One path to investing success is to buy shares of solid, well-managed companies and hold them for the long term. Growth stocks offer the prospect of long-term capital appreciation, helping you achieve your big financial goals. Characteristics investors should look for in a company include sustainable tailwinds for the business, a great management team with strategic vision and focus, and a track record of steadily growing profits and free cash flow.

However, even stocks with such characteristics are not immune to periodic bouts of market pessimism. Because investors closely monitor each quarterly result and compare it to analyst expectations, there are times when even the shares of strong companies sell off sharply. Investors should view such events as opportunities to acquire shares on the cheap – if the company’s fundamentals are still solid.

Lululemon (NASDAQ: LULU) is such a share. The share price is down 40% year to date. Let’s look at the reasons for this decline, and why the stock is looking increasingly attractive.

Weak demand from North America

Lululemon’s recently released first quarter 2024 report disappointed investors. For the period ending April 28, the athleisure apparel company’s revenue rose 10% year over year to $2.2 billion, with comparable sales up 6%. In North America, however, demand was weaker: sales rose only 3%, a sharp slowdown from 17% growth a year earlier. Comparable sales in North America remained flat.

CEO Calvin McDonald attributed the underperformance in North America to weaker demand, but acknowledged that Lululemon had bungled by having too narrow a color range. Moreover, she had not ordered enough products that customers wanted, in the sizes they needed. As a result, too often customers found that the items they were looking for were out of stock.

Management also gave weak guidance for the second quarter, but said it expects business conditions to improve in the second half of the year as it works to correct previous mistakes. On a more positive note, Lululemon still reported a 10.7% year-over-year increase in net profit to $321.4 million.

The Chief Product Officer leaves

In news that further fueled investor pessimism, Lululemon also announced the departure of Chief Product Officer Sun Choe in late May. Choe had served in the role for seven years and was responsible for Lululemon’s expansion into footwear. She also spearheaded the launch of the company’s men’s shoe line earlier this year and was seen as an integral part of Lululemon’s innovative designs and releases. The company will not seek a replacement to fill her former position; instead, it has announced a more integrated organizational structure in which it will pursue its long-term goals and take charge of product innovation.

Jonathan Cheung, the current global creative director, will report directly to the CEO and be responsible for product design, innovation and development. A new team will be created, consisting of top personnel from the company’s merchandising and branding divisions, to help scale the company into international markets.

Consistent net income growth with free cash flow generation

Despite weaker first-quarter budget results and Choe’s loss, there are reasons for optimism. Lululemon has grown steadily over the years and is also a true free-cash-flow machine. Revenues more than doubled between fiscal 2019 and 2023, from $4 billion to $9.6 billion – a compound annual growth rate (CAGR) of 24.7%.

Net profit also shot up from $646 million to $1.55 billion during the same period, representing a CAGR of 24.5%. Lululemon also generated an average positive free cash flow of $785 million over these five fiscal years. Additionally, the athleisure company managed to keep its balance sheet clear of debt, protecting itself from the effects of rising interest rates over the past two years.

The power of three x2

Lululemon announced a new set of strategic goals in April 2022, aptly titled “The Power of Three x2.” This updated set of goals was a follow-up to Lululemon’s first Power of Three plan, which debuted in 2019. The company successfully met the goals of that first plan, nearly doubling its revenue from $3.3 billion in 2018 to $6.25 billion in 2021. Management’s current ambition is to double revenue to 12.5 billion by 2021 billion dollars by 2026 by focusing on the same three key pillars: product innovation, guest experience and market expansion.

Lululemon has also set a goal to double sales of its menswear segment from 2021 levels by 2026, using its Science of Feel technology to innovate in the apparel and footwear categories. It also aims to double its digital sales by 2026 by building connections between both physical and digital stores, and nurturing its community of loyal customers. An effective tool for this is the membership program, which offers benefits such as early access to product drops, returns without receipts and free hems.

The third goal is to quadruple international sales over the same period by entering new markets such as China, Southeast Asia and Europe. Lululemon is on track to achieve this, with international sales up 35% year over year in its first fiscal year, while comparable store sales grew 25%.

A growing market for athleisure products

The growing market for casual apparel and products will support Lululemon as it pursues its goals. The athleisure market was valued at $358 billion last year, according to Grand View Research, which predicts it will grow 9.3% annually through 2030 to $667 billion. Lululemon can ride this trend to grow both top and bottom line, with the international push being a key growth catalyst.

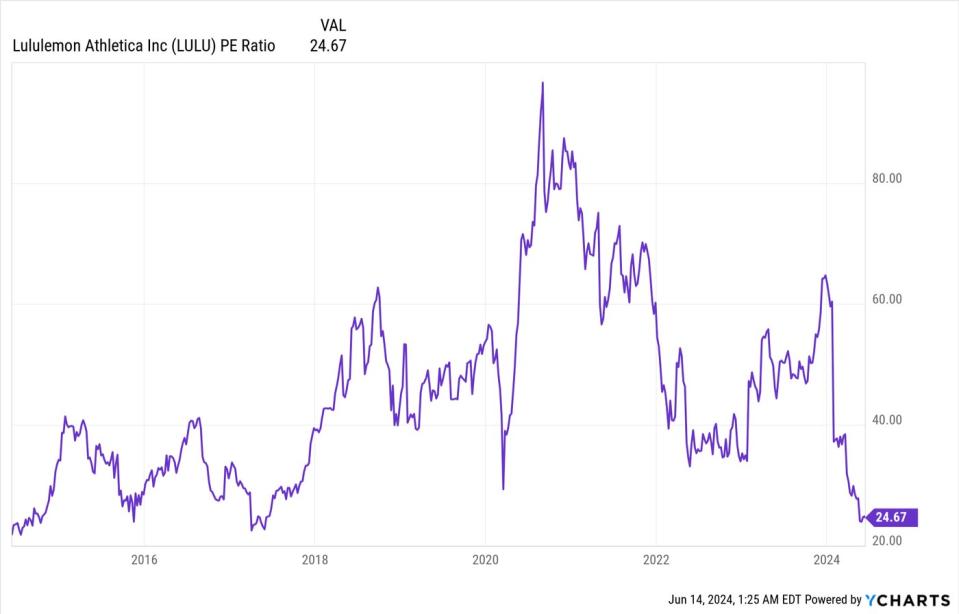

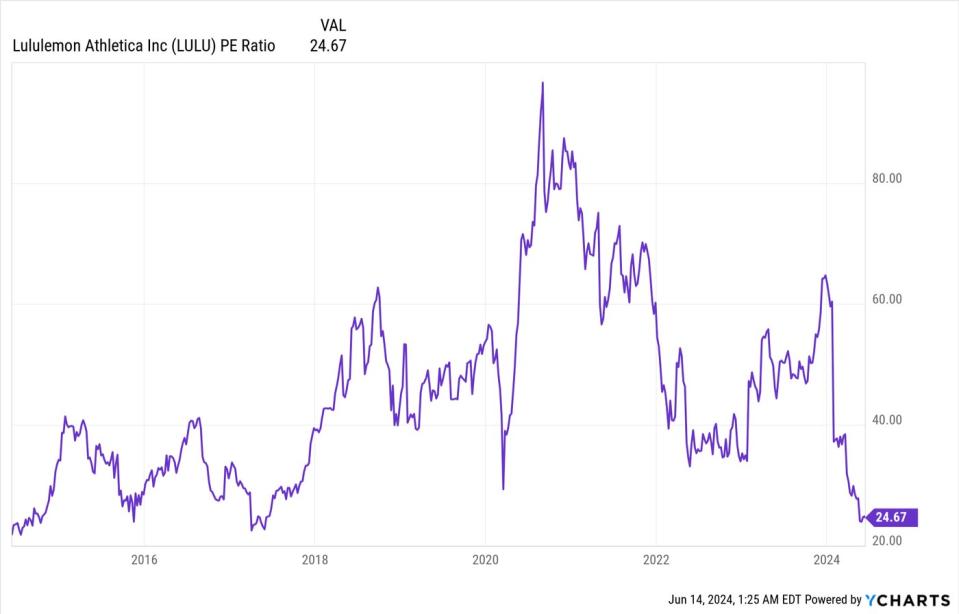

Lululemon has traded at more than 40 times earnings for most of the past decade, but its shares look cheap now at about 24.7 times earnings. Investors who believe in the power of this brand and have confidence in the company’s long-term future should consider taking a stake in Lululemon now or adding to their positions.

Should You Invest $1,000 in Lululemon Athletica Right Now?

Before you buy shares in Lululemon Athletica, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Lululemon Athletica wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Royston Yang has positions at Lululemon Athletica. The Motley Fool has positions on and recommends Lululemon Athletica. The Motley Fool has a disclosure policy.

1 Growth Stock Down 40% This Year to Buy Now was originally published by The Motley Fool