Looking to add a huge growth stock to your portfolio without paying a huge premium? Here’s your chance. Right now, there’s an EV stock that’s poised for a huge growth spurt, but the stock has seen a dramatic depreciation due to selling pressure across the rest of the sector.

You’ll need to be strategic, but you can grow your portfolio significantly if you’re patient.

Expect this company’s revenue to skyrocket soon

Typically, a company that is experiencing rapid revenue growth will have a valuation that reflects this. That’s why it’s possible to lose money on a stock even if the company itself is growing by leaps and bounds. If you pay too much for that growth, you could be getting a bad deal.

To avoid this problem, you can try to buy shares in a company before it starts growing. That way, the investment benefits not only from the underlying revenue growth, but also from the likely jump in valuation multiples that the stock could receive.

Of course, this is all easier said than done. In reality, it’s rare to lock in a discount valuation for a stock that everyone expects to grow by leaps and bounds. To do this, you usually have to get in early and invest before that growth trajectory becomes apparent to others. This is exactly the opportunity investors have with Rivian Automobile (NASDAQ: RIVN) now.

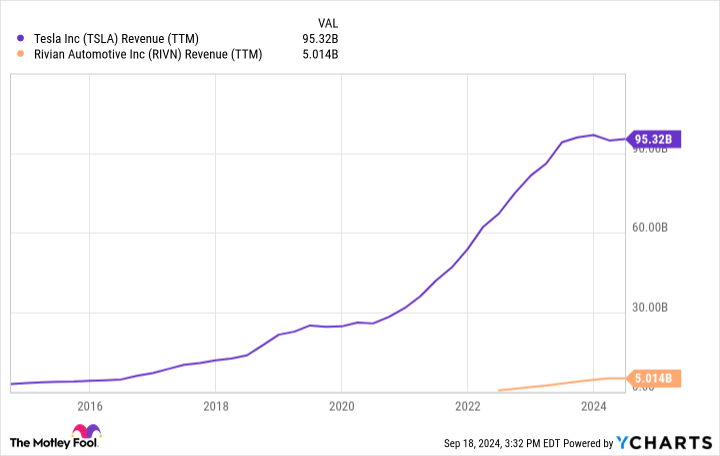

Rivian has already seen a huge jump in sales, growing nearly 900% in the past two years to $5 billion. But compared to the industry giant, Tesla, It’s clear that Rivian’s journey has only just begun.

In the chart above, you can see when Tesla’s sales peaked: around 2016 and then again in 2020. These two moments roughly correspond with the launch of the company’s first mass-market vehicles: the Model 3 and Model Y.

While the Model S and Model X were well-received by the market, their price point of around $100,000 is still far above what most consumers can afford. The Model 3 and Model Y, meanwhile, were priced around $50,000, pushing Tesla into the mass market and drove huge sales increases, a pattern Rivian appears poised to repeat.

Rivian currently has just two luxury models: the R1T and the R1S. They’ve gotten a lot of buzz, with Consumer Reports and calls the company the one with the highest brand loyalty of all automakers, electric and otherwise.

Earlier this year, the company surprised investors by announcing three new models: the R2, R3, and R3X. All are expected to debut under $50,000, marking Rivian’s first entry into the mass market. It’s not only possible, but likely, that we’ll see a huge spike in Rivian sales once these models hit the roads.

How to Invest in Rivian Now

Here’s the problem: The company doesn’t expect to release its new mass-market models until 2026, with some versions arriving as late as 2027. That’s potentially two or three years away, a reality consistent with Rivian’s tiny market cap of just $13 billion.

Shares trade at 2.5 times revenue, while Tesla’s valuation is 8.3. Right now, Rivian’s revenue is a promising start, but simply not enough to keep the company afloat.

Last quarter, the automaker lost $32,000 for every vehicle it sold, and its future will be made or broken based on the success of its lower-priced models.

There is even some question as to whether the company can raise enough capital to survive until then, a concern somewhat alleviated by a recent partnership with Volkswagen which could raise up to $5 billion in financing.

For now, the market remains skeptical and is placing a big discount on shares compared to their previous trading levels. If the company can deliver, Rivian stock could make a lot of money, but this stock is only for long-term investors.

Expect volatility and perhaps some dollar-cost averaging until we get more clarity on production and sales forecasts for the lower-priced vehicles. But investing now likely offers the most potential upside, even if there are legitimate risks.

Should You Invest $1,000 in Rivian Automotive Now?

Before you buy Rivian Automotive stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $710,860!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla and Volkswagen. The Motley Fool recommends Volkswagen Ag. The Motley Fool has a disclosure policy.

1 Magnificent Electric Vehicle (EV) Stock Drop 45.8% to Buy and Hold Forever was originally published by The Motley Fool