All eyes will be on Federal Reserve Chairman Jay Powell when he announces what the Fed plans to do about interest rates at its Sept. 17-18 meeting. It’s a foregone conclusion that there will be at least some rate cut, but no one knows how much. As a result, some consumers may hold off on purchasing until rates start to come down, something that could greatly benefit a few businesses.

One stock that could go parabolic if the Fed cuts rates is Upstart (NASDAQ: UPST)Upstart’s software is an alternative to FICO scores and is primarily used for personal and auto loans, two areas that have seen less demand since interest rates rose.

Upstart uses AI to assess creditworthiness

Upstart’s alternative lending model evaluates borrowers differently than a credit score. It uses alternative factors that aren’t normally used in FICO scores to better assess a borrower’s creditworthiness. It also uses artificial intelligence (AI) to do this, which can help remove bias in loan approvals. The results are pretty clear: Upstart has 53% fewer delinquencies than a traditional model with the same approval rates.

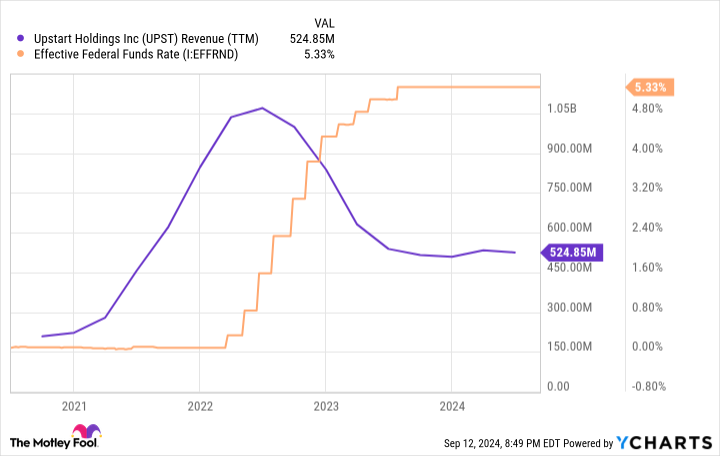

Upstart has a great model, but the problem is that it doesn’t control its own destiny. Because its business is tied to interest rates, it can boom and bust alongside those rates. Just a few years ago, it had annual revenues of $1 billion. Now, it’s about half that.

But those quarters of low earnings are virtually the inverse of the effective federal funds rate, so it begs the question: Could Upstart become popular again if the Fed cuts rates?

Upstart’s business has not done well with the higher rates

The problem with Upstart is that its business needs booms to survive. As mentioned above, Upstart’s lending expertise is focused on the personal and auto loan industries. These rates are often significantly higher than the federal funds rate because of the increased risk of these loans that the lender makes. As a result, there is little demand when rates are as high as they are now. However, if the Fed lowers rates, consumers are more likely to take out loans if they can get a lower interest rate than they were before.

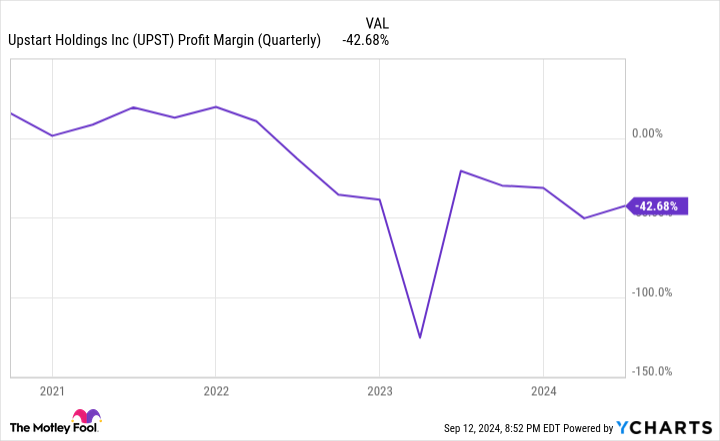

Unfortunately, Upstart has become very unprofitable since business took a nosedive due to high interest rates.

While the company’s revenues have been fairly stable, it has done little to become more efficient and limit its losses. This is a big red flag to me, because it shows that it needs these periods of low interest rates to survive.

That’s a sign of a company that’s not built for the long term. If Upstart was marginally profitable in bad times but enormously profitable in good times, I’d reconsider, but that’s not the case.

Still, that doesn’t mean the stock won’t see significant gains if the Fed cuts rates. There’s likely pent-up demand for personal and auto loans, as consumers may have avoided taking out loans due to higher interest rates than in recent times. As a result, Upstart’s business is likely to take off, and the stock could follow suit.

Unless management makes some changes from the previous boom, Upstart could be in trouble again in a few years. The stock could be a buy here if it changes for the better. But if it sticks to its old ways (which it has done in recent quarters), it could repeat its problems in a few years.

Should You Invest $1,000 in Upstart Now?

Before you buy shares in Upstart, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Upstart wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $729,857!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Keithen Drury has positions in Upstart. The Motley Fool has positions in and recommends Upstart. The Motley Fool has a disclosure policy.

1 Stock Drops 91%, Could Go Parabolic as Fed Cuts Rates was originally published by The Motley Fool