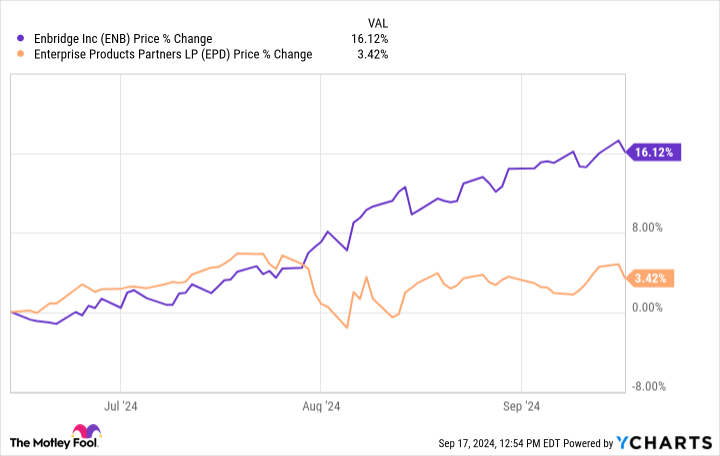

Stock prices of Enbridge (NYSE: ENB) have risen 16% over the past three months as investors reassess the future of the North American midstream giant. But that rebound is still not enough to close the gap with other high-yield midstream giants Business Product Partners (NYSE: EPD)that has recovered all losses since the peak in mid-2022.

There is likely further recovery potential at Enbridge.

Restore: Enbridge vs. Enterprise

Enterprise Products Partners is up about 3.4% over the past three months, well behind the 16% gain Enbridge shares have made. If you were to look at just this short-term performance, you’d probably suggest Enterprise is more attractive.

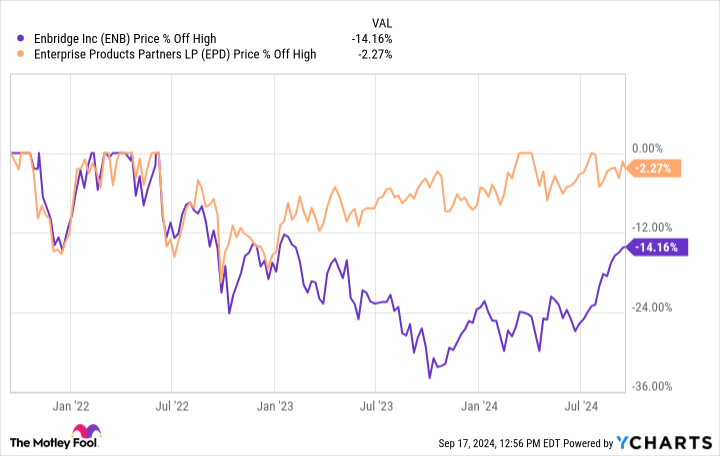

But if you pull the lens back a little further and cover three years, the story changes dramatically.

Over the past three years, you’ve seen Enterprise and Enbridge both peak in mid-2022. They both fell after the peak, but Enbridge’s decline was much more dramatic. It also lasted longer. So the Canadian midstream giant’s recovery started later, and the stock had to recover more losses. In this way, it makes sense that the last three months have been better for Enbridge shares than for Enterprise units.

But there’s another important piece from the chart above. Enterprise will have recouped everything it lost by 2024 and is trading near previous highs, while Enbridge has more room to run before it reaches that point. The difference between the recoveries of these two midstream players is about 12 percentage points.

If you’re looking for a mix of yield and growth, that probably gives Enbridge the edge right now. That said, on the income front, Enbridge’s dividend yield is about 6.6% versus Enterprise’s 7% distribution yield. So if you’re looking for income only, you might prefer Enterprise.

What’s the backstory of Enbridge?

The story here is quite interesting. Enterprise is essentially laser-focused on the midstream sector. Enbridge’s long-term goal is to shift its portfolio along with the world’s energy needs. While the bulk of its business is tied to midstream assets, such as pipelines, it also owns natural gas utilities and renewable energy facilities, such as offshore wind developments. The company’s regulated utilities business is a major focus today as it completes the acquisition of three major regulated U.S. natural gas utilities and integrates them into Dominion Energy (NYSE: D).

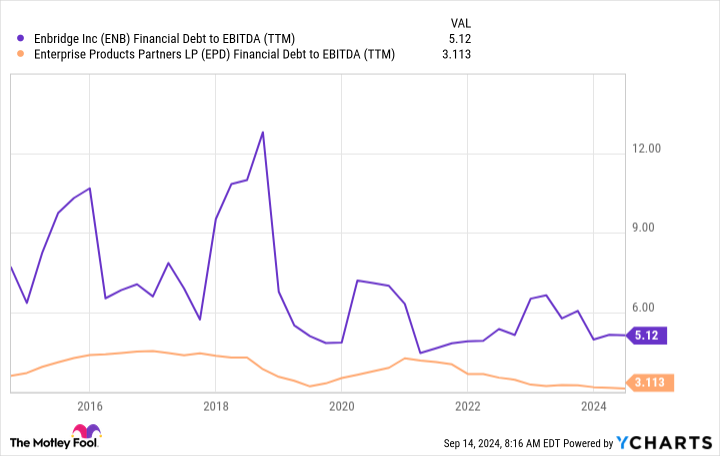

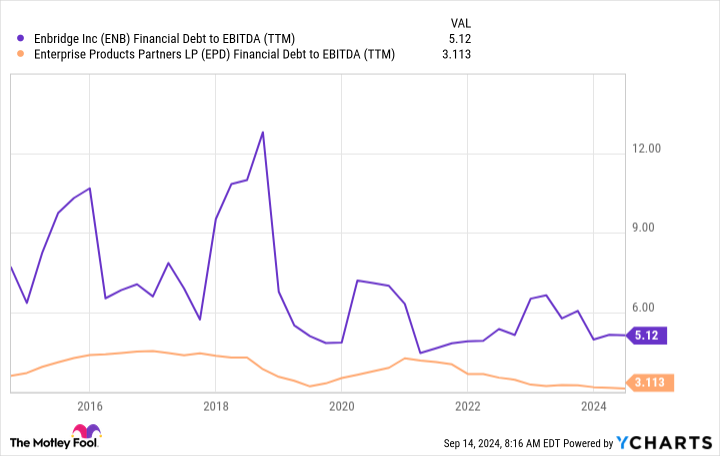

There are two important takeaways. Because of its utility business, Enbridge tends to use more leverage than other midstream players, such as Enterprise. In fact, Enterprise has long operated with very modest leverage on its balance sheet. When interest rates rose, investors simply worried more about Enbridge than Enterprise, and so Enbridge stock underperformed.

But Enbridge also agreed to buy those natural gas businesses from Dominion. There were concerns about how it would finance the purchase price, which led to more downward pressure on the stock. This is a big reason why Enbridge shares fell so far and hard.

Now, however, Enbridge has proven it can keep the cost of acquiring its utilities under control (without blowing up its balance sheet) and interest rates look set to fall. So there’s a dual tailwind behind Enbridge stock, with more room to run before it gets back to where it was before the current sell-off.

Enbridge has a solid future ahead of it

With nearly three decades of annual dividend increases under its belt, Enbridge has proven itself to be a reliable dividend stock. While its yield is now lower than Enterprise’s, don’t let that cloud your opinion of Enbridge. It’s still an attractive dividend stock, and unlike Enterprise, there’s still material recovery potential for the stock.

If you buy it, don’t just think about that short-term opportunity. It’s a high-yielding dividend stock that you can hold in your portfolio forever. Remember, unlike Enterprise, Enbridge is active adjusting his portfolio to meet the world’s changing energy needs.

Should You Invest $1,000 in Enbridge Now?

Before you buy shares in Enbridge, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Enbridge wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $715,640!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Reuben Gregg Brewer has positions in Dominion Energy and Enbridge. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Dominion Energy and Enterprise Products Partners. The Motley Fool has a disclosure policy.

1 Gorgeous High Yield Stock Drops 14% to Buy and Hold Forever was originally published by The Motley Fool