Cathie Wood is the founder and Chief Investment Officer of Ark Investment Management, which operates several exchange-traded funds focused on innovative technology stocks. Electric vehicles, e-commerce, space exploration, artificial intelligence (AI) and cryptocurrency are just some of the areas Ark is currently betting on.

Ark is very optimistic Bitcoin (CRYPTO: BTC)which is the world’s largest cryptocurrency by market capitalization. The company’s official research suggests Bitcoin could rise 2,193% by 2030, but Wood himself came up with a new price target earlier this year, implying an upside of as much as 5,789% instead.

Bullish sentiment appears to have returned to the cryptocurrency market and Bitcoin is currently trading near an all-time high. But is Wood’s prediction realistic?

A unique asset with dazzling returns so far

Bitcoin is a truly decentralized cryptocurrency because it is not controlled by any one person or institution. It is built on a blockchain, an accurate, transparent and autonomous registration system. For these reasons, many crypto enthusiasts have often touted Bitcoin as a viable alternative to traditional money.

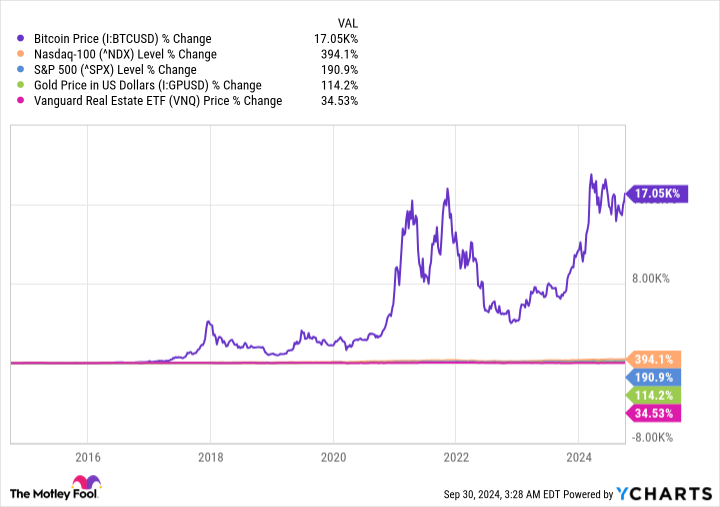

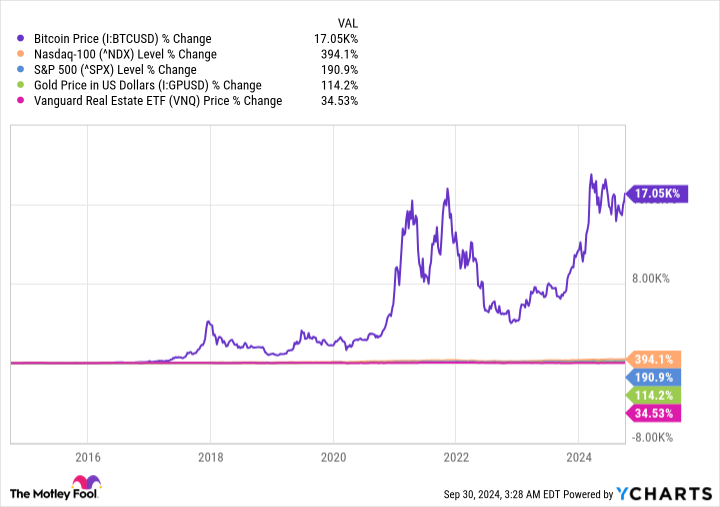

But it is incredible volatile. In the past decade alone, Bitcoin has risen more than 17,000%, wiping out the returns of every other major asset class. But it has also fallen 70% from its all-time high twice in that period:

Volatility makes cash flow management virtually impossible for any business that accepts Bitcoin as a primary means of payment for goods and services, which is likely why only 9,331 merchants in the entire world are willing to do so (according to CryptWerk). If consumers can’t spend their Bitcoin at their favorite stores, they don’t have much incentive to own it.

However, Bitcoin investors will cite Bitcoin’s favorable supply-and-demand dynamics as a reason for further upside potential. The supply is limited to 21 million coins, which are paid to miners who use powerful computers to add new blocks to the blockchain. A halving occurs for every 210,000 new blocks, halving the mining reward. According to most estimates, the last Bitcoin will be mined sometime around the year 2140.

Because supply is limited, any new source of demand will theoretically drive the price per Bitcoin higher. At the time of writing, more than 46 million crypto wallets contain Bitcoins or partial Bitcoins, and that number is gradually increasing. Additionally, the approval of exchange-traded funds (ETFs) by the Securities and Exchange Commission earlier this year is creating new demand from institutional investors.

However, these factors alone likely won’t be enough for Bitcoin to reach Cathie Wood’s lofty price target.

Ark’s Catalysts for a Bitcoin Peak

Ark outlines eight possible reasons for Bitcoin’s further rise in the coming years. Some are a bit fanciful. For example, Ark thinks wealthy individuals will buy Bitcoin because it is an asset that can withstand attacks, but regulators have successfully seized significant amounts of the cryptocurrency in recent years, so that doesn’t mean much. water I think.

However, three of the eight catalysts stand out to me as viable drivers of potential benefit:

-

Currency of emerging markets: Bitcoin’s decentralized nature makes it an intriguing replacement for traditional money in countries with political and economic instability or corruption, as the blockchain cannot be manipulated by governments. El Salvador is currently running this experiment, so time will tell if Bitcoin works in that environment.

-

Institutional investments: Bitcoin ETFs offer financial advisors and institutions a legitimate, regulated way to add the cryptocurrency to their portfolios. Buying an ETF is still a speculative bet on further upside, but having a broader investor base could be a positive catalyst for higher prices in the long term.

-

Digital gold: Ark thinks that between 20% and 50% of the money investors normally allocate to gold could instead flow into Bitcoin. Since it is more wearable than gold and has also significantly outperformed the yellow metal, that is not a crazy prediction.

Bitcoin is trading at $64,518 at the time of writing, but Ark thinks the above catalysts could catapult it to $1.48 million per coin by 2030. That represents a potential return of 2.193%.

But Wood issued a new price target of $3.8 million when she spoke at Bitcoin Investor Day in March, implying a staggering potential upside of 5,789% from here on out.

Is Wood’s prediction realistic?

Wood cites the endorsement of Bitcoin ETFs as her main reason for the $3.8 million goal. To date, more than 30 cryptocurrency funds have been approved by the SEC (including two managed by Ark), and they have a combined $61 billion in assets under management. She says that if institutional investors allocated just 5% of their total assets under management to Bitcoin and Bitcoin ETFs, that alone would be enough to justify a price of $3.8 million per coin.

There are a number of problems with that prediction. First, Bitcoin ETF inflows have slowed since earlier this year, indicating demand from institutional investors is slowing. Second, Bitcoin would have a fully diluted market cap of $79.8 trillion if it reached a price of $3.8 million per coin, making it nearly three times as valuable in terms of gross domestic product as the entire U.S. economy.

Bitcoin would also be 23 times more valuable than Applethe largest company in the world, and four times more valuable than all the above-ground gold reserves on Earth.

Therefore, a Bitcoin price of $3.8 million is extremely unlikely in my opinion. It makes sense to use Bitcoin as a store of value, but in that case I think investors should focus on gold’s market cap, which is currently $17.9 trillion. That would translate to a Bitcoin price of $852,380, which still represents a 13-fold gain from where it currently trades.

Should you invest $1,000 in Bitcoin now?

Consider the following before buying shares of Bitcoin:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $716,988!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Anthony Di Pizio has no positions in the stocks mentioned. The Motley Fool has positions in and recommends Apple and Bitcoin. The Motley Fool has a disclosure policy.

1 Top Cryptocurrency With 5,789% Gains in 2030, According to Cathie Wood Originally Published by The Motley Fool