After a promising performance in the first half of the year, Lamb Research (NASDAQ: LRCX) shares have been in the doghouse lately. It has lost 30% of its value since hitting a 52-week high on July 11, but the company’s latest results suggest the pullback could be a buying opportunity.

Lam reported fourth-quarter fiscal 2024 results (for the three months ending June 30) on July 31, and the numbers were well above analysts’ expectations. More importantly, the semiconductor manufacturing equipment supplier’s guidance also beat Wall Street’s forecasts.

Let’s take a closer look at Lam’s latest results and find out why it’s a good idea for investors to take advantage of the stock’s recent decline.

Lam Research to grow again this year thanks to AI

Lam Research reported fiscal Q4 revenue of $3.87 billion, beating the consensus estimate of $3.82 billion. The company’s top line rose nearly 21% year over year. More importantly, non-GAAP earnings per share rose an impressive 36% to $8.14, well above the analyst consensus of $7.58 per share.

However, total revenue in fiscal 2024 fell 14% to $14.91 billion and non-GAAP earnings fell 11% to $30.30 per share. Lam’s financial performance improved significantly in the final quarter of the fiscal year, and management’s guidance indicates that the momentum is here to stay.

The company has forecast revenue of $4.05 billion in the current quarter (mid-range). That would be a 16% increase from the same period last year. Meanwhile, the $8.00 per share earnings estimate (also mid-range) would translate to a 17% improvement year-over-year.

However, there’s a good chance that Lam will beat its forecast thanks to an increase in memory consumption due to the rapidly growing adoption of artificial intelligence (AI). During its last earnings call, Lam management said the company is seeing additional demand due to increased investment in high-bandwidth memory (HBM) capacity.

HBM is being deployed in data centers to tackle AI workloads because of its ability to process massive amounts of data while keeping power consumption low. Not surprisingly, demand for HBM is expected to grow from 478 million gigabytes (GB) in 2023 to nearly 1.7 trillion GB next year. As a result, memory manufacturers are dedicating more of their capacity to producing HBM chips.

Memory manufacturer SK-HynixFor example, is expected to spend approximately $60 billion on AI memory investments such as HBM through 2028. Samsungis expected to triple its HBM capacity this year. Micron technology aims to more than triple its share of the HBM market by next year by investing in new production facilities in the US and Malaysia.

Strong demand for memory chips, driven by AI, points to a sustainable growth opportunity for Lam, with the company generating 36% of its total revenue from sales of memory manufacturing equipment last quarter.

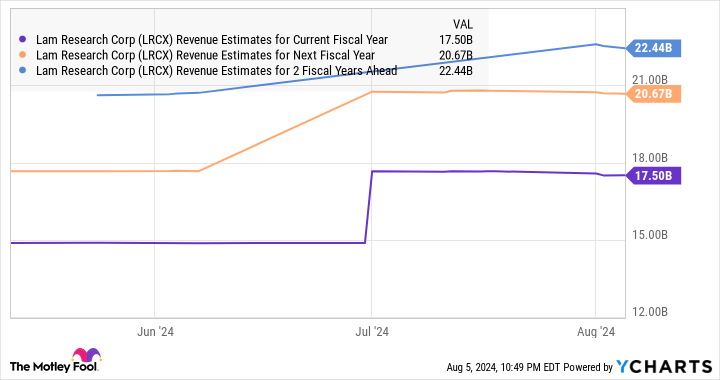

This solid end-market opportunity is also why analysts expect Lam’s revenue to grow 17% in fiscal 2025, followed by another solid performance next year.

More reasons to buy the stock

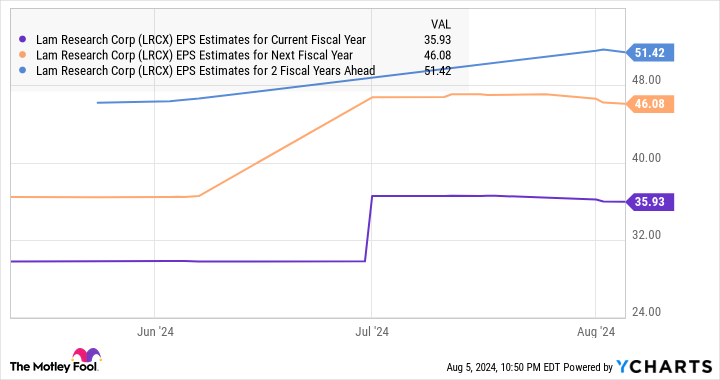

We’ve already seen that Lam is on track to produce healthy revenue growth in the current quarter and fiscal 2025 overall. Based on analysts’ earnings estimates for the next three years, that growth should trickle down to earnings as well.

Investors can still buy this AI stock at an affordable valuation. Lam trades at 28 times trailing earnings, while its forward earnings multiple of 22 highlights the earnings growth it’s expected to deliver. That’s cheaper than the U.S. tech sector’s average price-to-earnings ratio of 33. And given the strength of Lam’s latest results, the recent sell-off presents an attractive buying opportunity.

Should You Invest $1,000 In Lam Research Now?

Before buying Lam Research stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Lam Research wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $641,864!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Lam Research. The Motley Fool has a disclosure policy.

1 Top Growth Stock Drops 30% to Buy Now was originally published by The Motley Fool