Artificial intelligence (AI) is currently creating a significant amount of value for investors. It helped catapult Nvidia from a market cap of approximately $360 billion to over $3.3 trillion in the past 18 months alone, and this continues to drive Microsoft And Amazon higher, as well as many others.

But jumping on the AI bandwagon is not a silver bullet for organizations facing deeper challenges. Snowflake (NYSE: SNOW) is a good example: while it is in a fantastic position to develop AI products and services, the underlying business continues to struggle with slowing revenue growth and significant financial losses.

Although Snowflake stock is down 67% from its all-time high, a further 50% decline from its current price cannot be ruled out.

Snowflake is in a great position to build AI services

Snowflake developed its Data Cloud to help organizations break down the data silos that arise when they use different cloud service providers (such as Amazon Web Services and Microsoft Azure). The Data Cloud allows them to unify all their data and provide them with powerful analytics software to help them get the most value out of it.

Since Snowflake specializes in data management, it is perfectly positioned to provide AI products and services to its customers. Last year it launched Cortex AI, a platform that companies can use to develop their own AI applications using a combination of their own data and off-the-shelf large language models.

In addition, Cortex AI offers companies a number of AI tools developed in-house by Snowflake. Document AI can extract data from unstructured sources such as contracts, and Universal Search enables all employees – even those in non-technical roles – to discover valuable insights from their organization’s data using natural language searches, without any programming knowledge required is.

Snowflake’s revenue growth continues to slow

Snowflake generated $789.6 million in product revenue during the first quarter of fiscal 2025 (which ended April 30). That was an increase of 34% compared to the same period last year. However, the growth rate on this metric has consistently slowed since the company went public four years ago:

|

Period |

Product revenue growth (YOY) |

|

|---|---|---|

|

Q1 fiscal year 2022 |

110% |

|

|

Q1 fiscal year 2023 |

84% |

|

|

Q1 fiscal year 2024 |

50% |

|

|

Q1 fiscal year 2025 |

34% |

Data source: Snowflake. YOY = Year after year.

Snowflake isn’t cutting back on growth-generating costs like marketing or research and development, which could help explain this slowdown. In fact, operating costs rose 31.6% year-on-year during the first fiscal year.

There are a few other things at play. Snowflake’s net revenue retention was 128% in the first quarter, so its established customers spent an average of 28% more money on it than in the year-ago period. In a way, that’s a good sign. However, net revenue retention declined steadily from the peak of 179% at the end of fiscal 2022. That directly contributes to revenue growth.

Second, the rate at which Snowflake adds new customers is slowing. That’s understandable, as it has already secured 709 of the Forbes Global 2000 (the 2,000 largest companies in the world). It’s unclear how many of the others actually need the services Snowflake provides, which is critical because these large organizations could theoretically be among the highest-spending customers.

The combination of Snowflake’s slowing revenue growth and aggressive spending led to a net loss of $317 million in the first fiscal year, which was 40.5% larger than the same period last year. That’s a raw deal for investors who watch the company burn truckloads of cash without concrete results — at least for now. It’s possible that Snowflake’s growth will accelerate again in the future thanks to its AI initiatives.

Even after a 67% decline, Snowflake shares remain expensive

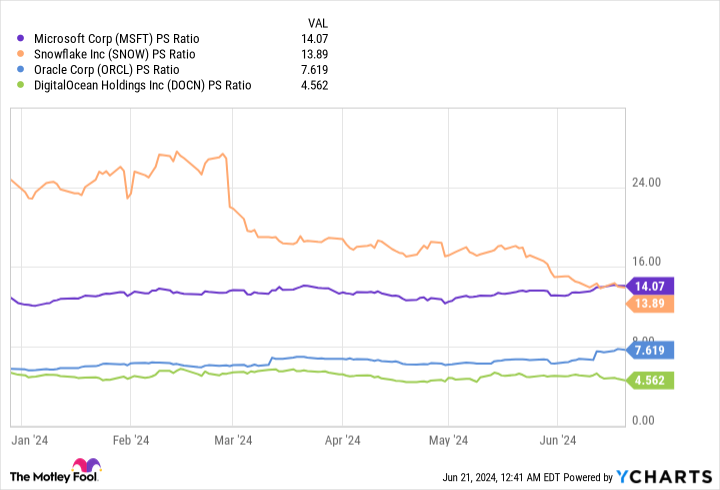

Based on Snowflake’s approximately $3 billion in trailing-twelve-month revenue and its current market cap of just under $42 billion, the stock trades at a price-to-sales ratio (P/S) of approximately 13.9. That makes Snowflake one of the most expensive cloud software stocks investors can buy — and that’s after the 67% decline it’s already experienced.

Here’s how Snowflake’s P/S ratio compares to some other companies in the cloud software and AI space:

Snowflake essentially trades at the same P/S valuation as Microsoft. That’s not exactly reasonable considering that Microsoft operates one of the largest cloud platforms (Azure) in the world and is already a recognized leader in AI software.

Oracle has developed a portfolio of cloud-based applications to help companies across industries improve efficiency and streamline their operations. Oracle has also become a leader in AI data center infrastructure. The company’s revenue grew just 3% in the most recently reported quarter, but that weakness was purely due to a supply issue; the order book (remaining performance obligation) increased by a whopping 44% to a record high of $98 billion, which is a better indication of demand.

Finally, DigitalOcean is a leading provider of cloud and AI services to small and medium businesses.

Snowflake’s P/S ratio is difficult to justify when comparing it to these stocks. It’s even less attractive when you consider that the company expects product sales growth to slow further to just 24% in fiscal 2025.

Therefore, investors cannot ignore the possibility that Snowflake stock could fall by about half from current levels, which would bring its price-to-earnings ratio closer to that of Oracle and DigitalOcean.

Should You Invest $1,000 in Snowflake Now?

Before you buy shares in Snowflake, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, DigitalOcean, Microsoft, Nvidia, Oracle, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

1 Artificial Intelligence (AI) Stocks Dropped 67% and Could Be Halved Again Originally Published by The Motley Fool