Over the past year, all eyes have been on the artificial intelligence (AI) market. The launch of OpenAI’s ChatGPT in late 2022 has reignited interest in the technology and forced many to reconsider what they thought was currently possible with AI. Advances in generative software could power countless industries, from self-driving cars to e-commerce, consumer products, cloud computing and more.

A boom in AI has been a crucial growth driver in the Technology sector Nasdaq-100‘s increase of 33% in the past twelve months. Dozens of AI-driven tech companies have seen solid profits thanks to AI. However, it appears that the market is far from reaching its ceiling, suggesting that it is not too late to invest in the sector for the long term.

Chip stocks such as Nvidia (NASDAQ: NVDA) And Intel (NASDAQ: INTC) are attractive options, with both companies developing the hardware that makes AI possible. These tech giants could have a lot to offer investors in the coming years as demand for chips increases and the AI market develops.

Here are two AI stocks to buy and hold for great long-term potential.

1. Nvidia

Nvidia shares are up more than 210% since June last year. The company has gathered investors by gaining a leading market share in AI graphics processing units (GPUs), the chips used to power and train AI models.

As a result, Nvidia’s stock is trading at a premium, with a price-to-earnings (P/E) ratio of around 44. However, that figure doesn’t necessarily tell the whole story.

First, Nvidia’s price-to-earnings ratio is lower than its closest rival. Advanced micro deviceswith a price-to-earnings ratio of 48. The difference indicates that Nvidia stock is trading at a better value, despite delivering significantly more share growth than AMD over the past year.

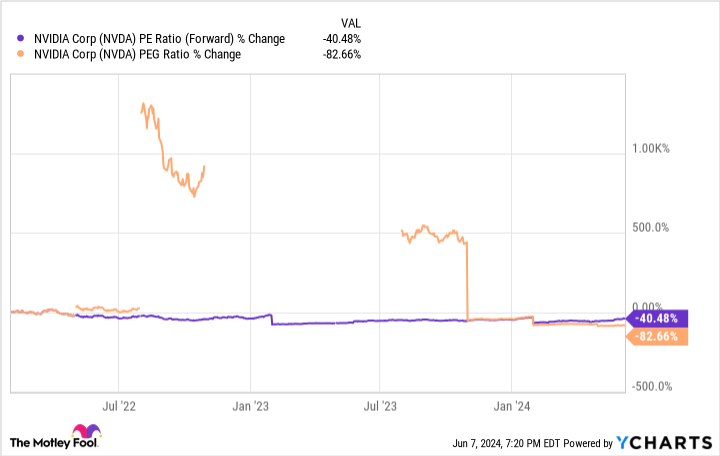

Furthermore, Nvidia stock has actually increased in value since 2021, even with Nvidia’s meteoric rise. This chart shows that Nvidia’s forward price-to-earnings ratio and price-to-earnings-growth ratio (PEG) have fallen, suggesting that the company’s stock could be trading at one of the following levels. the best values in years. This could be the best time to invest in Nvidia.

However, it will be crucial to approach this stock with a long-term mindset. Nvidia has delivered record profits for multiple quarters, posting 262% revenue growth in the first quarter of fiscal 2025 (ending April 2024). Still, Nvidia’s high price-to-earnings ratio suggests that some of its expected financial growth could already be priced into the stock to some extent. But holding it for many years will likely alleviate this.

Nvidia has an estimated 70% to 95% market share in AI chips. The company has become the chip supplier of choice for AI developers worldwide, illustrating a dominance that will likely prove challenging for rivals like AMD to overcome.

As a result, Nvidia could have a lot more to offer in the long run, and it remains an AI stock worth investing in right now.

2. Intel

Intel’s inclusion on this list may make you wonder why you should consider having two chipmakers in your portfolio. However, the recent restructuring means that Intel operates in a very different part of the chip market than Nvidia and could have equal, if not more, growth potential than its AI peers.

While Nvidia focuses on chip design, Intel is transitioning its operations to a foundry model. The company has plans to build chip factories across the US. With demand for chips soaring, Intel could become the country’s leading chipmaker and benefit from the growth of the entire AI market.

In May, CEO Pat Gelsinger said he expects Intel’s upcoming factory in Ohio to become the “AI systems factory for the nation.” Gelsinger then echoed this sentiment at a conference in Taipei on June 4, saying, “We want to build everyone’s chips, everyone’s AI chips. We want them to be built using America’s factories.”

Intel is fully committed to manufacturing, which could pay off significantly in the long run. However, a foundry model is not cheap and requires large upfront investments. That is why most technology companies prefer to outsource their production. As a result, it will take some time for Intel to recoup its investment.

However, with a price-to-earnings ratio of 28, Intel is potentially one of the best valued stocks in AI. The company’s forward price-to-earnings ratio is significantly lower than that of fellow chipmakers AMD or Nvidia, suggesting this is an excellent time to make a long-term investment in Intel.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,690!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel and short August 2024 $35 calls to Intel. The Motley Fool has a disclosure policy.

2 Artificial Intelligence (AI) Stocks to Buy and Hold for Big Long-Term Potential was originally published by The Motley Fool