Artificial intelligence (AI) is relatively new to most companies, but not to C3.ai (NYSE: AI). It has been developing the technology since 2009 and was one of the first enterprise software providers in the fast-growing AI industry.

Today, companies across 19 industries use C3.ai to accelerate their AI adoption, and company revenue growth is accelerating as demand increases.

C3.ai stock is currently trading at $25.90, but the proliferation of AI could take it significantly higher in the long term. This is why investors with extra money – money they don’t need for immediate expenses – might want to spend at least $30 on this opportunity.

A unique game in the business AI industry

Cloud software giants like Amazon And Microsoft have become synonymous with AI because they offer companies a choice of hundreds of off-the-shelf large language models (LLMs) that they can use to build their own applications.

C3.ai’s strategy is a little different. It offers more than 40 ready-to-use AI applications that companies can connect directly to their operations. Furthermore, C3.ai can customize them to specific needs upon request. For example, manufacturers use C3.ai to forecast revenue, manage costs, and even predict equipment failures to reduce potential downtime.

This also applies to the oil and gas giant Shell uses C3.ai’s applications to monitor thousands of devices so it knows when to perform preventive maintenance, as failures can be catastrophic – not only to the bottom line, but also to the environment. C3.ai’s Real Time Production Optimization software also helps Shell optimize pressure, temperature and flow rates in its liquefied natural gas facilities, leading to significant reductions in CO2 emissions.

During the recent fourth quarter of fiscal 2024 (ended April 30), C3.ai had 487 customer engagements, which was a 70% increase from the same period a year ago. Through its partnership network alone, it closed 115 deals, including tech giants like Amazon and Microsoft, which offer C3.ai’s applications in the cloud to their customers.

It’s a win-win for all parties: C3.ai gains access to a much larger potential customer base, and its partners benefit from more AI options on their platforms to satisfy their enterprise customers.

C3.ai’s revenues continue to rise

Two years ago, C3.ai changed its revenue model to drive long-term growth. Previously, it billed customers on a subscription basis, which required lengthy negotiations over contract length and pricing. Now a consumption model is being used instead, so companies can come and go as they please and only pay for what they use, making for a smoother and faster onboarding process.

C3.ai warned investors that this would lead to a temporary slowdown in revenue growth while it converts its existing customers to the new model, as it takes time to scale up consumption. In the third quarter of fiscal 2023 (ended January 31, 2023), the company’s revenues were actually shrank 4% annually.

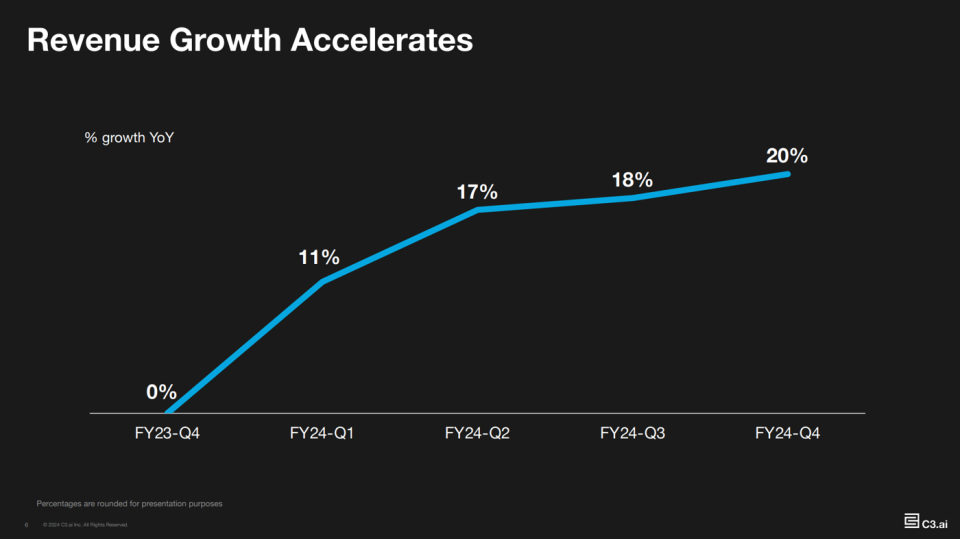

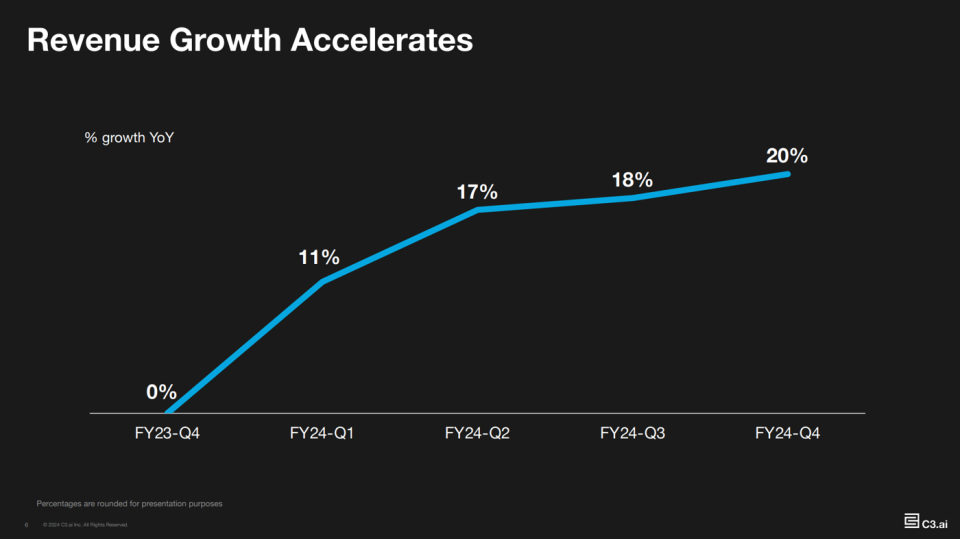

But since then, and true to management’s forecast, C3.ai’s revenue growth has accelerated convincingly:

Fourth quarter revenue was a record high of $86.6 million, and the 20% growth rate was the fastest in almost two years. The company’s forecast for the first quarter of fiscal 2025 (ending July 31) suggests that growth could accelerate further to 23%.

Why C3.ai stock is a no-brainer buy for the long term

First, it’s important to emphasize that C3.ai continues to lose money. Net loss was $72.9 million in the fourth quarter, which was up from the year-ago period as the company spent more money on its operating expenses (especially marketing) to boost sales. On a non-GAAP basis, which excludes one-time and non-cash expenses such as stock-based compensation, C3.ai’s loss was $14 million, which is slightly more palatable.

The company has $750.3 million in cash, equivalents and marketable securities on its balance sheet, so it can afford to bear its losses for the foreseeable future, but it will ultimately have to prove to investors that it can generate profits to meet rising to guide sales. grow.

On the other hand, Wall Street predictions suggest that AI could add anywhere from $7 trillion to $200 trillion to the global economy over the next decade. Capturing as much of that value as possible could yield significant rewards for investors in the long run. So it’s not necessarily a bad thing that C3.ai is giving up profitability in the short term in favor of aggressive spending to acquire customers.

C3.ai stock hit an all-time high of $161 shortly after its 2020 IPO, so the current price of $25.90 represents an 83% drop. To be clear, the company’s valuation was completely irrational at the time, but since then it has done nothing but grow its revenue and its customer base. Moreover, the opportunities in the field of AI have never been greater.

Therefore, this could be a great opportunity for investors to buy C3.ai with the intention of holding it for the next decade as the AI story unfolds.

Should you invest $1,000 in C3.ai now?

Before purchasing shares in C3.ai, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $677,040!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no positions in the stocks mentioned. The Motley Fool holds and recommends positions in Amazon and Microsoft. The Motley Fool recommends C3.ai and recommends the following options: long calls in January 2026 for $395 at Microsoft and short calls in January 2026 for $405 at Microsoft. The Motley Fool has a disclosure policy.

1 No-Brainer Artificial Intelligence (AI) Stock to Buy With $30 and Hold for 10 Years was originally published by The Motley Fool