Warren Buffett, the CEO of Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B)has long been regarded as one of the best investors of all time. His ability to consistently beat the market for decades stems from a fundamental principle: investing in high-quality companies with sustainable competitive advantages that generate consistent returns over the long term.

A stock that illustrates Buffett’s investment philosophy is American Express (NYSE: AXP)a company that has been a cornerstone of Berkshire Hathaway’s portfolio for decades. American Express first appeared in Buffett’s portfolio in 1964, when he seized an opportunity created by the infamous “salad oil scandal” that had rocked the company’s stock price.

Although Buffett did not retain his original stake, he later made American Express a significant holding company for Berkshire Hathaway, beginning in the early 1990s. Today, Berkshire Hathaway owns a substantial 21.3% stake in American Express, making it the holding company’s second-largest equity position, surpassed only by Apple.

Therefore, this financial services stock should fit into most portfolios.

A brand that commands respect

American Express’ heritage dates back to 1850 and has weathered countless economic storms along the way. The company’s name has become synonymous with quality, prestige and trust.

This strong brand recognition results in a loyal customer base, especially among high-value customers who appreciate the perks and benefits of American Express’ premium card products.

The company’s resilience through market cycles demonstrates the strength of its brand and business model. American Express has consistently adapted to changing consumer preferences and technological advances, maintaining its position as a leader in the financial services industry.

A unique business model in the financial sector

Unlike its competitors Visa And MasterCardAmerican Express operates as both a payment network and a card issuer. This dual role allows the company to collect fees from merchants and earn interest income from cardholders. The model gives American Express greater control over pricing, risk management and cross-selling opportunities.

This unique positioning also gives American Express a significant competitive advantage. Namely, the company can tailor its offering to the specific needs of both merchants and consumers, creating a more integrated and valuable ecosystem for all parties involved.

Consistent growth and shareholder rewards

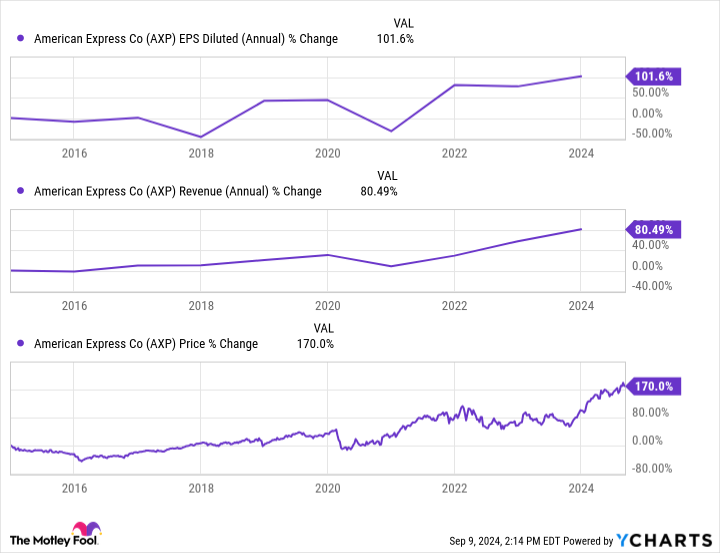

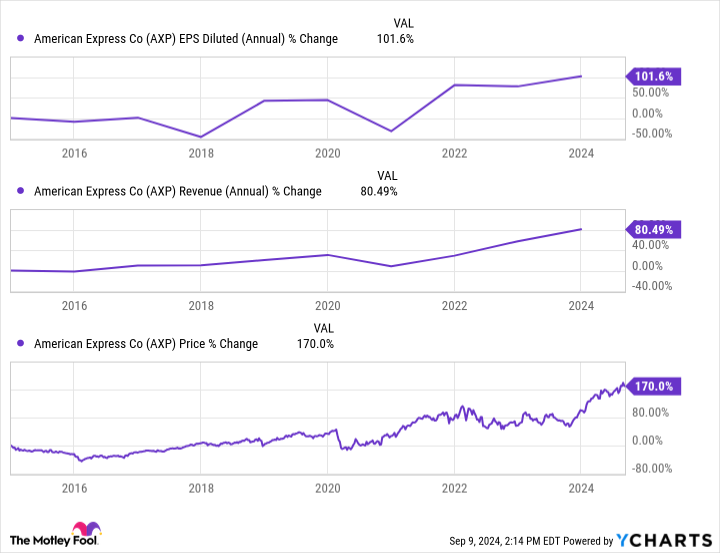

Over the past decade, American Express has demonstrated its remarkable ability to consistently grow revenues and profits (see chart below). The company has overcome enormous challenges such as increased competition and regulatory changes while maintaining its upward trajectory. This resilience speaks volumes to the strength of American Express’ business model and management team.

American Express’s commitment to shareholder value is evident in its aggressive share buyback program and steadily growing dividend. The company has reduced its outstanding shares by about 30% over the past decade, effectively boosting earnings per share and dividend growth.

While the current dividend yield of 1.15% seems modest, it is very sustainable with a payout ratio of just 19.4%. Dividend sustainability is key to building an income snowball over time, and American Express has a very reliable cash distribution.

What’s more, American Express has increased its dividend by an incredible 10.4%, on average, per year over the past decade. In fact, this is one of the highest dividend growth rates of any large-cap stock.

This combination of share buybacks and robust dividend growth exemplifies the compound effect Buffett seeks in his investments, offering investors a potentially growing income stream.

Why Most Investors Should Consider American Express

American Express offers investors an attractive combination of brand strength, a unique business model and shareholder-friendly policies. The financial services company is also well-positioned to benefit from the ongoing shift to digital payments.

Perhaps most importantly, the company’s ultra-low payout ratio leaves ample room for additional increases in quarterly cash distributions. Meanwhile, its entrenched market position and unique business model provide a solid foundation for long-term capital appreciation.

Should You Invest $1,000 in American Express Now?

Before you buy American Express stock, consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and American Express wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,404!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 9, 2024

American Express is an advertising partner of The Ascent, a Motley Fool company. George Budwell has positions in Apple. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Mastercard, and Visa. The Motley Fool recommends the following options: long Jan 2025 $370 calls on Mastercard and short Jan 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

1 Warren Buffett Dividend Growth Stock That Deserves a Spot in Your Portfolio was originally published by The Motley Fool