The US economy has an excellent reputation for producing the most valuable companies in the world. United States Steel became the first company to reach $1 billion in sales in 1901. General Motors and then rode the automobile revolution to become the first company to reach $10 billion in sales in 1955. In 2018, Apple was the first company to reach the $1 trillion mark thanks to the success of its iPhone.

Apple remains the largest company in the world with a market cap of $3.3 trillion, but the company has since been joined in the trillion-dollar club by tech giants Nvidia, Microsoft, Amazon, Meta platformsAnd Alphabet.

Broadcom (NASDAQ: AVGO) could join them. It’s currently valued at $761 billion, so the stock only needs to rise 31.4% from here to earn its membership. Here’s why I think it will happen.

Broadcom shares have been surging recently, leading to a split

Broadcom was originally a semiconductor and electronics company, but since merging with Avago Technologies in 2016, the company has been on an acquisition spree. It spent nearly $100 billion in total, buying semiconductor equipment company CA Technologies in 2018, cybersecurity giant Symantec in 2019 and cloud software developer VMware in 2023.

The acquisitions have sent Broadcom shares soaring 465% over the past five years, and earlier this year they soared above $1,800, making them somewhat inaccessible to investors with small portfolios. As a result, Broadcom’s management team decided to execute a 10-for-1 stock split, increasing the number of shares outstanding tenfold and reducing the price per share accordingly.

The split went into effect on July 12, so investors can now buy a single share of Broadcom stock for just $162 at the time of writing. That’s an opportunity, as the company’s growing presence in artificial intelligence (AI) could generate even more upside from here.

A versatile company in artificial intelligence

Broadcom has spent the past year focusing heavily on AI across the organization to help drive one of the most valuable technology revolutions in history.

On the semiconductor side, Broadcom makes data center accelerators, chips designed specifically for AI development. It also supplies networking equipment for data centers, including Ethernet switches that control how quickly data travels from one point to another. High-performance switches are critical to AI infrastructure, since data must flow quickly through tens of thousands of graphics processing units (GPUs) and accelerators.

During the recent third quarter of fiscal year 2024 (ended Aug. 4), Broadcom said its custom AI accelerator segment grew three and a half times compared to the same period last year, driven by surging demand from hyperscalers (which typically include Microsoft, Amazon and Alphabet). The company also said its Tomahawk 5 and Jericho3 AI switches delivered four times revenue growth compared to the same period last year.

Outside of the semiconductor industry, Symantec is weaving AI into its cybersecurity products. Earlier this year, it launched SymantecAI, a chatbot that can answer users’ questions about their endpoint protection.

Then there’s VMware, which acts as the data center software layer to help organizations optimize their infrastructure. They can use VMware to create virtual machines, which means multiple workers can plug into the same server to utilize its full capacity. This ensures that no computing power is wasted, which is critical right now due to the shortage of powerful GPUs and data center hardware.

Broadcom expects to generate $51.5 billion in total revenue for the full fiscal year 2024, which ends in late October. The company’s guidance initially suggested that $11 billion of that would be attributed to AI in its businesses, but it just raised that estimate to $12 billion , underscoring the significant momentum in this emerging space.

Broadcom’s (Mathematical) Path to the $1 Trillion Club

As I mentioned above, Broadcom currently has a market cap of $761 billion, so the stock price only needs to rise 31.4% to get it into the $1 trillion club.

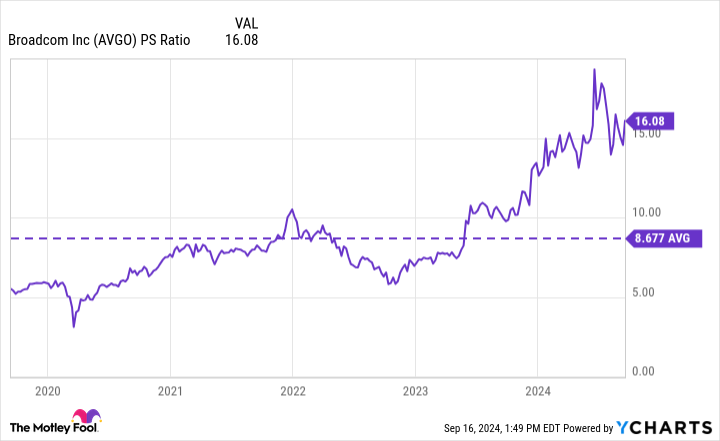

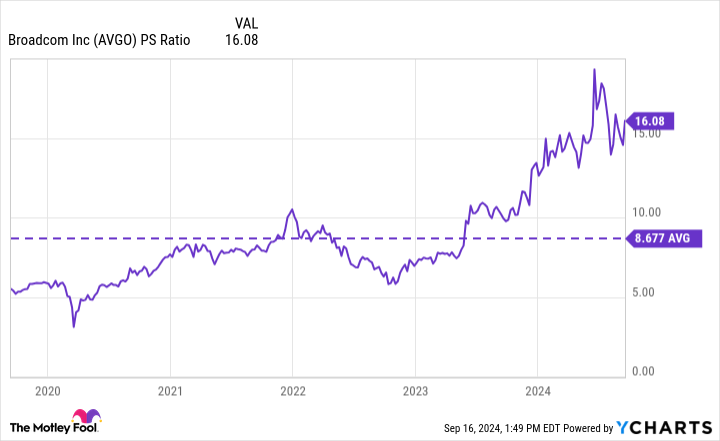

The company is not consistently profitable on a GAAP basis, so it cannot be valued using the traditional price-earnings (P/E) ratio. However, we can value it using the price-sales (P/S) ratio, which divides market capitalization by annual revenue.

Broadcom currently trades on a P/S ratio of 16. If that number holds constant, the company only needs to grow its annual revenue by 31.4% to justify its entry into the $1 trillion club. Wall Street expects Broadcom to grow its revenue by 17.2% in fiscal 2025, which won’t be enough, but it could get there in fiscal 2026 if it can grow by that amount again.

There is a caveat. While Broadcom’s P/S ratio has fallen from its peak of around 19, it is still very expensive compared to its average of 8.7 over the past five years:

It’s clear why investors are willing to pay a premium for the stock right now: Broadcom’s AI semiconductor products are delivering explosive growth, and its acquisitions are adding a huge amount of value. However, there’s no guarantee that investors will be receptive to such a high P/S ratio in the long run, and a cut back to the five-year average could help years on Broadcom’s quest to join the $1 trillion club.

While Broadcom will be a spectacular stock to own during the AI revolution, investors should take a very long-term view (perhaps a decade or more) if they buy it today. That gives the company plenty of time to grow to its current valuation.

Should You Invest $1,000 in Broadcom Now?

Before buying Broadcom stock, here are some things to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now…and Broadcom wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $708,348!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former chief market development officer and spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Stock Split Share That Will Join Nvidia, Apple, Microsoft, Amazon, Alphabet, Meta In $1 Trillion Club was originally published by The Motley Fool