Exchange-traded funds (ETFs) are a simple and practical way to gain exposure to a variety of companies. Many low-cost Vanguard index funds mirror the performance of major benchmarks such as the S&P500 and the Nasdaq Composite — achieving diversification and broad market exposure. However, some Vanguard funds charge low fees and have features that give them an edge over alternatives.

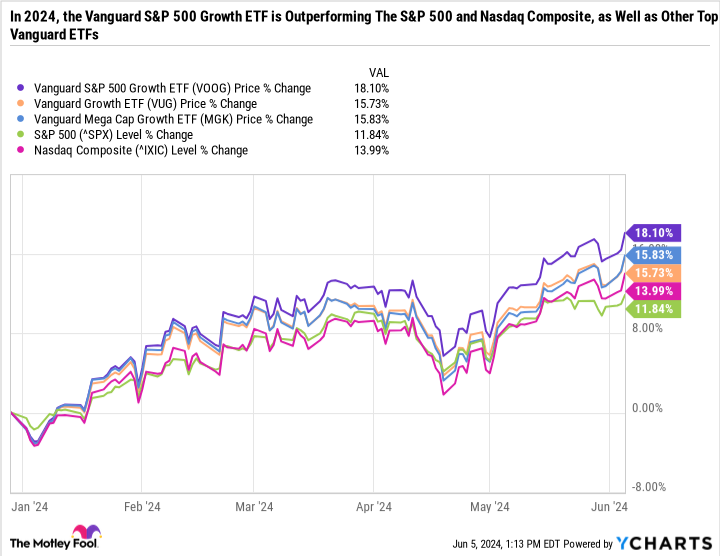

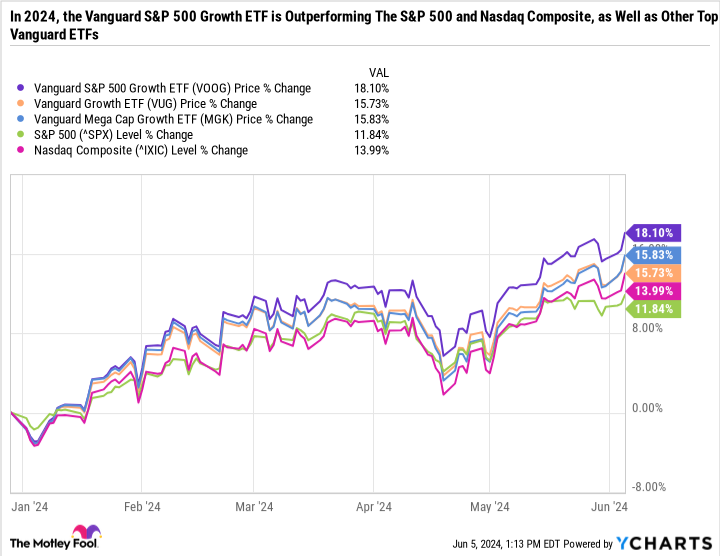

The Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) has crushed the performance of the S&P 500 and the Nasdaq Composite this year. Best of all, the fund charges a 0.10% expense ratio, meaning $1,000 invested in the fund will incur just $1 in annual fees.

Here’s how the fund compares to other Vanguard ETFs and why it’s a good buy now.

A growth-driven market

Even if you’ve loosely followed the broader market movements of the past few years, chances are you know that mega-cap growth companies like Nvidia And Metaplatforms have led the major indexes to new heights. On June 5, Nvidia caught up Apple as the second most valuable company in the world. Sectors or funds with exposure to these types of stocks have done quite well so far this year.

The Vanguard Growth ETF (NYSEMKT: VUG) is one of Vanguard’s most popular funds, with $220 billion in net assets and an expense ratio of just 0.04%. The Vanguard Mega Cap Growth ETF (NYSEMKT: MGK) isn’t that big, with just $18 billion in net assets and an expense ratio of 0.06%. But it has crushed benchmarks thanks to its high exposure to mega-cap growth stocks.

At just $10 billion in net assets, the Vanguard S&P 500 Growth ETF is even smaller. But so far this year, it has beaten the Vanguard Growth ETF, Vanguard Mega Cap Growth ETF, S&P 500 and Nasdaq Composite.

The top holdings of all three funds are the usual suspects MicrosoftApple, Nvidia, Amazon, Alphabet, Meta Platforms, etc. But what’s interesting is that the Vanguard S&P 500 Growth ETF contains some important names that aren’t in the other two ETFs. The most striking thing is Broadcomthe eighth largest holding in the Vanguard S&P 500 Growth ETF.

Oracle, UnitedHealth GroupAnd Procter & Gamble are also the top 20 holdings that are not included in the other two ETFs. You will also find leading dividend stocks such as DIY store in the Vanguard S&P 500 Growth ETF and not in the other two ETFs.

When weighing the pros and cons of different Vanguard ETFs, it’s important to understand how Vanguard structures its portfolio of funds and how that strategy affects holdings in other funds. For example the Vanguard Value ETF (NYSEMKT: VTV) is in many ways the counterpart of the Vanguard Growth ETF. Broadcom, UnitedHealth, Procter & Gamble and Home Depot are all top 10 holdings in the fund. However, it excludes Microsoft, Apple, Nvidia, Alphabet, Amazon, Meta Platforms and Tesla.

Meanwhile, the Mega Cap Growth ETF is heavily concentrated in top ideas. It has just 79 holdings, compared to 229 for the Vanguard S&P 500 Growth ETF.

Focus big on a few sectors

You can think of the Vanguard S&P 500 Growth ETF as the Vanguard Growth ETF plus some key holdings from the Vanguard Value ETF. Here’s how it compares Vanguard S&P 500 ETF (NYSEMKT:VOO)

|

Sector |

Vanguard S&P 500 Growth ETF |

Vanguard S&P 500 ETF |

|---|---|---|

|

Information Technology |

46.8% |

29.2% |

|

Discretionary consumer products |

14.4% |

10.3% |

|

Communication services |

13% |

9.1% |

|

healthcare |

7.4% |

12.3% |

|

Industrialists |

6.5% |

8.8% |

|

Financial details |

5.1% |

13.1% |

|

Consumer goods |

2.8% |

6.2% |

|

Energy |

1.8% |

4.1% |

|

Materials |

1.4% |

2.4% |

|

Property |

0.7% |

2.2% |

|

Utilities |

0.1% |

2.3% |

Data source: Vanguard.

As you can see in the table, the Vanguard S&P 500 Growth ETF is heavily weighted in three sectors and has less exposure to consumer staples, energy, financials, healthcare, industrials, materials, real estate and utilities than the S&P 500. Don’t ignore downright stiff, dividend-paying companies – as some of the more aggressive growth funds do.

As mentioned, the Vanguard S&P 500 Growth ETF includes Procter & Gamble, UnitedHealth and Home Depot – parts of the Dow Jones Industrial Average that reward shareholders with buybacks, dividend growth and organic growth.

The largest oil and gas holding in the Vanguard S&P 500 Growth ETF is not an integrated major company ExxonMobil or Chevronbut exploration and production company ConocoPhillips – which focuses on the upstream side of the industry rather than refining, marketing and the rest of the value chain. This is another example of how the Vanguard S&P 500 Growth ETF is more aggressive than a pure S&P 500 fund, but is a more balanced choice than the Vanguard Growth ETF or the Vanguard Mega Cap Growth ETF.

A winning formula

If there’s one word that defined the stock market winners last year and this year, it’s quality. Investors have paid for companies with industry leading positions, strong balance sheets and clear paths to sustainable growth, passing on to smaller companies with greater uncertainty, even though many of those smaller companies are dirt cheap.

Quality, regardless of sector, has helped the Vanguard S&P 500 Growth ETF outperform other growth-oriented ETFs and major indexes so far this year. The combination of a heavy weighting in top growth stocks and the fastest growing sectors of the market – while simultaneously involving weaker market leaders in slower growing sectors has been very effective so far this year.

All told, the ETF has the makeup needed to beat the S&P 500 over the long term without charging exorbitant fees. Investors looking for a basket of higher-quality, faster-growing S&P 500 names without sacrificing value might consider the Vanguard S&P 500 Growth ETF over other Vanguard funds.

Should You Invest $1,000 in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF Now?

Consider the following before buying shares in Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard Admiral Funds – Vanguard S&P 500 Growth ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool holds and recommends Alphabet, Amazon, Apple, Chevron, Home Depot, Meta Platforms, Microsoft, Nvidia, Oracle, Tesla, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Value ETF and Vanguard S&P 500 ETF. The Motley Fool recommends Broadcom and UnitedHealth Group and recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

$1,000 in this Vanguard ETF carries only a $1 annual fee, and has beaten the S&P 500 and Nasdaq Composite in 2024. Originally published by The Motley Fool