Data analysis and storage company Snowflake (NYSE: SNOW) went public as one of the most hyped IPOs in modern history. But today? Investors have largely moved on. Snowflake is down a whopping 71% from its previous peak, which admittedly came in 2020-2021 during a zero-interest-rate-driven market bubble.

But Snowflake’s story does not reflect poor management, even though the share price performance suggests otherwise.

The good news is that Snowflake has now fallen far enough that it could completely change the stock’s long-term investment prospects. Here’s why it’s finally time to buy Snowflake.

A Tragedy: A Story of Appreciation

Snowflake was a wildly popular IPO, which made it a success. After all, the purpose of an IPO is to raise money that a company can use to grow its business. Snowflake hit Wall Street; it seemed like there was no price that investors weren’t willing to pay for stock.

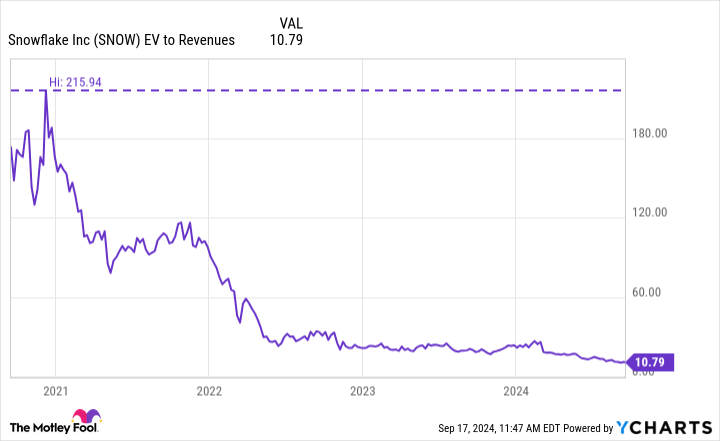

At its peak, investors were paying an enterprise value (EV)-to-revenue ratio of nearly 216. That’s not a ratio of Snowflake’s profits — that’s revenue! For reference, the vaunted AI stock, Nvidiawhich some claim is in a bubble itself, has only managed to get past 45 on that ratio during this AI frenzy. Investors can view valuations as expectations; the reality is that Snowflake’s early valuation set the bar impossibly high. It seemed to doom the stock from the start.

You can see above how Snowflake’s valuation has completely collapsed over the past four years, with a combination of share price declines and revenue growth helping to drive that valuation ratio down. The good news is that Snowflake is a much better opportunity today, with an EV-to-revenue ratio of just 11. Snowflake’s current valuation isn’t even top-of-market today; it’s well below some other popular software stocks like CrowdStrike (17) and Palantir (31).

Huge potential for long-term growth

Snowflake is a data software company. Its platform enables businesses to securely store, organize, share, and access their data. Businesses want a firm grip on their data as they move toward artificial intelligence (AI), which uses data to train and deploy AI technologies. Snowflake’s product is cloud-neutral, which appeals to the many enterprises that don’t want to be locked into one cloud or another.

While Snowflake’s revenue growth has slowed from triple-digit percentages to less than 30% in recent years, investors shouldn’t panic. Snowflake charges based on usage, and rising fees have created a challenging environment for customers to reduce their spending. Underlying growth numbers look healthy: Snowflake still has a 127% retention rate among existing customers, and the company’s customer base grew 21% year-over-year in the most recent quarter. Revenue growth doesn’t appear likely to slow much further from its current pace.

Meanwhile, the long-term opportunity is huge. Management estimates the market it addresses was worth $153 billion last year and will grow to $342 billion by the end of 2028. The company’s revenue over the past 12 months is $3.2 billion, only about 1% of that number in the long term. Snowflake has one direct competitor, a privately held company called Databricks, but there’s plenty of opportunity to fuel both companies in the coming years.

The pitch to buy stocks today

Investing often comes down to potential risks versus rewards. Today, Snowflake’s business is bigger than ever and its stock is nowhere near the top of the market.

Right now, Snowflake’s financial losses are the biggest risk for investors. The company has lost more than $1 billion over the past four quarters. For some, investing in an unprofitable company may not be for you. However, these are GAAP losses, and Snowflake is very cash flow positive. The company’s $815 million in free cash flow over the past 12 months represents 25% of revenue. High equity compensation largely explains the losses and is part of life for tech companies bidding for the best talent.

Ultimately, the company must demonstrate that it can overcome these costs and become GAAP profitable. For now, Snowflake is very cash flow positive and well financed with $3.2 billion in cash and zero debt, so the financial risk is not as bad as it might seem at first glance. Snowflake has time, and so do investors.

Snowflake’s strong revenue retention and massive market opportunity offer investors ample upside to consider the stock at a valuation that finally gives it a chance to shine.

Should You Invest $1,000 in Snowflake Now?

Before you buy shares in Snowflake, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $722,320!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends CrowdStrike, Nvidia, Palantir Technologies and Snowflake. The Motley Fool has a disclosure policy.

1 Growth Stock Down 71% to Buy Now was originally published by The Motley Fool