The artificial intelligence (AI) revolution is in full swing, and according to one Wall Street analyst, this well-positioned company shows no signs of stopping anytime soon.

While most investors lean towards chip leaders Nvidia (NASDAQ: NVDA) At the moment, AI is and will continue to be other market winners. In fact, an S&P 500 AI company even surpassed Nvidia this year. And despite this stock’s impressive run through 2024, one Wall Street analyst is predicting another 70% rise.

Super Micro Computer has beaten Nvidia and is ready for a breakthrough with liquid cooling

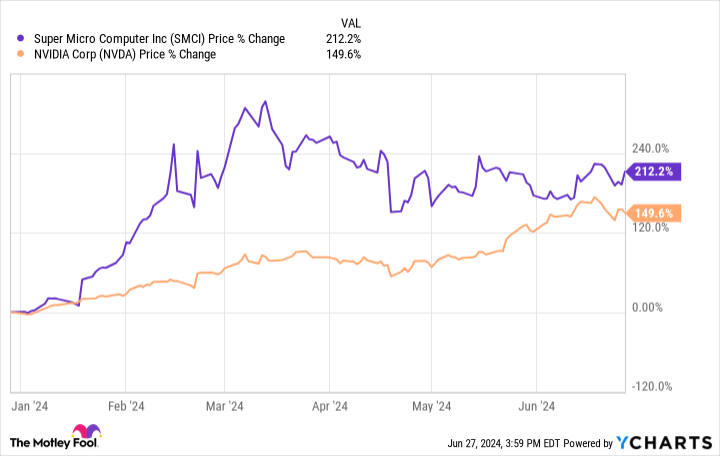

This year server maker Supermicrocomputer (NASDAQ: SMCI) is already up 212%, easily outperforming Nvidia’s impressive 149% year-to-date gain.

Supermicro has undoubtedly benefited handily from working closely with Nvidia as its preferred server partner. However, the company has also gained market share thanks to its internal technical prowess.

Supermicro’s strategy of building servers from “building block” pieces enables rapid, large-scale customization while saving customers money. The building block architecture allows parts of a server to be easily swapped and upgraded rather than having to replace the entire unit.

In addition, its building block architecture and close relationship with Silicon Valley technology companies allow Supermicro to build custom servers faster than its competitors. With so many companies thinking about building advanced AI infrastructure as quickly as possible, it’s no wonder customers are flocking to Supermicro’s solutions.

Additionally, Supermicro’s long-standing ethos of resource-saving and energy-efficient design has come to the fore in the age of AI. AI chips require a huge amount of energy and must dissipate a lot of heat. To further reduce energy costs, Supermicro is now introducing its own direct liquid cooling (DLC) technology.

DLC technology has been around for decades. However, because it is an added expense and can take a long time to implement in a data center, it has only captured about 1% of the data center market.

However, AI servers are becoming extremely energy intensive and will soon require DLC instead of air-cooled racks. DLC data centers reduce the need for extensive air conditioning systems, saving both energy and space within the data center, allowing for even denser server clusters.

From its mere 1% market share, CEO Charles Liang expects a wave of DLC deployments to account for 15% of Supermicro racks this year and 30% next year. According to Liang, today Supermicro can deliver DLC solutions within weeks, and implementing DLC can help reduce data center energy consumption by up to 40%.

So despite the company’s 200% revenue growth last quarter, DLC’s customer benefits should help maintain the company’s hypergrowth and margins for the foreseeable future.

Loop Capital Thinks Supermicro Will Hit $1,500

In recent years, Supermicro has routinely beaten even the most optimistic analysts’ expectations. But with this year’s inclusion in the S&P 500 Index, many more Wall Street analysts have begun covering the stock.

One of the most optimistic is tech-focused research shop Loop Capital. In April, Loop analyst Ananda Baruah raised his price target for Super Micro Computer from $600 to $1,500 per share.

Explaining the increase, Baruah rightly noted that Supermicro has built a reputation as “an increasing leader in the need for both complexity and scale” for AI implementations. Additionally, Baruah sees Supermicro’s speed and agility as a key factor, elaborating: “While it is not really possible to know the scale of these wins or the timeframe of deployments, there has been an overall momentum in the industry to accelerate deployments to set up faster instead of slower.”

To arrive at his valuation, Baruah expects Supermicro to earn between $50 billion and $60 billion in fiscal 2026, ending in June 2026, on revenue of between $30 billion and $40 billion. That compares to estimates of nearly $15 billion in revenue and $24 billion in fiscal 2024, which ends today, June 30.

With that kind of growth and earnings power, Baruah thinks Supermicro can maintain a price-to-earnings ratio of 25 to 30 even in 2026. So with 30 times $50 or 25 times $60 he will reach his goal of $1,500.

Supermicro could have more of an advantage than Nvidia

While Nvidia is the king of AI chips today, it will also face an onslaught of competition from other processor companies and the custom ASICs (application-specific integrated circuits) of cloud giants. Supermicro’s servers, however, can house any type of AI chip.

So Supermicro should see continued growth and share gains regardless of which AI chip wins the day or even if the gains are spread across multiple chipmakers. That makes the stock a solid buy today, even after the impressive gains so far this year.

Should You Invest $1,000 in Super Micro Computer Now?

Before you buy Super Micro Computer stock, consider the following:

The Motley Fool stock advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had invested $1,000 at the time of our recommendation, you would have $757,001!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Billy Duberstein and/or his clients have positions in Super Micro Computer and hold the following options: short January 2025 $1,840 calls on Super Micro Computer, short January 2025 $110 puts on Super Micro Computer, short January 2025 $125 puts on Super Micro Computer, short January 2025 $130 puts on Super Micro Computer, short January 2025 $280 calls on Super Micro Computer, and short January 2025 $85 puts on Super Micro Computer. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

1 Top Artificial Intelligence (AI) Stocks to Buy Before It Surges 70%, According to Loop Capital, originally published by The Motley Fool