Many companies have witnessed a massive rise in their stock prices in recent years thanks to the increasing adoption of artificial intelligence (AI), which is not surprising as this technology has created a huge demand for both hardware and software.

The good thing is that AI is currently in the early stages of growth. IDC estimates that global AI spending could increase 29% annually over the next five years, reaching $632 billion by 2028.

This robust increase in AI adoption could make businesses happy Nvidia (NASDAQ: NVDA) And Snowflake (NYSE: SNOW) making a parabolic move, which refers to the rapid increase in a company’s stock price over a short period of time (much like the right side of a parabolic curve).

Nvidia shares have already soared in recent years thanks to their pioneering role in the AI hardware market, but Snowflake has headed south due to slowing growth. More specifically, Snowflake shares are down more than 42% in 2024, while Nvidia is up 152%.

Let’s take a look at the reasons why AI could help one of these names take a parabolic leap and go even higher, while the knocked-down Snowflake could also rise quickly.

Nvidia’s new Blackwell chips could fuel the rally

Robust demand for Nvidia’s data center graphics processing units (GPUs) based on the Hopper architecture has played a major role in the company’s excellent growth in recent quarters. Demand for the H100 Hopper AI GPUs was so high that the chip reportedly had a wait of up to a year.

The company followed up this chip with the more powerful H200 processor, which began production and shipments in the previous quarter.

Nvidia points out that shipments of its Hopper-based GPUs will increase in the second half of the current fiscal year due to improved supply and availability, suggesting the H200 could continue to drive more revenue for the company. However, all eyes are on Nvidia’s next generation AI chips, based on the Blackwell platform.

The company began sampling Blackwell processors from customers last quarter. Nvidia says production of the Blackwell chips will begin in the fourth quarter of the fiscal year. More importantly, Nvidia claims that “demand for Blackwell platforms is well in excess of supply, and we expect this to continue next year.”

Additionally, CEO Jensen Huang recently told CNBC that Blackwell is witnessing “crazy” demand. That’s not surprising, as the company has already amassed several customers, including MicrosoftOpen AI, Metaplatformsand others for this chip which will reportedly deliver a four times performance increase over the Hopper chips.

Morgan Stanley estimates that Nvidia could sell $200 billion worth of Blackwell-based server systems next year. While that seems like an ambitious goal, the pace at which Nvidia’s data center revenues are growing suggests that it could indeed achieve that goal. More specifically, Nvidia’s data center revenues more than tripled to $49 billion in the first six months of fiscal 2025, compared to $14.6 billion in the same period last year.

The current run rate suggests Nvidia could end the year with $98 billion in data center revenue. That would be more than double fiscal 2024 data center revenue of $47.5 billion. Morgan Stanley’s forecast suggests Nvidia could double data center revenue again in the next fiscal year. If that is indeed the case, the semiconductor giant’s revenue could well exceed the $178 billion in sales that analysts expect from the company next fiscal year.

That could reignite Nvidia’s astonishing rally after a flat performance over the past three months, and could even help the stock go on a parabolic run.

AI helps Snowflake build a solid revenue pipeline

Snowflake is a cloud-based data platform provider where customers store and consolidate data so they can derive insights from that data, build applications, and even share that data. And now Snowflake is adding AI-focused capabilities to its data cloud platform.

The company is leasing GPUs so it can “meet customer demand for our newer product features,” indicating that Snowflake’s AI offering is gaining momentum. Snowflake enables its customers to develop AI applications using large language models (LLMs) and deploy these models within the secure environment of its data cloud platform.

Snowflake customers can build custom chatbots, use the company’s Copilot feature to speed up their tasks, and extract data from documents, among other things. Snowflake management pointed out during its August earnings conference call that more than 2,500 customers used its AI offering in the second quarter of fiscal 2025 (ended July 31).

It’s worth noting that Snowflake ended the quarter with just over 10,000 customers, indicating that the company is well-positioned to sell its AI services to a large customer base. The good part is that the increasing adoption of the AI tools is leading to increased spending from existing customers.

The company’s net revenue retention was 127% in the second fiscal quarter, a measure that compares the spending of its customers at the end of a given period to the spending of the same customer base in the year-ago period. So a net revenue retention of more than 100% means it captures a larger share of customers’ wallets.

In fact, the quality of Snowflake’s customer base also appears to be improving. This is evidenced by the fact that the number of customers who generated more than $1 million in product revenue for the company increased 28% year-over-year to 510 in the previous quarter, compared to the 21% growth in the total customer base. .

This combination of increased spending by existing customers and the addition of new customers explains why Snowflake’s remaining performance obligations (RPO) skyrocketed a remarkable 48% year-over-year to $5.2 billion last quarter. That exceeded the 30% annual growth in the company’s product sales.

Because RPO refers to the total value of a company’s future contracts yet to be fulfilled, the faster growth in this metric compared to revenue growth suggests that Snowflake’s revenue growth is likely to accelerate in the long term. Naturally, the investments the company is making are weighing on margins, with non-GAAP (adjusted) operating margin falling from 8% last year to 5% last quarter.

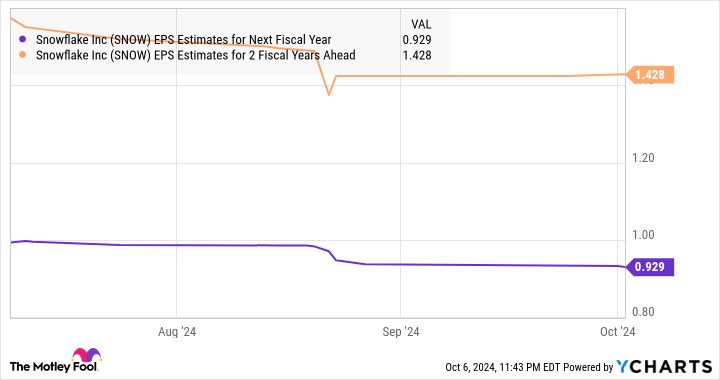

As a result, analysts expect Snowflake’s operating income to shrink to $0.61 per share in fiscal 2025, compared to $0.98 per share the year before. However, the economy is expected to record tremendous growth again from next fiscal.

As such, investors should consider buying Snowflake stock as it falls in value, as the rise of AI and the acceleration of its growth thanks to the adoption of this technology could send the stock skyrocketing.

Should You Invest $1,000 in Nvidia Now?

Before you buy shares in Nvidia, consider the following:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $814,364!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns October 7, 2024

Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Meta Platforms, Microsoft, Nvidia, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks That Could Go Parabolic was originally published by The Motley Fool