While there’s little doubt that Wall Street is loving the rise of artificial intelligence (AI), the return of stock split euphoria has given investors another reason to cheer.

A stock split allows publicly traded companies to change their share price and number of outstanding shares by the same factor. In the past six months, 12 proven companies have announced or completed a stock split.

Stock splits can go either way. A reverse stock split is intended to increase a company’s stock price, usually to ensure that the company continues to meet the minimum listing requirements of a major stock exchange. On the other hand, a forward stock split is done by companies that want to decrease their nominal stock price. Since forward splits are almost universally done from a position of strength, this is the type of split that most investors gravitate toward.

After the recent 10-for-1 forward split for Nvidiahistoric 50-for-1 split for Chipotle Mexican Grilland 10-for-1 split for AI network solutions specialist Broadcomthe time has come for MicroStrategy (NASDAQ: MSTR) to participate in the stock split of the “Class of 2024”.

Here are the 10 things you need to know about MicroStrategy’s upcoming stock split.

1. This is a historic stock split for MicroStrategy

On July 11, MicroStrategy announced that it would execute a forward split. With the stock price firmly in the $1,300s, the company’s board of directors approved a historic 10-for-1 stock split.

This is the third split in the company’s history since its IPO in June 1998. It is the largest forward split, following a 2-for-1 forward split in January 2000 and a 1-for-10 reverse split in July 2002, during the dot-com bubble.

2. It shall enter into force after the close of trading Today

The use of the word “imminent” in the headline is no exaggeration. After the close of trading today, August 7, MicroStrategy’s 10-for-1 forward split will go into effect. Based on where things ended on August 2, the company’s stock price will fall to about $145, while the number of outstanding shares will increase tenfold.

Keep in mind that some online brokers may not recognize that a split has occurred for up to 24 hours. In other words, shareholders should not panic if they see a large, unexplained loss in their portfolio on Thursday morning.

3. Stock splits are entirely cosmetic

While the euphoria associated with stock splits is real and companies that implement forward splits have on average outperformed the benchmark S&P 500 In the 12 months following the announcement of the split (which dates back to 1980), stock splits themselves are purely cosmetic events.

While a split changes a company’s stock price and the number of shares outstanding, it does not change its market capitalization or affect underlying operating performance.

4. MicroStrategy’s split is about accessibility (and retail investors)

According to the company, the single most important “Why?” behind the split is to “make MicroStrategy stock more accessible to investors and employees.” For retail investors and employees without access to fractional share purchases, it costs nearly $1,450 to buy one share. Tomorrow, investors will only need about $145 to buy one share.

While some online brokers offer access to fractional share purchases, MicroStrategy’s stock has reportedly seen more retail buybacks than any other Class of 2024 stock split. Getting the stock price down to a level that’s friendly to retail investors is critical to maintaining the interest of MicroStrategy’s core supporters.

5. Technically, it is an AI-driven software company

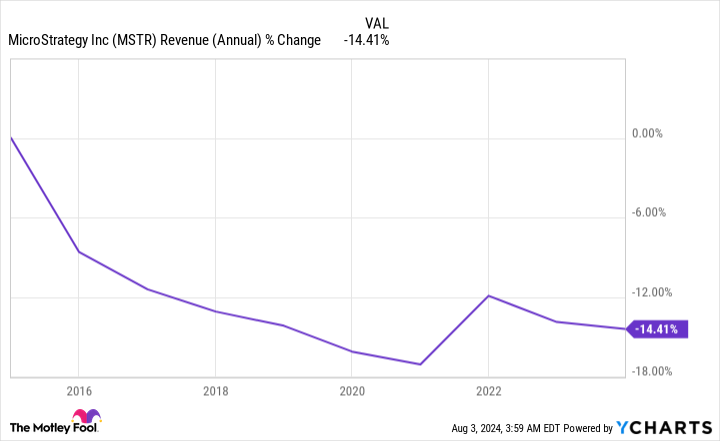

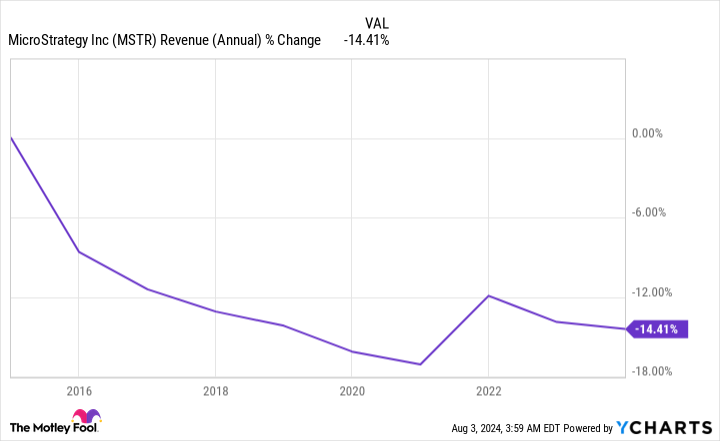

Software has been MicroStrategy’s foundational operating segment for decades. Management is betting on artificial intelligence to spark the enterprise analytics software segment, which has seen sales decline 14% over the past decade (end of 2023).

If there is a silver lining, it is that subscription revenues have grown by a double-digit percentage year-over-year. Unfortunately, this has not stopped the decline in overall software sales or the segment’s operating losses.

6. MicroStrategy is the largest corporate holder of Bitcoin

But let’s face it: Investors aren’t buying MicroStrategy stock for AI-driven enterprise analytics software. They’re buying stock because it’s the largest corporate shareholder in Bitcoin (CRYPTO: BTC)the leading cryptocurrency by market cap.

As of July 31, the company held 226,500 Bitcoins, representing more than 1% of the 21 million tokens that will ever be mined. Cryptocurrency enthusiasts and Bitcoin supporters have flocked to MicroStrategy as an easy way to bet on the success of this digital gold.

7. Bitcoin assets are valued at a premium of nearly 90%

Investors have been a bit overzealous in their bid to own MicroStrategy stock. At the time of this writing, a single Bitcoin was worth about $61,400. This means that the company’s Bitcoin assets are worth about $13.8 billion.

The problem is that MicroStrategy’s market cap as of August 2 was $27.6 billion. If we assume a fair value for its money-losing software business, it turns out that investors are paying about a 90% premium over Bitcoin’s actual token price to own MicroStrategy stock. In other words, instead of buying Bitcoin for $61,400 per token on a crypto exchange, investors are paying closer to $116,000 per token for MicroStrategy’s Bitcoin portfolio assets. This premium is nonsense.

8. The company financed its Bitcoin purchases with convertible debt offerings

Another thing that is clearly a concern is how Bitcoin enthusiast CEO Michael Saylor has facilitated the steady buying of the world’s largest cryptocurrency. On numerous occasions, MicroStrategy has sold convertible debt, which it uses to buy Bitcoin.

While this is a strategy that can work wonders during crypto bull markets, it’s akin to playing with fire during prolonged bear markets. Bitcoin has endured multiple drawdowns of 80% (or more) in its relatively short existence. Relying heavily on Bitcoin with convertible debt and minimal operating cash flow from its software business is a disaster waiting to happen.

9. The world’s largest cryptocurrency has reportedly lost much of its first-mover advantages

While Bitcoin has undeniably benefited from its first-mover advantages, the digital gold to which MicroStrategy has staked its future has reportedly given up many of these advantages as time has passed. Numerous blockchain projects and crypto-based payment networks offer faster payment validation and lower transaction fees.

Furthermore, Bitcoin’s real-world utility experiment has failed to pass muster. Despite repeated efforts by El Salvador’s regulators to encourage its citizens to adopt Bitcoin as legal tender, roughly 7 out of 8 El Salvadorans did not transact in Bitcoin last year.

10. MicroStrategy Stock Should Be Avoided by Investors

The 10th and most important thing to know is that the euphoria over stock splits eventually fades. When it does, investors are left with an over-leveraged company, stuck with a volatile asset that has lost much of its first-mover advantage.

If you disagree with me and believe that Bitcoin is going up, there are many ways to invest in it. Paying a 90% premium on the current price of Bitcoin by buying shares of MicroStrategy is probably the worst way to do it.

Should You Invest $1,000 in MicroStrategy Now?

Before you buy MicroStrategy stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and MicroStrategy wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $615,516!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of August 6, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Chipotle Mexican Grill, and Nvidia. The Motley Fool recommends Broadcom and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

MicroStrategy’s 10-for-1 Stock Split Is Coming: 10 Things You Need to Know was originally published by The Motley Fool