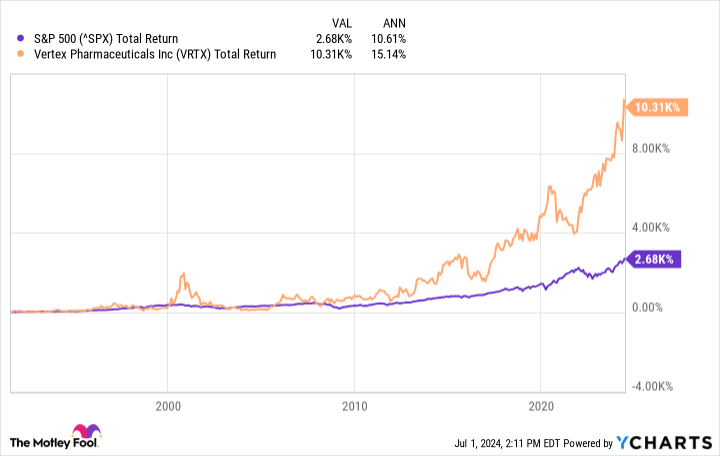

Investing in stock markets is a reliable, wealth-building strategy. Over the past 33 years, the S&P 500‘s average annual yield is about 10.6%. It’s hard to find a much better yield elsewhere.

However, some individual stocks have done even better. Take Vertex Pharmaceuticals (NASDAQ: VRTX)a leading biotech company whose average annual return since its initial public offering (IPO) in 1991 is 15.1%. The pharmaceutical company has grown by 10,310%.

It’s an impressive performance, but Vertex still has plenty of growth ahead of it and the stock looks like a solid buy-and-hold-forever pick. Here’s why.

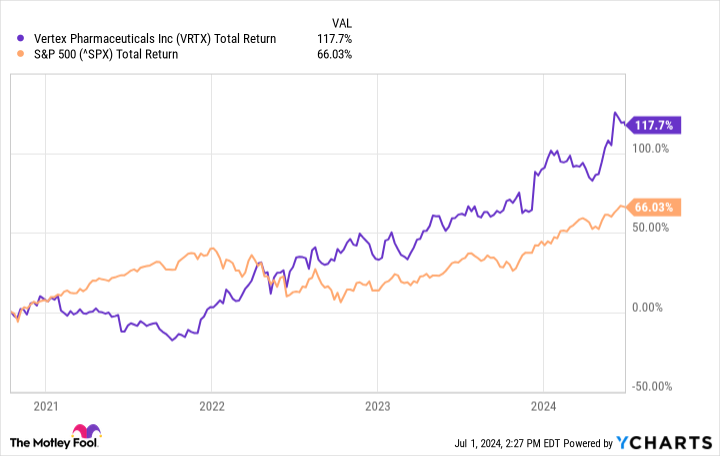

^SPX data from YCharts.

The Secret of Vertex’s Success

About 7,000 rare diseases affect between 25 and 30 million Americans. Many of them have no approved therapies that address their underlying causes. So it’s not hard for a biotech to pick a target in this universe of unmet medical needs that could prove very lucrative. The hard part is developing effective drugs. That’s Vertex’s primary (but not exclusive) focus. The company is trying to target the underlying causes of diseases for which few, if any, therapies exist.

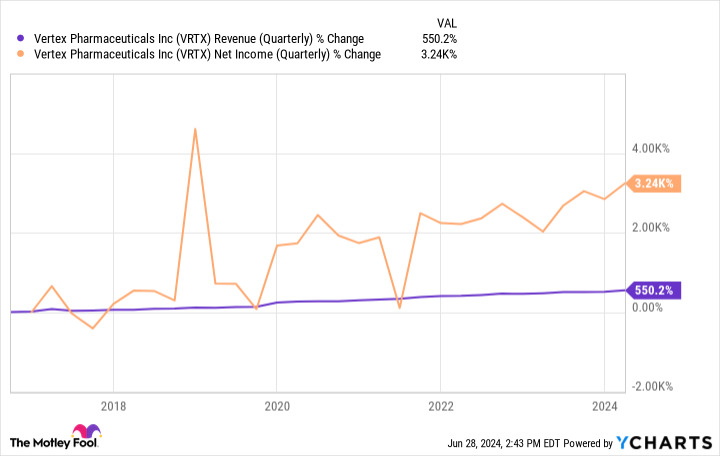

The work in cystic fibrosis (CF) over the past few decades has been an astonishing success story. CF is a disease that affects approximately 92,000 patients in North America, Europe and Australia. It causes damage to internal organs. And until Vertex’s breakthroughs—its first CF product was formally approved in the U.S. in 2012—there were no drugs that addressed the disease at the genetic level. Vertex has been richly rewarded for its advances in this area. Sales and profits have grown rapidly.

VRTX revenue data (quarterly) from YCharts.

But that is a thing of the past. Can Vertex Pharmaceuticals continue to perform well in the future?

Don’t change a winning formula

Success in business doesn’t happen by accident. Yes, there is often an element of luck. However, companies that perform consistently well over the long term must have a vision and the ability to execute a winning strategy. Vertex’s vision remains the same. The company is still developing drugs for rare (and not-so-rare) diseases. In the past, the biotech has proven that it can execute. Many of its competitors have tried to develop competing CF therapies. So far, they have all failed.

Vertex is now proving itself outside its core area. It recently received approval for Casgevy, a gene-editing treatment for a number of rare blood-related diseases. It is advancing important programs in its pipeline. Inaxaplin, a potential therapy for APOL1-mediated kidney disease, is now in the phase 3 portion of a phase 2/3 trial.

Suzetrigine, an experimental drug for acute and neuropathic pain, performed well in a late-stage clinical trial, the results of which were announced earlier this year. There are plenty of painkillers out there, but they often have troublesome side effects, so there’s still a need for this one.

Vertex’s early-stage programs also look promising. The company aims to “cure” type 1 diabetes with VX-880. In an ongoing Phase 1/2 trial, three patients have achieved insulin independence with at least one year of follow-up. All people with type 1 diabetes (as opposed to the type 2 variety) typically have need insulin. These results are impressive, although it is too early to cheer. More is happening with Vertex Pharmaceuticals.

The key point, however, is this: don’t invest in biotech because of specific clinical programs. VX-880 may prove ineffective, and so may inaxaplin. Despite positive Phase 3 results, suzetrigine may encounter unforeseen regulatory hurdles. After all, Vertex has faced similar clinical and regulatory headwinds before.

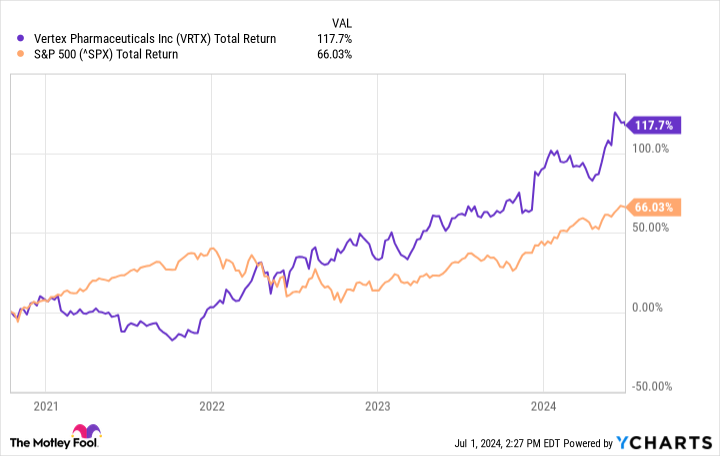

In October 2020, the biotech company halted a Phase 2 trial for an otherwise promising candidate, in part due to safety concerns. The company’s shares fell dramatically in a single day as a result. Here’s how the stock has performed since then.

VRTX Total Return Level data from YCharts.

The lesson? Vertex’s prospects don’t hinge on a single program. The company’s strength lies in its clear vision and strategy, and the culture of innovation that enables it to realize that vision. That’s what makes Vertex Pharmaceuticals stock worth holding on to forever.

Should You Invest $1,000 in Vertex Pharmaceuticals Now?

Before you buy Vertex Pharmaceuticals stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Vertex Pharmaceuticals wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $786,046!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.

1 Stock That’s Up 10,000% in 33 Years to Buy and Hold Forever was originally published by The Motley Fool