Companies involved in artificial intelligence (AI) have seen their stock valuations rise over the past year. Investors are bullish on companies that can leverage next-generation technologies to their advantage and unlock future growth opportunities.

One company that has delved deeply into AI has been Palantir Technologies (NYSE:PLTR). Last year, the data analytics company unveiled its AI platform, AIP, which management says has been a big hit with customers. But as promising as the company’s prospects seem, I wouldn’t jump on the Palantir bandwagon just yet.

Management has set the bar high

One thing that makes me wary is when management sets expectations that may be a bit high. That could make it incredibly difficult for the company to exceed expectations, and it also means the stock is likely trading at a significant premium as investors price in whatever future growth management is talking about that hasn’t materialized yet. And with trading at more than 60 times estimated future earnings, it’s clear this is the case with Palantir.

During Palantir’s most recent earnings call with analysts, CEO Alex Karp did his part to hype up the company by saying, “I don’t believe there is competition in the U.S. commercial market.” Ryan Taylor, the company’s chief revenue officer, also said that conversions following the company’s “boot camps” — workshops where it helps potential customers figure out how to use its products — were often fast and significant. “We see clients, you know, signing seven-figure deals shortly after boot camp,” he said.

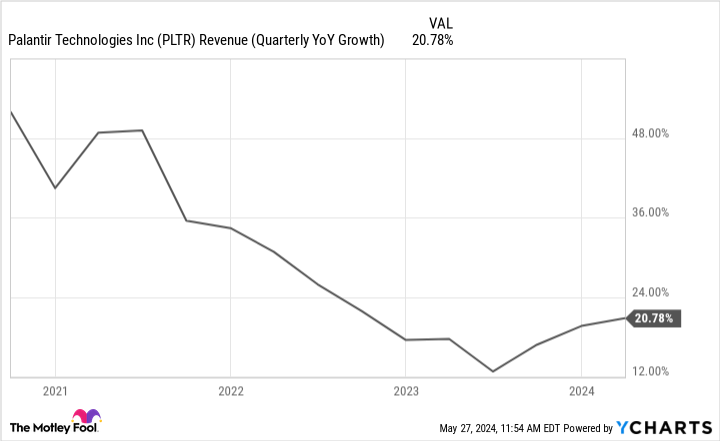

The problem is that with such bold claims, investors will expect strong results. And while Palantir has grown, its growth rate has remained relatively stable.

Palantir’s growth is strong, but not exactly taking off yet

Through the first three months of 2024, Palantir’s revenue was $634 million and grew 21% year over year. It’s a good growth rate, but considering how the company has done in recent quarters, it’s not a huge improvement.

The results appear to be at odds with the rosy rhetoric, with management talking about the lack of competition in certain markets and the ability to quickly convert customers to large purchases.

The company held more than 660 bootcamps last quarter, and investors should likely expect much more growth if these conversions indeed happen quickly. While the numbers may not immediately trickle down to the company, that’s what the guidance increases are for, to reflect the company’s optimism about what lies ahead.

But the company only modestly raised its full-year guidance in May. Palantir now expects 2024 revenue to be between $2.677 billion and $2.689 billion. Three months earlier, the forecast range was $2.652 billion to $2.668 billion. Without three decimal places, it would be difficult to see any major improvement in the guidelines at all.

While Palantir says it is growing and says customers are seeing value in AIP and converting, the growth doesn’t seem to be evident in the results or guidance. And that makes me worry that there may be a little too much hype behind the tech stocks and not enough substance to back it all up.

Palantir can be a good investment, but it comes with considerable risk

Over the past three months, Palantir shares are down 11% as recent quarterly results haven’t done much to inspire investors to pay more for what is already an incredibly expensive investment. Given the high earnings numbers and the results that don’t seem to match what management says, I’m concerned that more sell-off for Palantir stock may be on the way.

It still has a lot of potential to be a good buy in the long run, but investors might be better off waiting a few more quarters to see if there’s a dramatic improvement in Palantir’s growth rate before making a decision take over the share.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

David Jagielski has no position in the stocks mentioned. The Motley Fool holds positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

1 Big Reason I’d Hold Off on Buying Palantir Technologies Stock Now was originally published by The Motley Fool