Nvidia (NASDAQ: NVDA) Shares are up 1,080% over the past four years, meaning the $10,000 invested in the semiconductor company in May 2020 would now be worth $118,000. To put these numbers in context: the S&P500 (SNPINDEX: ^GSPC) delivered a 91% return over the same period, so the $10,000 invested four years ago would now be worth $19,100.

Nvidia lowered its stock price with a 4-for-1 stock split in July 2021, and the company now has a 10-for-1 stock split planned for next month. After the market closes on Friday, June 7, shareholders will receive nine new shares of Nvidia for every share they owned at the previous close. To be clear, the split will not have a direct impact on the value of the company, but it will make the shares more affordable.

Despite Nvidia’s phenomenal run, 90% of Wall Street analysts covering the company still rate the stock as Buy, with the remaining 10% rating the stock as Hold. No analyst recommends selling. Nvidia has an average price target of $1,200 per share, which implies an upside of about 13% from the current price of $1,064 per share.

Here’s what investors need to know about this artificial intelligence stock.

Nvidia is a leader in accelerated data center computing

Nvidia is best known for its graphics processing units (GPUs), chips that are the gold standard in (1) rendering ultra-realistic computer graphics in multimedia such as video games and (2) accelerating complex data center workloads such as artificial intelligence (AI) applications. The company has an exceptionally strong presence in both markets, although the greatest growth opportunities lie in the latter category.

For context, Wells Fargo Data collected by Eric Flaningam shows that Nvidia was responsible for 98% of data center GPU spending in 2023, and the company is expected to capture a 94% market share by 2024. Perhaps more importantly, Nvidia accounted for 92% of the spend on data center GPUs used. for generative AI workloads by 2023, according to IoT Analytics.

That dominance is partly due to the full-stack strategy. GPUs are just one element of the data center stack, but other components are needed to build and run complex applications. That includes central processing units (CPUs), networking platforms and software development tools. Nvidia addresses every layer of the stack. That makes the company a one-stop shop for AI training and inference, and it supports the rapid innovation that gives Nvidia an edge over its competitors.

CEO Jensen Huang commented on that benefit during the last earnings call. “We’re moving so fast and making progress [our systems] quickly, because we have all the stacks here. We literally build the entire data center and can monitor, measure and optimize everything,” he told analysts. “This deep, in-depth knowledge across the entire data center scale is fundamentally what sets us apart today.”

Nvidia just delivered another blockbuster financial report

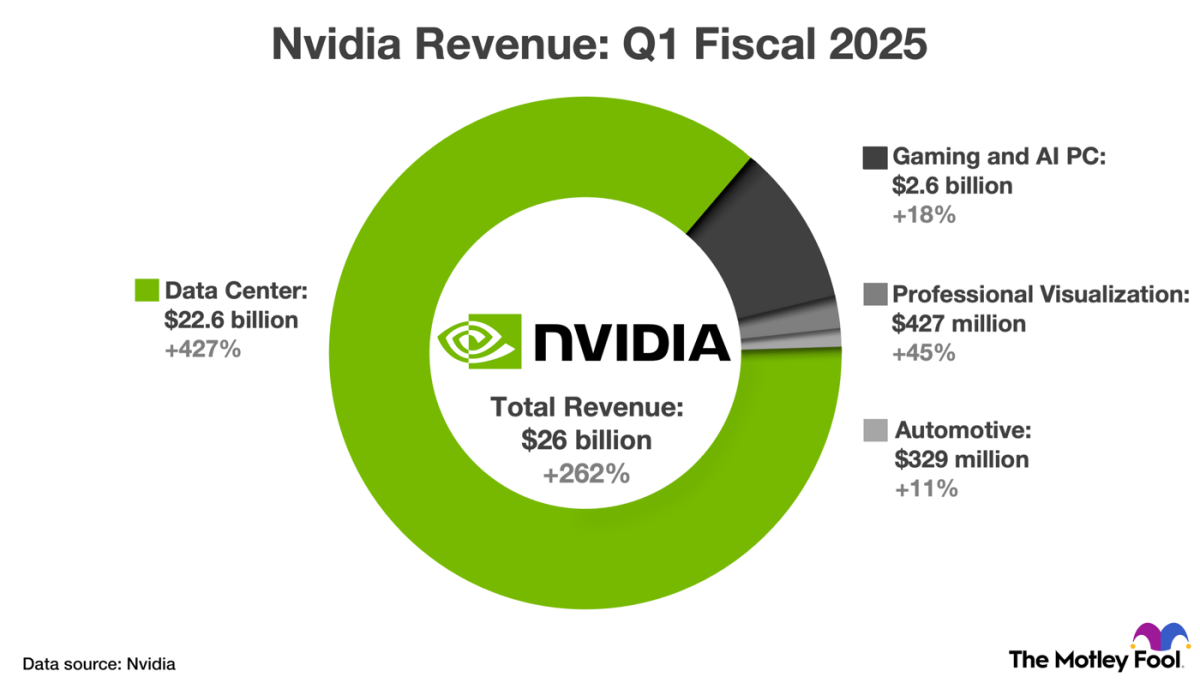

Nvidia reported financial results for the first quarter of fiscal 2025 (ending April 28, 2024) that easily exceeded Wall Street expectations. Revenue increased 262% to $26 billion thanks to exceptional revenue growth in the data center product category, itself driven by demand for generative AI systems. Meanwhile, non-GAAP net income rose 461% to $6.12 per diluted share.

The chart below provides more detail on first-quarter revenue growth across Nvidia’s four major product categories.

Looking ahead, Nvidia expects second-quarter revenue of $28 billion, implying 75% growth. That was easily better than the $26.6 billion that Wall Street analysts had expected. Management also projected approximately $15.5 billion in non-GAAP net income, implying growth of approximately 130%.

More importantly, CFO Colette Kress recently told analysts that “demand could exceed supply well into the year” due to the upcoming launch of Blackwell, the name given to Nvidia’s next-generation AI factory platform. The Blackwell GPU architecture delivers up to four times faster AI training and 30 times faster AI inference compared to the previous Hopper GPU architecture.

Nvidia stock is trading at a somewhat reasonable valuation

The graphics processor market is expected to grow 28% annually through 2030, and AI spending across hardware, software and services is expected to grow 37% annually over the same period, according to Grand View Research. Based on these estimates, Nvidia has a good shot at annual earnings growth of around 30% (plus or minus a few points) through the end of the decade.

In fact, Wall Street expects the company to grow earnings per share 38% per year over the next three to five years. That consensus estimate makes the current valuation of 62.3 times earnings seem relatively reasonable, especially compared to other AI stocks. I say that because these values (the price-to-earnings ratio divided by forecast earnings growth) give Nvidia a PEG ratio of 1.6. Meanwhile, chip maker Advanced micro devices has a PEG ratio of 5.8, and cloud service providers Alphabet And Microsoft have PEG ratios of 1.5 and 2.7 respectively.

That doesn’t mean Nvidia stock is cheap, but the stock is (arguably) cheaper than AMD and Microsoft, and almost as cheap as Alphabet. I think investors can buy a few shares of Nvidia now, provided they keep their purchases small (maybe 2% of their portfolios). Investors should also understand the risks associated with Wall Street’s high expectations. Nvidia stock could implode if the company fails to match analysts’ earnings growth expectations.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Wells Fargo is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennevine has positions at Nvidia. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

1 Stock-split Artificial Intelligence (AI) Stock Rises 1,080% in 4 Years to Buy Now, According to Wall Street Originally Published by The Motley Fool