MercadoLibre (NASDAQ: MELI) may not be a household name in the US, but smart investors know that this e-commerce stock has been a top performer in the online retail sector throughout its history.

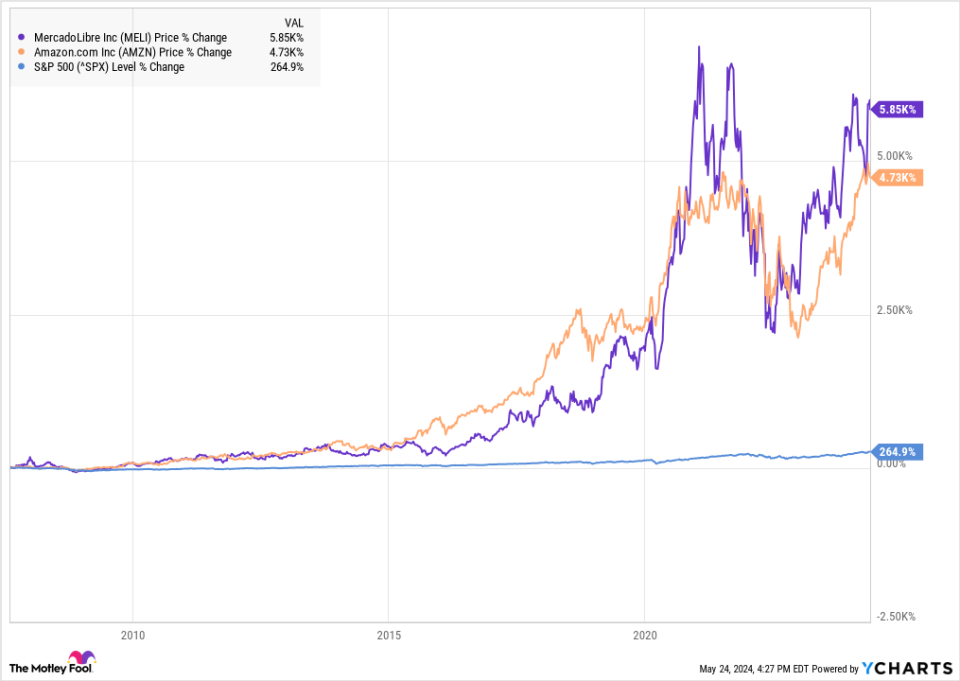

In fact, it even performs better Amazon since its initial public offering in 2007, and both stocks have eclipsed the returns of both stocks S&P500 during that time frame.

Like much of the e-commerce sector, MercadoLibre stock fell in 2022 during the bear market, but unlike most e-commerce peers, MercadoLibre’s business continued to grow strongly, with demand continuing to rise even after the tailwinds of the pandemic. has passed.

MercadoLibre has since recovered and recouped much of those losses, but the stock is still down about 15% from its pandemic-era peak. With the S&P 500 and the Nasdaq Composite back at record highs, it seems reasonable to expect MercadoLibre stock to reach new highs as well.

Let’s take a closer look at MercadoLibre and why the stock is a buy today.

What is MercadoLibre?

MercadoLibre is best known as an online retailer, but the company is much more than that.

The company operates as a direct online retailer, selling goods it owns through its website, and operates a third-party marketplace, allowing individual sellers to sell goods on its platform, for which it collects a commission. It’s the same e-commerce model that has made Amazon so successful.

MercadoLibre operates throughout Latin America, but almost all of its business comes from Brazil, Argentina and Mexico. Brazil is the largest market and represents approximately half of sales.

In addition to its core e-commerce business, the company also owns MercadoPago, a digital payments and fintech company, which has emerged as perhaps the most valuable part of the business. In addition to serving as a payment platform, MercadoPago also offers point-of-sale devices to physical store merchants throughout Latin America, where digital payment technology is not as developed as in the United States. Thanks to this company, MercadoLibre has been able to tap into the enormous physical retail market in Latin America.

In addition to its two main businesses, e-commerce and fintech, the company also operates its parcel delivery service, MercadoEnvios, which strengthens its competitive advantage as most sellers use MercadoEnvios to ship their orders. Finally, the company also has its own lending company, MercadoCredito, which lends money to its merchants and other borrowers, and a wealth management company called MercadoFondo.

Like Amazon, MercadoLibre has built an interconnected network of companies that complement each other and create a wide economic moat. MercadoLibre is not only growing rapidly, but its margins are also expanding. The company has proven itself against competition such as Amazon and Sea limited‘s Shopee.

Is MercadoLibre a growth stock?

MercadoLibre is one of the fastest growing stocks in the e-commerce sector, and that pattern was visible in the first quarter.

Revenue rose 36% to $4.3 billion and rose 94% on a currency-neutral basis as the devaluation of the Argentine peso impacted reported results. Gross merchandise volume increased 71% on a currency-neutral basis to $11.4 billion, and total payments volume increased 86% on a currency-adjusted basis.

Operating margin came in at 12.2%, which the company said increased by 120 basis points after adjusting for year-over-year comparisons.

MercadoLibre is growing rapidly and the company has a lot of room to grow in Latin America, further penetrating the region and adding new businesses.

Why MercadoLibre Stock is a Buy

The company has a long history of outperforming the stock market and gaining market share, and its profit margin is growing with additional activities such as advertising and credit and by scaling its core businesses such as the marketplace and MercadoPago.

With profit margins improving, the stock looks about as cheap as it’s ever looked, with a forward price-to-earnings ratio of 50. Investors can take advantage of the discount from the peak by buying the stock now.

Should you invest $1,000 in MercadoLibre now?

Consider the following before purchasing shares in MercadoLibre:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and MercadoLibre wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jeremy Bowman has positions in Amazon, MercadoLibre and Sea Limited. The Motley Fool holds positions in and recommends Amazon, MercadoLibre, and Sea Limited. The Motley Fool has a disclosure policy.

1 Growth Stock Down 15% to Buy Right Now was originally published by The Motley Fool