Altria (NYSE:MO) is generally considered a defensive stock. That is, if you want to defend against a potential bear market, this is the type of stock you want to own.

No one knows exactly where the markets will go from here. But if you want to protect your nest egg, keep reading.

Make sure you own Altria stock if this thing happens

When a bear market hits, you’ll want to own Altria stock. Of course, no one can predict when the next crash will come, but if you’re worried about a downturn, or just want to make sure your money is protected, start introducing these types of stocks into your portfolio.

Let’s look at a few examples of how Altria can insulate your money during a bear market.

Through the first 60 days of the 2020 crash, Altria stock outperformed the market by a healthy margin. While Altria shares lost value – down about 7.2% – S&P500 lost 14.8% of its value. If you had invested in Altria instead of the market, you would have cut your losses in half.

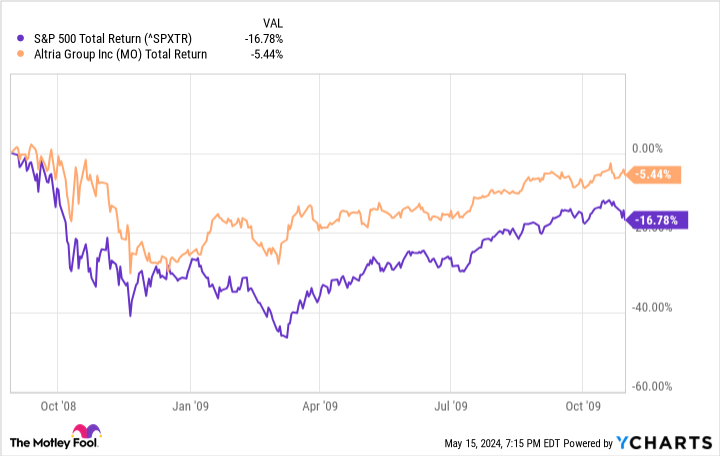

And what about the first 60 days of the 2008 crash? From September 1 to November 1, Altria shares lost about 5.4% in value. The S&P 500, meanwhile, fell 16.8%. Holding Altria stock would therefore have cut your losses by two-thirds.

Altria stock can also perform during bull markets

Altria is not just a reliable stock for bad times. In the long run, it has also been shown to be able to beat the market, even during bull markets. For example, since 2000, Altria shares have delivered a total return of 12,370%. The S&P 500, meanwhile, posted a total return of just 472%. That period included several significant bull and bear markets, but Altria’s stock still came in well ahead of the market.

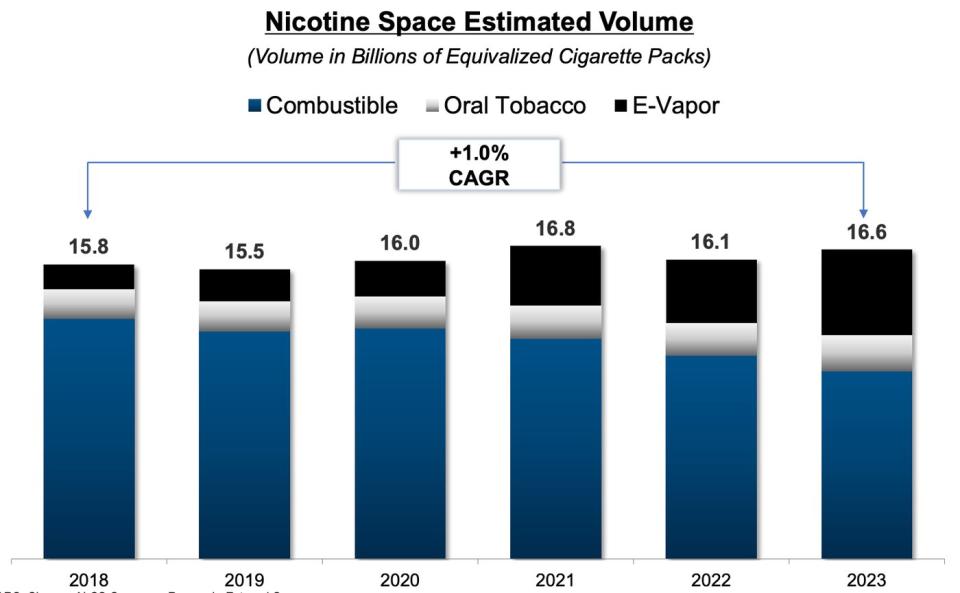

What makes Altria so good at generating above-average returns regardless of market conditions? First, it has the advantage of selling recession-proof products. As the largest nicotine company in the US, Altria has many well-known brands, including Marlboro and Black & Mild. But heavy investments are also being made in e-vapor and non-flammable products. That’s a wise move, because while combustible levels in the US have declined over time, overall nicotine use continues to slowly rise.

With a dominant market share in a stable, steadily growing end market, Altria has been able to pay outsized dividends in virtually all market conditions; the 2008 financial crisis was the only time in the past forty years that the dividend was cut. However, the current yield is now over 8%, the highest level in over a decade.

This increased dividend yield is the result of a number of things. First, the dividend payout has continued to rise, supported by rising cash flows. Since 2018, cash flow from operating activities has roughly doubled. The second reason is a struggling stock price. This is what investors should get excited about.

While Altria has proven its ability to perform well in both bull and bear markets, stocks often struggle during dramatic market upturns like the one we are experiencing now. That’s because the company cannot grow faster at the push of a button. The company’s main advantage – a stable, slow-growing end market – becomes a liability in markets like these. For example, over the past five years, the S&P 500 has doubled in value, while Altria stock has only risen 31%.

In many ways, this is a perfect time to buy. There are legitimate concerns about Altria’s ability to transition its combustibles business to non-combustibles. And markets like this don’t value these types of companies very highly. But when the markets fall, you’ll be happy to have Altria as part of your portfolio. The reliable cash flows, high dividend and extensive share buyback program provide sufficient protection against downward developments during a recession. Shares also now trade at a free cash flow yield of 11%, providing further downside protection. It’s just hard to see Altria stock trading at a much bigger discount.

Is Altria a perfect stock? Certainly not. But if you want to prepare parts of your portfolio for a possible bear market, start with these types of stocks.

Should You Invest $1,000 in Altria Group Now?

Consider the following before purchasing shares in Altria Group:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Altria Group wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

1 Reason to Buy Altria Stock Like There’s No Tomorrow was originally published by The Motley Fool