The Nasdaq-100 The technology index fell by 33% in 2022, before rising by almost 54% in 2023. This year the index has already delivered a gain of more than 10%. These fluctuations prove that it is virtually impossible to predict the direction of the market in the short term.

However, if we zoom out to observe the past ten years, the Nasdaq-100 returned 421%, for an average annualized gain of 18%. History shows that the longer investors stay in the market, the more likely they are to earn positive returns. It’s easy to track the performance of major indexes like the Nasdaq-100 using exchange-traded funds (ETFs).

But investors with a greater appetite for risk can outperform the broader market if they pick the right individual stocks. Uber Technologies (NYSE:UBER) could be a worthy candidate due to its strong growth and extraordinary future potential thanks to autonomous vehicles.

In fact, Uber stock could turn a $200,000 investment into $1 million over the next decade. But don’t be put off by those large numbers; By all means, investors can seize the opportunity to potentially earn a fivefold return.

Uber’s biggest expense: drivers

Uber operates the world’s largest ride-hailing platform, in addition to a dominant food delivery service called Uber Eats and a growing commercial freight network. During the first quarter of 2024 (ended March 31), more than 7 million drivers completed nearly 2.6 billion trips requested by Uber’s 149 million monthly users.

Uber collected $37.7 billion in bookings for these rides during the quarter, of which $16.6 billion was paid to its drivers – the company’s largest expense. After removing other direct costs, including the money paid to restaurants for their Uber Eats orders, Uber was left with $10.1 billion.

Moving further down the income statement and taking into account operating costs such as research, development and marketing, Uber ultimately lost $654 million. To the company’s credit, it was profitable in 2023, and that trend would have continued had the value of its investments not fallen by $721 million.

Nevertheless, if Uber could eliminate the $16.6 billion cost of its drivers, it would stand to reason that both revenue and profitability would soar (assuming the price per ride remained the same).

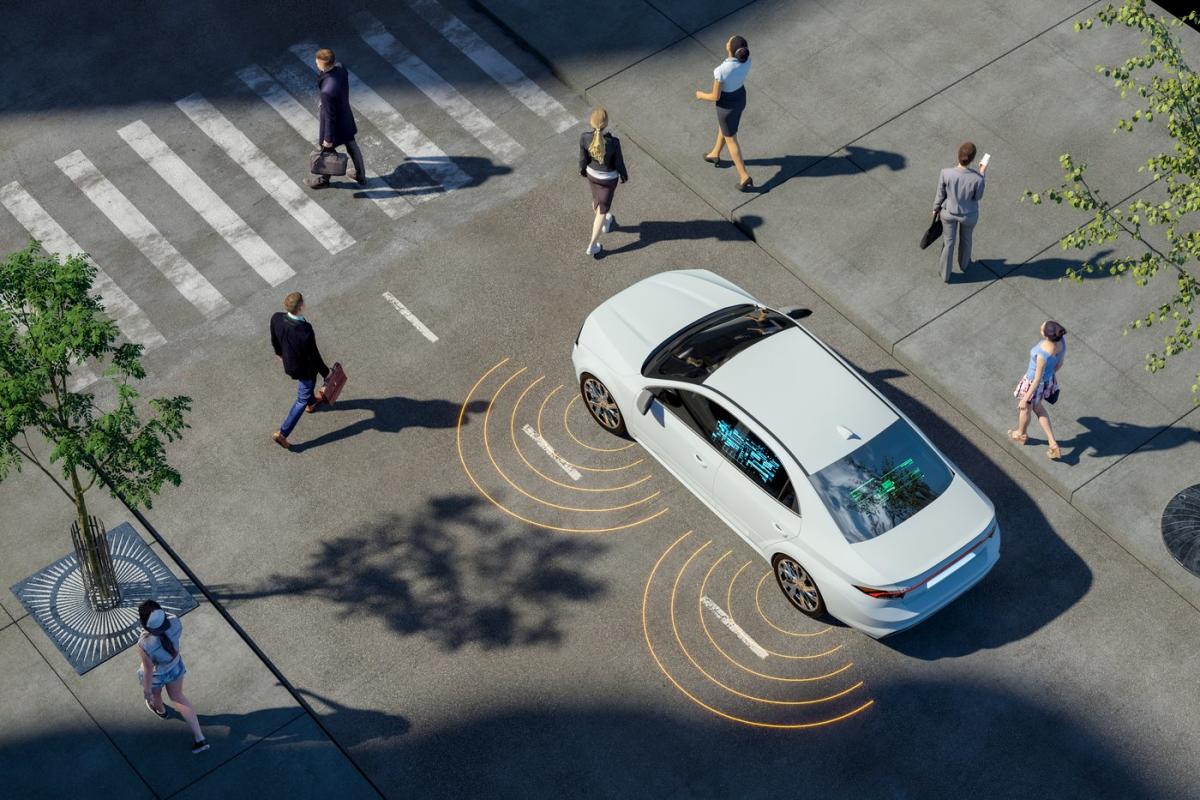

Autonomous vehicles could become a multi-billion dollar industry

According to Cathie Wood’s Ark Investment Management, the proliferation of self-driving vehicles will create an autonomous car industry that could generate $4 trillion in revenue by 2028. That timeline could be ambitious considering only a handful of U.S. states have approved self-driving cars. in a very limited capacity and with strict rules.

Uber CEO Dara Khosrowshahi says it is very difficult to predict when autonomous vehicle penetration will increase, but he is certainly not waiting. For starters, Uber owns a 21% equity stake in Aurora, which acquired Uber’s self-driving development division in 2020 and continues to build on the technology.

Uber also has a multi-year partnership with Motional, a joint venture between a self-driving mobility company Suitable And Hyundai. Motional has developed a fully autonomous car based on Hyundai’s Ioniq 5 electric car, which users can ultimately use via the Uber platform.

Uber has a similar partnership with Waymo, the self-driving division of Google’s parent company Alphabet. Users can already hail an autonomous Waymo in Phoenix, Arizona, and the partnership recently expanded to food delivery. Internationally, Uber Eats and Mitsubishi Electric are teaming up to create an autonomous food delivery service in Japan.

Uber’s actions send a clear message to investors: autonomous vehicles are very likely to be the future of its business.

Uber’s stock could increase fivefold within ten years

Khosrowshahi says Uber wants to be a partner for the autonomous vehicle industry, meaning it will provide its platform and its vast network of users, and companies like Motional and Waymo will provide the cars. Tesla is also emerging as one of the leaders in self-driving, planning to unveil a fully autonomous robotaxi, the Cybercab, in August.

Tesla CEO Elon Musk wants to build a taxi network within Tesla, but he will likely find it more beneficial if he and his customers instead lend vehicles to an established platform like Uber. Alternatively, assuming a change in strategy, Uber could also buy a fleet of Cybercabs and keep 100% of the revenue from its ride-sharing and delivery business. That’s a potential win-win for both companies.

It’s too early to know exactly how this will work out, and we don’t know how much it will cost Uber to offer self-driving cars compared to human drivers. But even if Ark Invest’s forecast of $4 trillion in revenue from autonomous rides is generated in the next decade instead of 2028, Uber could theoretically still rake in $1 trillion of that since it has a 25% market share in the existing ride service. industry. That would translate into revenues averaging $100 billion per year.

Assuming Uber’s price-to-sales (P/S) ratio remains constant, the company will need to grow its revenue 17.5% annually over the next decade to justify increasing its stock fivefold. Wall Street’s forecast suggests that Uber will generate $43.1 billion in revenue this year, which would represent a 23.9% increase from 2023. It also means that the company has increased its revenue by a compounded amount over the past five years will have grown at an annual rate of 24.9%.

In both cases, Uber comfortably expands above the threshold without only notable contribution from self-driving vehicles so far. Simply put, a fivefold return over the next decade is well within the realm of possibility for Uber stock, and there could be even more upside to that result thanks to autonomous technologies.

Should you invest $1,000 in Uber technologies now?

Before purchasing shares in Uber Technologies, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Uber Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Aptiv, Tesla and Uber Technologies. The Motley Fool has a disclosure policy.

1 Extraordinary Stocks That Could Turn $200,000 Into $1 Million by 2034 was originally published by The Motley Fool