The hype around artificial intelligence (AI) has accelerated over the past eighteen months. Although AI has been around for years, recent advances in technology mean that AI is still in its infancy in terms of investment potential.

Investors can expect many more changes in the coming years, with some companies thrust into the spotlight while others fail and are unable to keep up with the competition. That leaves many investors interested in this sector wondering how to identify the winning AI stocks that will remain winners in the long term.

Exchange-traded funds (ETFs), which are groups of individual stocks traded under a single ticker symbol, could be the answer. The diversification they provide means you don’t have to pick specific winners, which is beneficial for investors looking to leverage the benefits of artificial intelligence (AI).

Here are two AI-related ETFs you can comfortably buy and hold for decades.

A broad gem with a proven track record

The Invesco QQQ Trust (NASDAQ: QQQ) isn’t marketing itself as an AI-focused fund, but its “DNA” could make it the most reliable AI ETF money can buy. It follows the Nasdaq-100. This index is technology heavy; approximately 60% of the shares come from the technology sector. The rest consists mainly of healthcare and consumer discretionary stocks.

More importantly, the ETF’s top holdings are already major players in the AI space. Names like Microsoft, Nvidia, AmazonAnd Metaplatforms are in the top five and account for 26% of the total value. These big tech companies are major players in AI-related areas such as semiconductor chips (Nvidia), cloud computing (Microsoft and Amazon) and the metaverse (Meta Platforms). That’s excellent AI exposure from companies that are already fundamentally sound.

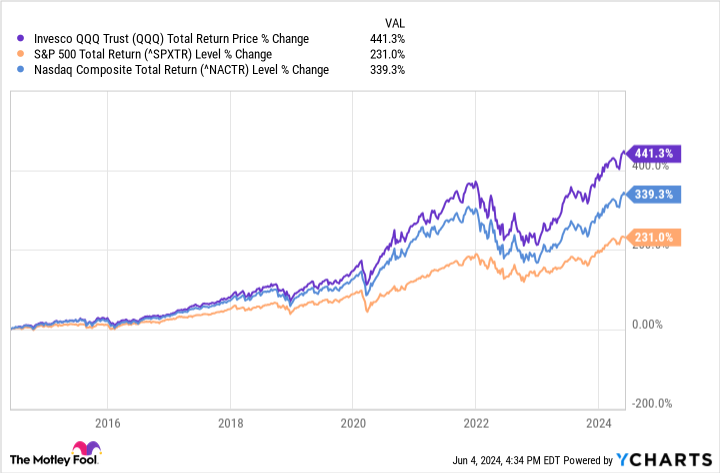

The fund has already shown strong results; the Invesco QQQ easily outperformed the S&P500 and the Nasdaq Composite in the past decade:

There’s no guarantee that the outperformance will last indefinitely, but betting on the world’s largest tech companies has paid off well. Since these same companies are already at the forefront of the AI industry, it seems like a good idea to continue riding these horses for long-term growth.

A more concentrated AI fund with high upside potential

Investors who are feeling a bit more adventurous may find an ETF specifically focused on AI attractive. The Roundhill Generative AI & Technology ETF (NYSEMKT: CHAT), launched in May 2023, aims to deliver long-term outperformance by focusing heavily on generative AI and its growth potential. The big difference between this ETF and the Invesco QQQ is that it does not track an index. The fund managers of the Roundhill Genative AI & Technology ETF regularly actively buy and sell positions.

The potential benefit of an actively managed fund is that smart investment decisions can deliver huge returns. Right now, fund managers are bullish on Nvidia (the ETF’s top holding, with over 14%) and Microsoft (the ETF’s second largest holding, with over 10%). The fund currently has 50 positions. The risk is that poor decisions by these managers could undermine investor returns.

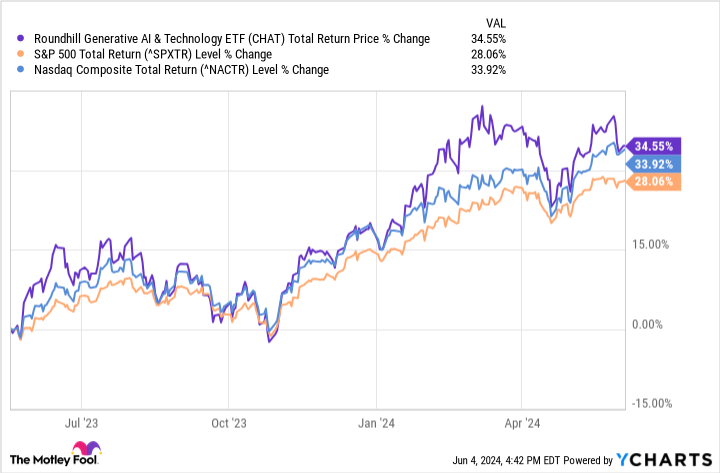

Year to date, the Roundhill Generative AI & Technology ETF has performed well, outperforming the S&P 500 and the Nasdaq Composite since inception:

Actively managed ETFs often charge higher fees than passively managed funds. The expense ratio for this one is 0.75%, significantly higher than the Invesco QQQ’s 0.2%. That fee effectively puts this ETF on par with the Nasdaq Composite in terms of performance (so far). However, the high compensation will not make much difference if the investment return is high enough for long enough.

Ultimately, each of these funds could benefit long-term investors. According to a forecast by PwC, the global economic impact of AI could exceed $15 trillion annually by 2030. In that scenario, investors who put money into the trend will likely do very well, regardless of which of these funds they own.

Should you invest $1,000 in Invesco QQQ Trust now?

Consider the following before purchasing shares in Invesco QQQ Trust:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Amazon, Meta Platforms, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Two Artificial Intelligence (AI) ETFs You Can Buy Now and Hold for Decades Originally published by The Motley Fool