Participate in the S&P500 (SNPINDEX: ^GSPC) is a prestigious achievement for any American company. The index has strict entry criteria: companies must have a market capitalization of at least $18 billion and generate positive revenues. But even then, participation is subject to the judgment of a special committee that rebalances the index once a quarter.

Then there is the S&P 500 growth index, which uses even stricter criteria to reduce the 500 companies of the regular S&P to the best-performing stocks. At the time of writing, it only counts 231 companies and ignores the rest. As a result, the growth index consistently outperforms the S&P 500 every year.

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) directly tracks the performance of the growth index by holding similar stocks and maintaining similar portfolio weights. This is why investors with $350 of extra cash can confidently buy the ETF heading into 2025.

Large holdings in the highest quality stocks

Both the S&P 500 and S&P 500 Growth indexes are weighted by market capitalization, meaning the largest stocks have a greater impact on their performance than the smallest. Technology is the largest of eleven different sectors in the S&P 500, with a weighting of 31%.

The Growth Index selects stocks based on their momentum and the revenue growth of the underlying companies. Because tech giants like it Nvidia based on these factors tend to lead the rest of the market, it is no surprise that the growth index has a much higher weighting towards the technology sector, at 49.9%.

In fact, most of the top 10 holdings in the Vanguard S&P 500 Growth ETF are from the technology sector, and each has a much higher weighting than in the regular S&P 500:

|

Stock |

Vanguard Growth ETF Weighting |

S&P 500 weighting |

|---|---|---|

|

1. Apple |

12.40% |

6.97% |

|

2. Microsoft |

11.65% |

6.54% |

|

3. Nvidia |

11.03% |

6.20% |

|

4. Metaplatforms |

4.48% |

2.41% |

|

5. Amazon |

4.14% |

3.45% |

|

6. Alphabet class A |

3.61% |

2.03% |

|

7. Alphabet class C |

3.03% |

1.70% |

|

8. Eli Lilly |

3.01% |

1.62% |

|

9. Broadcom |

2.78% |

1.50% |

|

10. Tesla |

2.33% |

1.25% |

Data source: Vanguard. Portfolio weights are accurate as of August 31, 2024 and are subject to change.

Every company in the top 10 currently creates value by developing and deploying artificial intelligence (AI). Even Eli Lilly – a biopharmaceutical company – signed partnerships earlier this year with startups like OpenAI and Genetic Leap to help invent various drugs and therapies.

Tesla, known as an electric vehicle company, is also developing AI to power its autonomous self-driving software.

Apple, on the other hand, has more than 2.2 billion active devices worldwide, so the company could soon become the largest distributor of AI for consumers through its Apple Intelligence software. It’s currently only available on the latest devices like the M3 MacBooks and the iPhone 16, so the new AI features could drive a robust upgrade cycle in the coming years.

Microsoft, Amazon and Alphabet have each created their own AI models, virtual assistants and chatbots. Moreover, they are the three largest providers of cloud computing services worldwide. These cloud platforms have become distribution channels for AI models and data center computing capacity, which companies need to develop and deploy AI software.

Nvidia designs the semiconductor industry’s most powerful graphics processors (GPUs) for the data center, which are at the heart of everything I just mentioned. The chips are in high demand at OpenAI, Tesla, Microsoft, Amazon, Alphabet and almost every other tech giant looking to capitalize on the AI opportunity.

The Vanguard ETF could beat the S&P 500 (again) next year

The Vanguard S&P 500 Growth ETF is up 27.6% so far in 2024, outpacing the 21.5% gain in the S&P 500. Why? The top 10 investments in the table above have returned an average of 43.7% this year, so the index that gives them a higher weighting will obviously perform better.

That’s a consistent theme for the Vanguard ETF (and the Growth Index). Since its inception in 2010, it has generated a compound annual return of 16%, easily surpassing the S&P 500’s average annual return of 13.7% over the same period.

The ETF rebalances every quarter by replacing poorly performing stocks. In other words, it will almost always outperform the S&P 500 in the long run because it doesn’t have to hold the stocks in that index that aren’t delivering strong results.

The only time the S&P 500 power Outperformance is when dividend stocks experience a period of outperformance relative to growth stocks.

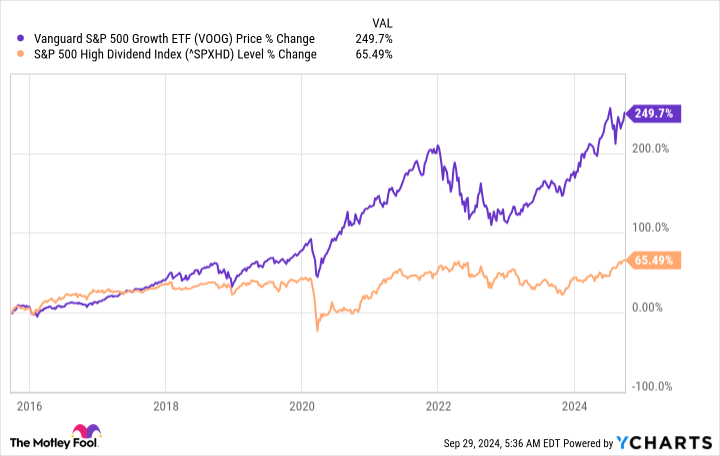

The chart below shows the Vanguard ETF with the S&P 500 high dividend index. Growth stocks have only lagged dividend stocks one of the last ten years, and there’s a big difference in total returns over that entire period, making the Vanguard ETF an obvious choice:

That’s why the Vanguard ETF looks like a great buy heading into 2025. But investors should always take a long-term approach, because the difference in returns between the ETF and the S&P 500 could have a significant dollar impact over time , thanks to the effects of compounding:

|

Opening balance (2010) |

Compound annual return |

Balance in 2024 |

|---|---|---|

|

$50,000 |

16% (Vanguard ETF) |

$399,375 |

|

$50,000 |

13.7% (S&P 500) |

$301,728 |

Calculations by author.

Should You Invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF Now?

Consider the following before buying shares in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no positions in the stocks mentioned. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia and Tesla. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.

1 Unstoppable Vanguard ETF to Buy with Confidence with $350 Heading to 2025 was originally published by The Motley Fool