When it comes to all things accelerated computing and artificial intelligence (AI), Nvidia (NASDAQ: NVDA) rightly stole the spotlight. But an entire supply chain ecosystem is hard at work to help Nvidia bring its AI systems to market. And a company called Applied materials (NASDAQ: AMAT) is one of those crucial parts of the supply chain.

Applied is the largest US-based supplier of semiconductor manufacturing equipment based in the Netherlands ASML (NASDAQ: ASML) the largest supplier of production equipment in general, but a specialist in lithography equipment. Applied is a generalist, with a broad and deep technology portfolio that can be used to make all kinds of high-quality chips. And perhaps a new wave of growth is just around the corner.

The last quarter was just okay, so why apply now?

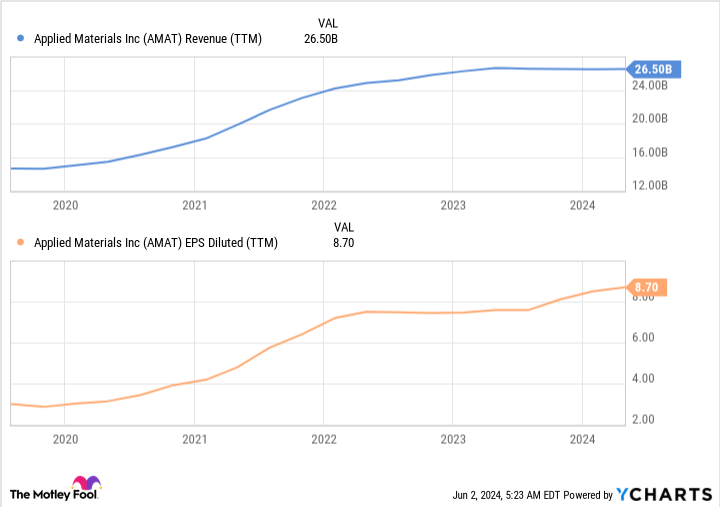

Applied recently reported earnings results for the second fiscal year of 2024 (the three months ending April 2024). Sales were just under $6.7 billion and remained stable year after year. However, earnings per share (EPS) and adjusted earnings per share rose 11% and 5%, respectively.

Much of the semiconductor industry is still in a cyclical slump or just emerging from the bear market of the past few years. Nvidia’s AI and accelerated computing systems were an obvious exception, as data centers used specifically for AI training are a brand new market.

As a result, Applied’s recent revenue performance looks lackluster. However, it sidestepped a severe downturn that has plagued many of its peers since 2022 by moving into “mature” chip manufacturing, focused on areas like the auto industry and its electric vehicle initiative. Along the way, management has continued to buy back shares and control costs, leading to earnings per share outperformance even as revenue has leveled off. That’s really impressive and indicative of the strength of the business model.

But in the second half of 2024, the semiconductor industry is expected to boom. These new AI chips are obviously leading the way, and more manufacturing capacity will be needed to meet data center demand. But all other end markets that were in the doldrums (smartphones, PCs and industrial products such as cars) are also expected to be affected.

To help offset this increase, many chip factories (facilities that make chips) are currently under construction and need to be filled with new equipment. Industry group Semi.org predicts record sales of advanced equipment from 2025 through 2027. Applied is ready.

Putting deep technical knowledge to work

Applied already has a broad and deep equipment portfolio that covers virtually every step of the electronics industry. And over the last few years it’s been rolling out new equipment that deepens its hooks in this new AI race.

For example, in March 2023, the company officially announced a new machine called Centura Sculpta. It acts as an extension of ASML’s lithography equipment used in the production of high-quality chips, helping manufacturers save costs during crucial steps in the production process. Earlier this year, even more advanced chip manufacturing equipment lines were announced, addressing other parts of the chip manufacturing process. Applied is well anchored in this industry.

The end result of this? The second half of the year could finally deliver new revenue growth for Applied, and even higher earnings per share. Shares aren’t as cheap as they were last year, but perhaps rightly so if the company delivers on the coming wave of fantastic spending. The stock currently trades at 25 times trailing twelve month earnings. I am pleased to continue to maintain my position, as well as that of ASML and some other colleagues at Applied, as the next growth cycle of the chip market, driven by AI, approaches.

Should You Invest $1,000 in Applied Materials Now?

Before purchasing shares in Applied Materials, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Applied Materials wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Nicholas Rossolillo holds positions at ASML, Applied Materials and Nvidia. The Motley Fool holds positions in and recommends ASML, Applied Materials, and Nvidia. The Motley Fool has a disclosure policy.

1 Top Semiconductor Stocks for Massive AI Growth was originally published by The Motley Fool