defense contractor

To understand Lockheed Martin, we must understand government contracts in defense and aerospace. Typically, the U.S. government will propose a technology or defense system (e.g., a fighter jet) that private companies can bid on. There will also be subcontracting and the ability to sell these products to US allies. Once these contracts are in place, they can last for decades as the company builds, sells and maintains these product platforms.

Lockheed Martin is the largest defense contractor in the US with a focus on aerospace systems. It is the prime contractor for the F-35 fighter jet, the current generation fighter jet on which the US government has spent hundreds of billions over decades. As one of the longest-standing defense contractors with a reputation for technological innovation, Lockheed was able to win the F-35 deal over competitors such as Boeing.

In addition to aerospace, Lockheed also has programs in space exploration, missiles and mission systems. All four segments are profitable for Lockheed, generating combined operating income of $8.5 billion over the past twelve months. With long-term agreements in place for these programs, Lockheed Martin has a massive $158 billion backlog that will generate predictable revenue for many years to come.

Predictable dividend growth

Dividend growth is driven by earnings growth. Lockheed Martin enjoys predictable profit growth thanks to these long-term government contracts. Let’s use the free cash flow per share earnings measure and compare it to Lockheed’s dividend per share.

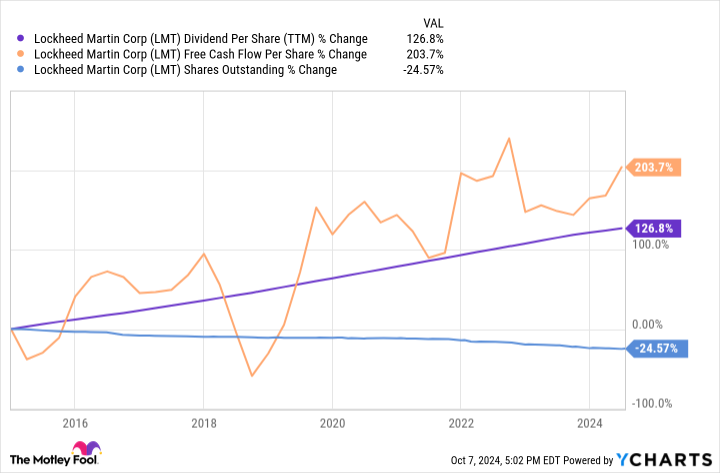

Lockheed Martin’s free cash flow per share has grown by 204% over the past ten years. This is the fuel for growing dividend payments. There is no cash flow and the dividends cannot be paid. It’s that simple. Combined with this cash flow growth, Lockheed’s dividend per share has grown by a total of 127% over the past decade. Interestingly, cash flow growth has significantly exceeded dividend growth for Lockheed, which should tell investors that the company could have grown its dividend payout faster than it actually did.

With free cash flow per share of $28.46 over the last twelve months and a dividend per share of just $12.45, Lockheed Martin can continue to grow its dividend for many years to come, even if free cash flow per share growth stagnates. However, as discussed above, these long-term contracts make it extremely unlikely that Lockheed’s revenues will stop growing anytime soon.

Don’t forget about stock buybacks

The icing on the cake of Lockheed Martin’s dividend growth is the company’s stock buyback program. Share buybacks reduce the number of shares of a stock, which means you have fewer shares to pay dividends on. This makes it easier (all else equal) for a company to keep increasing its dividend per share. Lockheed has been buying back shares for years, with the number of shares outstanding falling by about 25% over the past decade. As this continues, the dividend per share you receive as a remaining shareholder should continue to grow as well.

Right now, Lockheed Martin stock has a dividend yield of just 2.1%, which doesn’t look very delicious. However, with its history of dividend growth, this could be a huge winning stock for investors who plan to buy and hold for decades.

Don’t miss this second chance at a potentially lucrative opportunity

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, then you have $20,855!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $43,423!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $392,297!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

See 3 “Double Down” Stocks »

*Stock Advisor returns October 7, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool recommends Lockheed Martin. The Motley Fool has a disclosure policy.

Do you want a decade of growing passive income? Buy this dividend growth stock and never sell it. was originally published by The Motley Fool