Polaris (NYSE:PII) has become the leading manufacturer of motorsports vehicles in North America, with sales increasing sixfold since 2000. During this period, Polaris has achieved the total return of the S&P500 Table of contents.

However, over the past ten years it has been a completely different story. Despite doubling revenue over the past decade, Polaris’ total return has fallen 16% as the market placed increasingly lower valuations on the company’s share price over time.

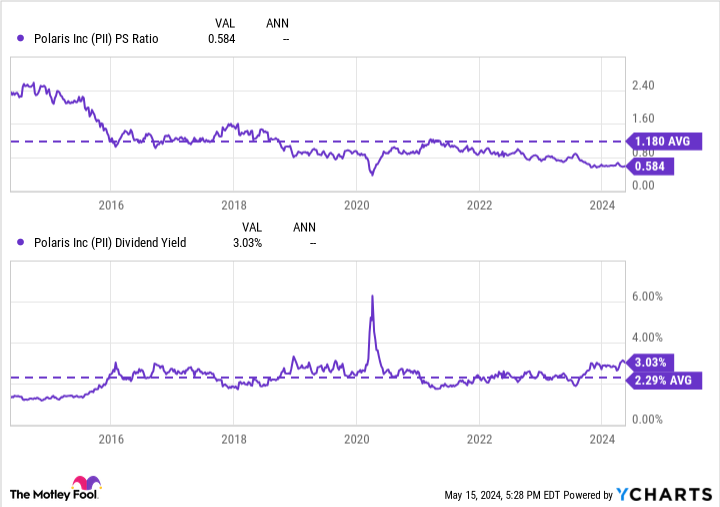

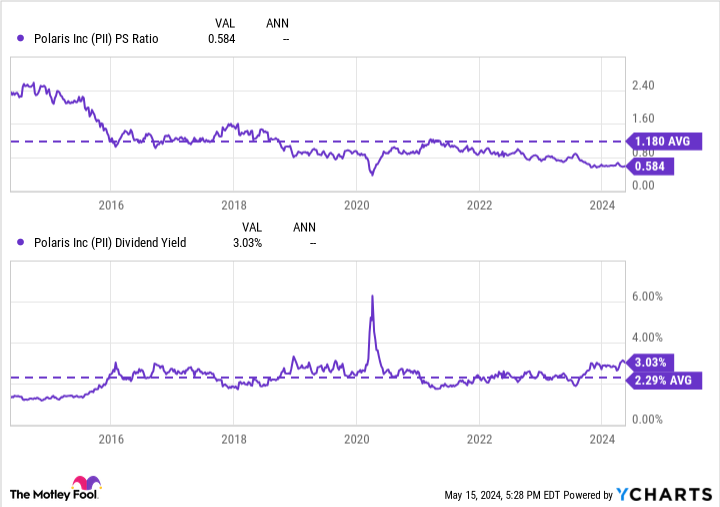

With Polaris trading at its lowest price-to-sales (P/S) ratio since 2000 (barring the crashes of 2009 and 2020), Polaris has become too intriguing to pass up – or is it a doomed company worth a deeply discounted valuation ? That’s why I think of the first.

A market leader with a talent for finding new customers

Polaris operates in three business segments: off-road (all-terrain and commercial vehicles, plus snowmobiles), on-road (Indian and Slingshot motorcycles), and marine (pontoons and deck boats). While the company’s segments are varied across many use cases, its business is highly cyclical, as evidenced by revenue declining for three consecutive quarters.

As consumers were hampered by rising inflation and higher interest rates, Polaris saw sales drop another 20% in the first quarter of 2024. Despite this disappointing earnings report, there were four insights hidden in that highlight as to why Polaris could prove to be an exciting investment in the first quarter of 2024. the current once-in-a-decade valuation.

No. 1 or No. 2 stock in each of its markets

Polaris has the largest market share in North America in its largest sales cohort, off-road vehicles, and first in pontoons and deck boats. Meanwhile, it holds the No. 2 position in the snowmobile and motorcycle markets and rounds out a portfolio with healthy market shares in all its niches.

What stood out in the latest earnings call, however, was that even though sales fell 20%, Polaris grew its market share in all of these groups, with the exception of snowmobiles. These gains highlight that the recent struggles have been industry-wide and that Polaris continues to outperform its niche, relatively speaking.

Reliable demand for commercial vehicles

The company’s off-road vehicles represent more than 40% of Polaris sales and are historically reliable due to their importance to the end markets they serve. With customers ranging from farmers and ranchers to government departments, militaries and corporations, these commercial vehicles are not really a discretionary purchase and are vital for many work purposes.

Polaris dominates this niche in the motorsports market, somewhat protecting itself from an industry that is often considered entirely discretionary and recreational.

Ability to find new customers

While these loyal commercial vehicle customers generate valuable revenue, the company’s ability to attract new customers remains as strong as ever. This fact was evident in the company’s recent results, as management believes that 70% of first quarter sales came from customers new to Polaris vehicles.

One reason for this success is the company’s Polaris Adventures team, which partners with local outfitters to rent vehicles for a range of unique ride experiences across the United States. This unit has provided more than 1.5 million rides across its 250 locations since 2017, and management believes customers are twice as likely to purchase a Polaris vehicle after taking an Adventures ride.

The potential for falling inflation and interest rates

CME Group recently calculated that the probability that the Fed will cut rates in September rose from 65% to 73% after a better-than-expected inflation report. While higher inflation and interest rates are not ominous issues for Polaris, lower numbers are certainly better for consumers because their dollar would appreciate further and financing would become cheaper. Should developments continue towards lower inflation with some rate cuts, discretionary sectors that struggled in the first quarter could recover amid higher consumer confidence.

An opportunity that only comes around once every ten years

While these four factors make Polaris an intriguing investment proposition on their own, the company’s once-in-a-decade valuation makes it even more attractive.

Trading at just 0.6 times sales and with a 3% dividend yield that is 30% higher than the 10-year average, Polaris is undeniably cheap. Despite this large discount, the company has achieved positive earnings per share and free cash flow (FCF) every year since its IPO in 1987.

Thanks in part to this steady FCF generation, Polaris has increased its dividend payments for 29 consecutive years. Even after this incredible series of dividend payments, only 48% of the company’s free cash flow was used for payouts over the last twelve months, leaving room for future increases.

While dividend growth has slowed in recent years, the reason why should be music to investors’ ears. Forgoing significant dividend increases in favor of large-scale share buyback plans, the company has benefited from its depressed valuation of late, retiring 14% of its outstanding shares over the past decade.

This smart allocation of cash returns to shareholders, along with the company’s surprisingly robust business and low valuation, makes Polaris look like a fantastic stock to buy and hold for years to come.

Should You Invest $1,000 in Polaris Now?

Consider the following before purchasing shares in Polaris:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Polaris wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $578,143!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool recommends CME Group. The Motley Fool has a disclosure policy.

A once-in-a-decade opportunity: 1 great dividend stock drops 36% to now double, originally published by The Motley Fool