While it is widely believed that artificial intelligence (AI) and the ‘Magnificent Seven’ have driven the major stock indexes to record levels, it’s fair to say that stock splits are the hottest trend on Wall Street right now.

A stock split is an event that allows a publicly traded company to change its stock price and the number of outstanding shares by the same factor. Since the beginning of 2024, nine top companies have announced and/or completed a stock split.

Stock splits come in two varieties: forward and backward, with investors clearly favoring the former. Forward-stock splits aim to make shares more nominally affordable to ordinary investors, while a reverse-stock split aims to increase a company’s share price to ensure it meets the minimum listing standards of a major stock exchange, or perhaps has a sufficiently high share. price to attract the attention of institutional investors and investment funds.

After watching Retail Kingpin Walmart and AI Titan Nvidia complete their respective 3-for-1 and 10-for-1 forward splits, it’s time for a fast-casual restaurant chain Chipotle Mexican Grill (NYSE:CMG) to join this elite stock split club. With the stock split looming, here are the 10 things you need to know.

1. Chipotle’s forward split is historic

On March 19, Chipotle’s board of directors announced a 50-to-1 forward split, marking one of the largest nominal stock splits for any company in the history of the New York Stock Exchange. This split, which was approved by the company’s shareholders earlier this month, increases the number of shares outstanding by a factor of 50 and reduces the share price to 1/50th of its value.

2. It shall take effect after the closing bell

When I said Chipotle’s stock split is “imminent,” I wasn’t exaggerating. The effective date for the 50-for-1 split is after the close of business today, June 25. Before trading begins on June 26, Chipotle’s stock price will be reduced to 1/50th of its current closing price.

Please note that it is not uncommon for online brokers to take 24 hours to recognize that a stock split has occurred. If you’re a Chipotle shareholder, don’t panic if you notice a significant (but incorrect) unrealized loss during the morning hours of June 26.

3. Stock splits are purely cosmetic

While stock splits are all the rage on Wall Street right now, they are purely cosmetic. Changing a company’s share price and number of shares outstanding does not affect its market capitalization or operating performance. The market cap that Chipotle Mexican Grill ends up with on June 25 will be exactly what it’s worth after the split, just before the start of trading on June 26.

4. Chipotle’s employees are a major catalyst behind the stock split

Something you may not realize is that Chipotle’s first stock split in more than 18 years as a publicly traded company is being undertaken as much for its employees as it is for retail investors. The company wants to encourage its employees to participate in the Employee Stock Purchase Plan (ESPP), which will be much more attractive if the company’s shares trade closer to $64 instead of $3,200.

Walmart’s 3-for-1 split was also implemented to encourage employees to participate in the company’s ESPP.

5. The company has exceptional pricing power

Since trading at $22 for its initial public offering (IPO) in January 2006, Chipotle’s stock has risen more than 14,000%! One of the reasons the company has been such a phenomenal investment is because its management team recognized early on that consumers would willingly pay more for its food if it used responsibly sourced meat, prepared its food daily in its restaurants, and would source its vegetables locally. when possible). This exceptional pricing power has contributed to Chipotle’s continued outperformance.

6. Having a limited menu is a ticket to success in the restaurant industry

Another catalyst behind Chipotle’s historic 50-to-1 split is the company’s limited menu. Chipotle’s management team eschews the idea that “bigger is better” and has stuck with a relatively small menu, which helps maximize food preparation efficiency and keep restaurant lines moving quickly.

Additionally, having a smaller menu allows Chipotle to generate a lot of buzz when it introduces a new food item.

7. Innovation has been a key growth driver

The company’s innovation has played a key role in its return of more than 14,000% since its IPO in 2006. In addition to introducing the occasional new food product, the company made waves with the addition of special mobile drive-thru lances for orders. , which calls it ‘Chipotlanes’ as of 2018. Chipotlanes have helped the company thrive during the COVID-19 pandemic.

8. Stocks with a stock split outperform the broader market

The reason investors are flocking to stock splits is because they historically run circles around the broader market. Data is available from 1980 to the present bank of America Global Research shows that the average company that implements a forward split has achieved a return of 25.4% in the twelve months following the stock split announcement. For comparison: the benchmark S&P500 has achieved an average return of 11.9% over the same timeline.

9. Billionaire investors have mixed views on Chipotle stock

Even though stock split stocks have history on their side, and Chipotle has leaned on some competitive advantages to grow earnings per share, Wall Street’s smartest money managers are mixed on what the future holds for this top-performing fast-casual restaurant . chain.

Based on Form 13F filings detailing first-quarter trading activity, billionaires Ken Griffin of Citadel Advisors, John Overdeck and David Siegel of Two Sigma Investments, and Jeff Yass of Susquehanna International were all buyers of Chipotle stock.

Meanwhile, activist investor Bill Ackman of Pershing Square Capital Management, Steven Cohen of Point72 Asset Management and Israel Englander of Millennium Management have all cut their funds’ respective holdings ahead of the company’s upcoming stock split.

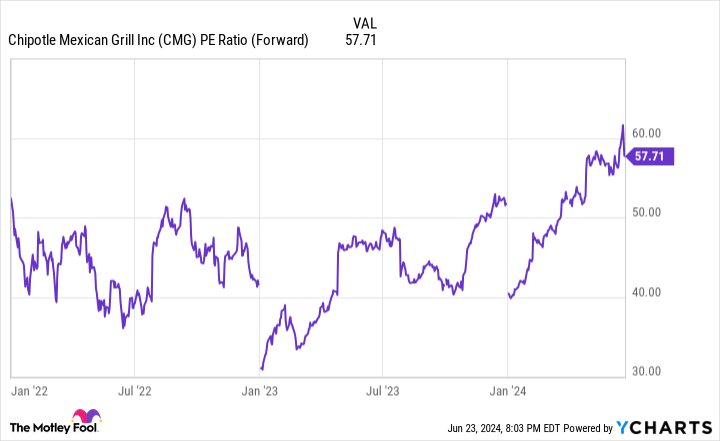

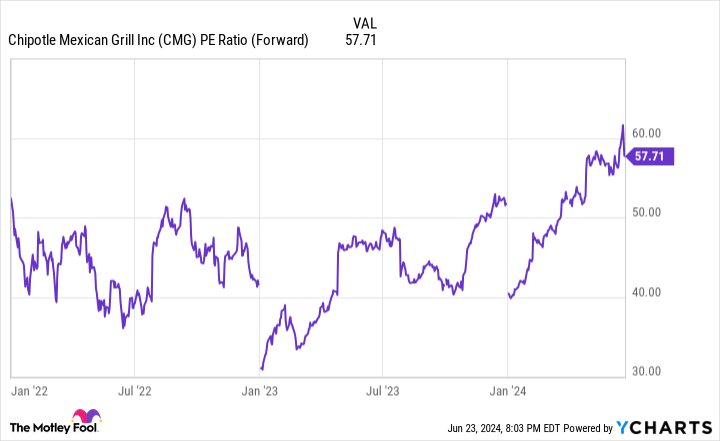

10. Chipotle stock is exceptionally expensive (and a split won’t change that)

Last but not least, Chipotle Mexican Grill’s valuation makes absolutely no sense – and a 50-to-1 stock split won’t change that. While there’s no doubt the company deserves a valuation premium for consistently innovating and outperforming other fast-casual restaurant chains, Chipotle’s first-quarter same-store sales growth of 7% doesn’t come close to a multiple of sales growth from Chipotle. 58 times this year’s expected earnings or a price-earnings ratio (P/E) of 48.

Once the euphoria around Chipotle over its stock split wears off, don’t be surprised if the stock undergoes a significant correction.

Should You Invest $1,000 in Chipotle Mexican Grill Now?

Before you buy shares in Chipotle Mexican Grill, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $775,568!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 24, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Sean Williams has positions at Bank of America. The Motley Fool holds and recommends positions in Bank of America, Chipotle Mexican Grill, Nvidia, and Walmart. The Motley Fool has a disclosure policy.

Chipotle Mexican Grill’s 10-for-1 Stock Split Is Imminent: 10 Things You Need to Know Originally published by The Motley Fool