The artificial intelligence (AI) market that took over Wall Street last year shows no signs of recovery. Investors are fascinated by the enormous potential of the technology, as well as the rising profit growth of the companies driving it.

Chipmakers have proven to be one of the best ways to invest in the arena. These companies are developing the hardware that powers the AI market, with demand for chips soaring in the past year.

As a leading chipmaker Advanced micro devices‘ (NASDAQ: AMD) has seen its share price rise by 31% in the last twelve months. However, a rising stock price and a company that has yet to see a significant return on its investment in AI have made AMD stock too expensive for the time being.

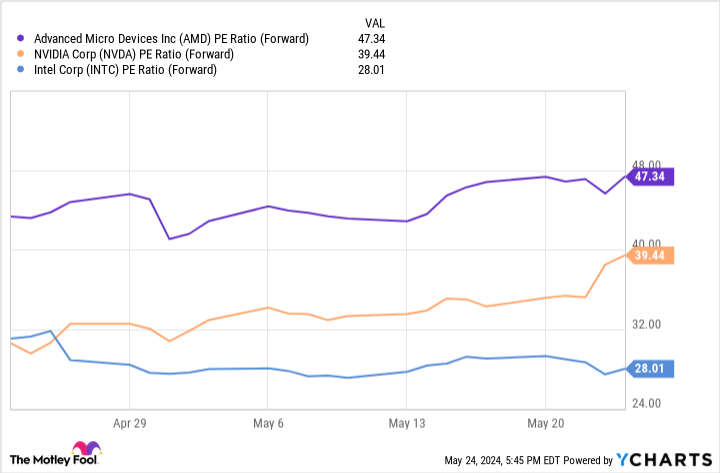

This chart uses forward price-to-earnings (P/E) ratios to compare the valuations of the three most prominent chip names. Each of these companies has growing businesses in AI and could see big gains in the coming years as the market develops. Still, AMD’s forward price-to-earnings ratio – the highest of the three companies – indicates that its shares offer the least value, while the other two appear to be more attractive options for investing in AI.

So forget AMD and consider buying these two artificial intelligence stocks now.

1. Intel

With repeated hits Intel‘S (NASDAQ: INTC) Since the company has reduced its share price by about 46% since 2021, the company is undoubtedly a long-term strategy. However, its forward price-to-earnings ratio of 28 could make it one of the best-valued stocks in AI, suggesting this is an excellent time to invest in its growing business.

Recent headwinds have forced Intel to rethink its business model. The company has transitioned to a foundry model and is beginning to build chip factories across the US. Intel is one of the largest recipients of the CHIPS Act, which aims to expand U.S. chip capacity as tech companies look to reduce their dependence on Taiwanese semiconductor manufacturing company. It will take time and significant investment, but this move could boost Intel’s revenues for years to come.

Intel’s focus on manufacturing is promising as the semiconductor foundry market is expected to double in size soon. According to Allied Market Research, the industry generated $107 billion in spending in 2022 and is expected to reach more than $231 billion by 2032. Meanwhile, Intel has already signed contracts for technology giants. Microsoft as a chip customer.

Furthermore, Intel believes its foundry business could result in a lucrative position in AI. CEO Pat Gelsinger said in mid-May that the company expects its Columbus, Ohio factory to be “the AI systems factory for the nation.” Manufacturing could differentiate Intel from other chipmakers in the AI space in the long run, with companies like AMD focusing more on design than manufacturing.

In the first quarter of 2024, Intel’s AI and data center segment posted $184 million in operating revenues, a significant improvement from the negative $69 million it posted in the prior year quarter. Meanwhile, Intel Foundry’s revenue rose 8% year over year.

It will take patience, but Intel is on a growth path you don’t want to miss. The company has significant potential in AI and could be a better option than AMD in the coming years.

2. Nvidia

Despite the stock price being up 173% over the past year compared to AMD’s 31%, Nvidia’s lower price-to-earnings ratio suggests the stock is better value. This is mainly due to Nvidia’s tremendous financial growth over the past twelve months.

In the first quarter of 2025 (ending April 2024), Nvidia posted 262% year-over-year revenue growth, while operating income rose 690%. The company benefited from a 427% increase in revenue from its data center segment, driven by a spike in sales of AI graphics processing units (GPU).

Nvidia shares are up 12% since reporting earnings on May 22 and appear primed for more. The company’s longstanding dominance in GPUs has given it an edge in AI, and this lead is unlikely to disappear anytime soon.

Intel has cleverly found its niche in manufacturing and differentiated itself from Nvidia. However, AMD could find it difficult to take on the likes of Nvidia in the field of AI chips.

In addition to its enormous potential in AI, Nvidia has become the go-to chip supplier for countless other industries.

For example, Nvidia CFO Colette Kress has said she expects automotive to be the “largest vertical in the industry.” [the] Data center [segment] this year.” Self-driving car technology is advancing rapidly, with a call from CEO Jensen Huang Tesla‘s autonomous technology is the most advanced system available today. Tesla’s technology is powered by Nvidia’s chips, and demand will likely only continue to rise as the auto industry evolves.

Nvidia just posted another quarter of stellar gains, suggesting it can continue its current growth trajectory for years to come. Its stock is worth considering now, before it’s too late.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel, long January 2026 $395 calls to Microsoft, short January 2026 $405 calls to Microsoft, and short May 2024 $47 calls to Intel. The Motley Fool has a disclosure policy.

Forget AMD: 2 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool