I’m a big believer in looking for subtle, less obvious opportunities that hide in the shadows of broader megatrends.

When it comes to artificial intelligence (AI), I think its applications in the defense sector are underappreciated, if not misunderstood. Although Palantir Technologies (NYSE:PLTR) has emerged as a darling of the AI revolution, I consider its presence in the public sector a true hidden gem.

Below, I’ll break down Palantir’s latest defense victory and explore why I see this particular deal as such an important catalyst for the company’s long-term growth story.

Seize the day

The National Geospatial-Intelligence Agency (NGA) is a security detail within the Department of Defense (DOD). A key responsibility of NGA is executing Project Maven, one of the Army’s premier efforts in AI, machine learning and cloud computing infrastructure.

AlphabetGoogle was a core member of Project Maven in 2018. However, some employees took issue with Google’s involvement – especially as it related to the military’s exploration of autonomous defense systems and how they could be used in combat.

After Google opted not to renew its Maven contract in 2019, Palantir stepped in and took the wheel.

Huge wins for Palantir

Like any other company, the Department of Defense seeks to seamlessly integrate and connect information across the enterprise. This initiative is called the Combined Joint All-Domain Command and Control (CJADC2) protocol and is linked to Project Maven.

There have been some notable wins for Palantir since its involvement with Project Maven and CJADC2.

In May, the US Digital and Artificial Intelligence Office awarded Palantir a five-year deal worth up to $480 million. Under the terms of the deal, Palantir’s software will be a key part of the CJADC2 initiative as it relates to broadening the Department of Defense’s data analytics capabilities in AI and machine learning.

In addition to the above deal, Palantir was also awarded a $33 million contract aimed at onboarding additional suppliers into Palantir’s existing infrastructure across the DOD.

Most recently, the Army Research Laboratory (ARL) awarded Palantir a five-year deal worth up to $100 million. According to the press release, Palantir will help “expand access to the Maven Smart System across the military services to the Army, Air Force, Space Force, Navy and U.S. Marine Corps.”

Don’t underestimate Palantir’s government activities

Since replacing Google in 2019, Palantir has secured several deals as part of the Project Maven initiative. The obvious benefit is that these deals are worth hundreds of millions of dollars, and therefore could be a lucrative source of revenue for Palantir.

The less obvious idea here, however, is that AI should become a more important cornerstone of defense capabilities over time. I think Palantir’s consistent accolades regarding Project Maven serve as a sign of approval from the US military, and could lead to even more defense contracts in the long run.

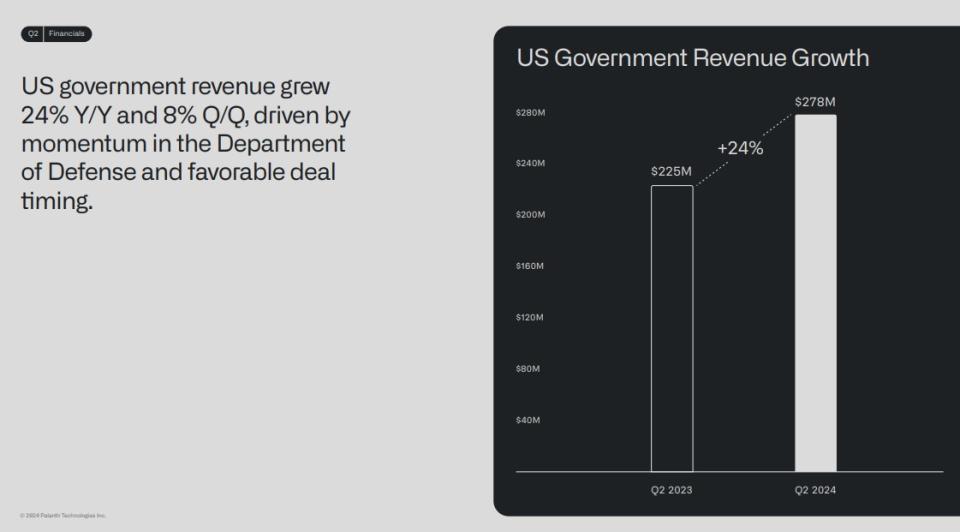

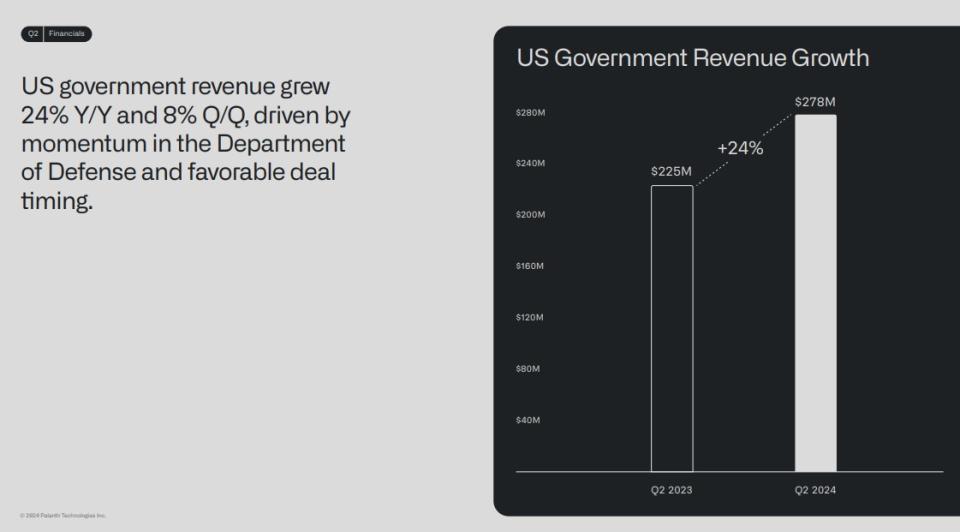

From a macro perspective, Palantir’s US government revenues are rising at a healthy pace – thanks in large part to these DOD contracts. The company’s latest $100 million Maven deal and a new defense partnership with Microsoft are just two catalysts that should fuel even further penetration into the public sector for Palantir.

To me, Palantir’s public sector business is widely overlooked and not fully embedded in its long-term valuation opportunities. I’m optimistic that Project Maven will continue to be a source of growth for Palantir over time, and that the company’s influence in the defense sector more broadly will serve as a tailwind that investors should not underestimate.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $760,130!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 23, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions at Alphabet, Microsoft and Palantir Technologies. The Motley Fool holds positions in and recommends Alphabet, Microsoft, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

100 Million Reasons to Love Palantir Stock Right Now was originally published by The Motley Fool