One of the most important aspects of the S&P 500 index is the way it is weighted. While the market cap weighting approach was an improvement over the way the Dow Jones Industrial Average is designed to expose the S&P 500 Index – and all products that track it – to additional risk during periods of overperformance.

That is why adding the Invesco S&P 500 ETF with equal weight (NYSEMKT: RSP) If you have $1,000 in cash available to invest today, it might be a good idea to add money to your portfolio.

Why is weighting so important for the S&P 500 index?

When the Dow Jones Industrial Average was created, people had to calculate it by hand.

When it became the primary measure of market performance, its creators chose a simple method to calculate the level: take the share prices of each of 30 stocks you select and divide them by 30. (That’s actually an oversimplification: the method also requires you to divide by the Dow Divisor, which is adjusted to account for things like stock splits.)

Therefore, it is ultimately the stocks that have the greatest impact on the movements of the Dow that you can invest in SPDR Dow Jones Industrial Average ETF (NYSEMKT: DIA) — are the ones with the highest stock prices. That’s not ideal.

In contrast, the S&P 500 index is weighted by market capitalization. This means that the largest companies by size have the greatest impact on performance, because they make up the largest portion of the index. This makes more sense, since the largest companies are typically the most important companies in the economy. The index also tracks 500 companies, as opposed to the 30 in the Dow.

Overall, that much broader diversification is a major reason why the S&P 500 index is considered a better way to track the market than the Dow Jones. SPDR S&P 500 ETF (NYSEMKT: SPY) is the go-to exchange-traded fund (ETF) for tracking the S&P 500 index. In fact, it’s one of the oldest ETFs in existence.

However, there are still some potential pitfalls to investing in a product that tracks the S&P 500 index, since the most popular stocks tend to be the largest stocks. This may feel nice when Wall Street is going up, but it can cause extra pain if a bull market turns into a bear market.

Why Invesco S&P 500 Equal Weight ETF is Attractive Right Now

Markets go up and down — that’s just the way Wall Street works. And usually, when the market goes up big, there’s excess enthusiasm that’s eventually washed away by a correction (a market decline of 10% or more from its high) or, worse, a bear market (a market decline of 20% or more). Right now, the stock market is hovering near all-time highs, but a small number of mega-cap companies are driving much of the market’s movement. There’s a way to soften the blow this is likely to cause in a market downturn — equal weighting. That’s the methodology used by the Invesco S&P 500 Equal Weight ETF.

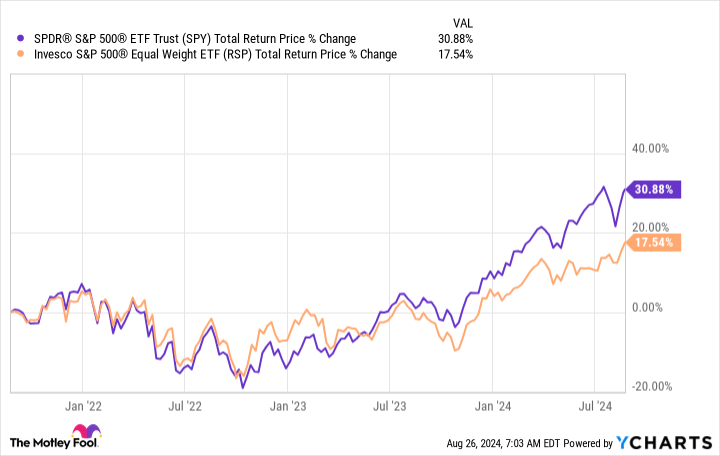

Essentially, it takes the same list of stocks that make up the S&P 500 index, but allocates the same dollar investment to each one, and then periodically rebalances the portfolio to bring each company’s share of the total back into parity. This means that the stock movements of the largest companies in the index have the same impact on performance as the smallest companies. That makes a big difference, especially in times like these, as the chart below shows. Note how the equally weighted Invesco ETF lags the market cap-weighted ETF.

In particular, pay attention to how the total return of the S&P 500, which measures dividends reinvested, has risen over the past year or so. That’s essentially when the so-called “Magnificent Seven” stocks became the primary driver of the broader market index’s movements. Yes, it feels good to own those stocks in a market-cap-weighted index when they’re going up big, but in a bear market, those stocks are often the ones that fall the hardest. When that happens, it feels a lot better to invest in an index that owns shares of all the same companies but with equal weighting, since the steep declines of a small handful of them won’t have such a painful impact on your returns.

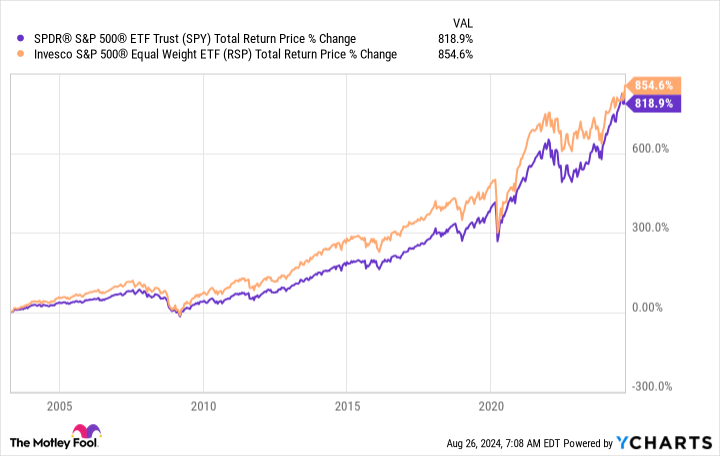

In fact, the pullbacks in those stocks may even be offset to some extent by the fact that investors often flock to stocks that are considered safe havens, such as utilities and consumer staples, during market corrections. Since the movements of those stocks will have the same impact on the performance of an equally weighted index as any other, they can help soften the blow to the stocks that potentially implode. If you’re wondering how helpful that might be, note in the chart above that the Invesco S&P 500 Equal Weight ETF has outperformed the S&P 500 over a 20-year period.

Prepare for the worst today

This isn’t to say you should put all of your money in the Invesco S&P 500 Equal Weight ETF. However, it may be a good idea to hedge your bets a bit if you have a large portion of your portfolio in market-cap-weighted funds like the SPDR S&P 500 ETF. That way, when the bad times eventually come – and they will eventually come, if history is any guide – you won’t have to bear the brunt of the pain that is likely to come from the small number of popular stocks driving the market higher.

Should you invest $1,000 in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF now?

Before you buy shares in Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Invesco Exchange-Traded Fund Trust – Invesco S&P 500 Equal Weight ETF wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 26, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 No-Brainer S&P 500 ETF to Buy Now for Under $1,000 was originally published by The Motley Fool