Artificial intelligence (AI) is currently the hottest topic in the technology field. Indeed, megacap giants like the ‘Magnificent Seven’ are innovating at lightning speed and investors can’t seem to get enough of it.

In addition to the largest of the big tech players, numerous other enterprise software companies have captured Wall Street’s interest. Salesforce.com (NYSE: CRM) makes for one of the most interesting case studies when it comes to AI software.

With the stock down about 12% year to date, Salesforce is drastically underperforming Nasdaq Composite And S&P500 indexes. Nevertheless, I see the company as an attractive investment opportunity, and I think shares are dirt cheap.

Control at Salesforce

Since 2018, Salesforce has spent nearly $50 billion to acquire three companies: MuleSoft, Tableau and Slack.

To put this in perspective, Salesforce only generated about $35.7 billion in revenue over the last twelve months. Considering that the three companies mentioned above have been part of the Salesforce ecosystem for several years, it’s fair to conclude that the company may not be monetizing these assets very well.

Furthermore, given that artificial intelligence (AI) is currently the bedrock of the tech world, investors don’t seem to be inspired by Salesforce’s paltry 11% revenue growth in its most recent fiscal quarter, which ended April 30.

At first glance, I would say these concerns are valid. However, a deeper dive into the company’s latest earnings report sheds light on where Salesforce is witnessing impressive growth, and more importantly, how the operational efficiencies management is pursuing are finally starting to materialize.

Looking beyond turnover

While the headline numbers on an income statement are useful for getting an idea of a company’s sales and profitability profiles, getting too caught up in these numbers can cause investors to miss the bigger picture.

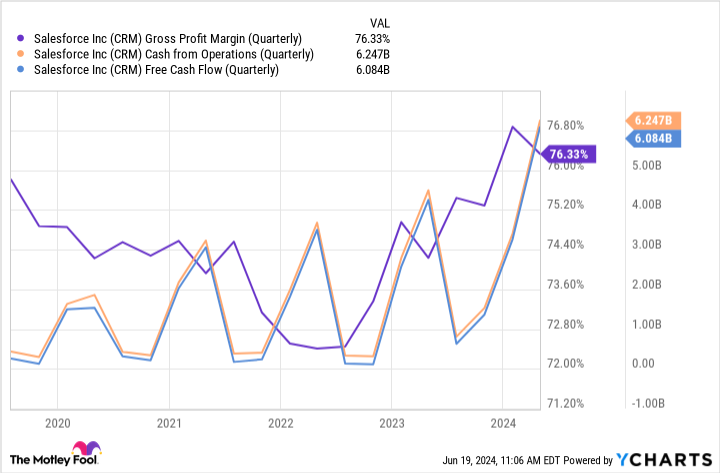

The chart below contains some other financial indicators that I would encourage investors to analyze.

There are a number of important themes that need to be discussed here. First, Salesforce’s gross margin profile has improved dramatically in recent years. This also applies to the cash flow situation.

This dynamic is very much by design. “We have more than tripled the cash we generated just four years ago,” Chief Financial Officer Amy Weaver said during the company’s most recent earnings call. Although Salesforce’s revenue is only growing at 11% per year, its free cash flow is essentially increasing at over 40% per year.

To me, that robust growth in cash flow generation is much more important than trends in revenue.

Salesforce stock is a bargain among AI software capabilities

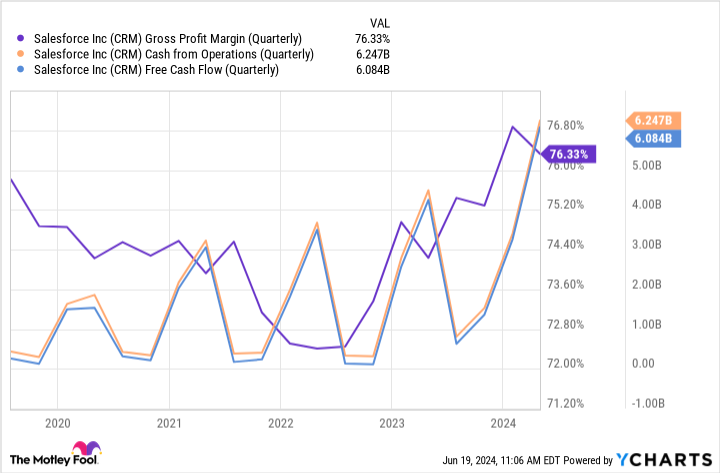

The chart below compares Salesforce to a cohort of other leading AI software companies on a price-to-free-cash-flow (P/FCF) basis.

Of these competitors, Salesforce has the lowest P/FCF multiple, and that’s not even close. I think investors are missing the forest for the trees when it comes to Salesforce and its potential as a leading AI opportunity.

It’s important to keep in mind that sales will ebb and flow from quarter to quarter. Moreover, on a macroeconomic level, the past few years have seen first a sharp spike in inflation and then, even after it retreated, the lingering effects of that increase. Considering this, it makes sense that companies of all sizes have curtailed spending and are operating on tighter budgets – a dynamic that will directly impact Salesforce’s ability to grow its revenues.

Additionally, I’d be remiss not to note that the company’s integration and analytics business – which includes Tableau and MuleSoft – was Salesforce’s best performing business during the first quarter, growing 25% year over year.

I think Wall Street was right to start demanding more growth from Salesforce’s acquired assets. But as the AI story continues to unfold, I think the company is only scratching the surface of its potential.

As Tableau, MuleSoft and other services become a more meaningful part of Salesforce’s overall business, I think accelerating revenue prospects are very much on the horizon. These should further contribute to improving the company’s profit margin and cash flow positions.

I think investing in Salesforce is a no-brainer at this point. With the stock trading at such a noticeable discount to its peers and underperforming the broader market, I think Salesforce looks dirt cheap.

Should you invest €1,000 in Salesforce now?

Before you buy shares in Salesforce, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Salesforce wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions at Alphabet and Microsoft. The Motley Fool holds positions in and recommends Alphabet, Microsoft, Oracle, Salesforce, ServiceNow, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

1 Ridiculously Cheap Artificial Intelligence (AI) Growth Stocks to Buy Now Hand Over Fist was originally published by The Motley Fool