All eyes are on it Nvidia (NASDAQ: NVDA) last year, when the stock rose more than 200%. The company has benefited greatly from a boom in artificial intelligence (AI), as its graphics processing units (GPUs) have become the go-to for developers around the world. Due to the rapid rise of Nvidia, it was even briefly overtaken Apple as the second most valuable company in the world on June 5, when its market capitalization was $3 trillion.

As the AI market develops, Nvidia will likely have a lot to offer investors in the coming years. However, while the recent rise has benefited current investors, it has made the stock fundamentally more expensive.

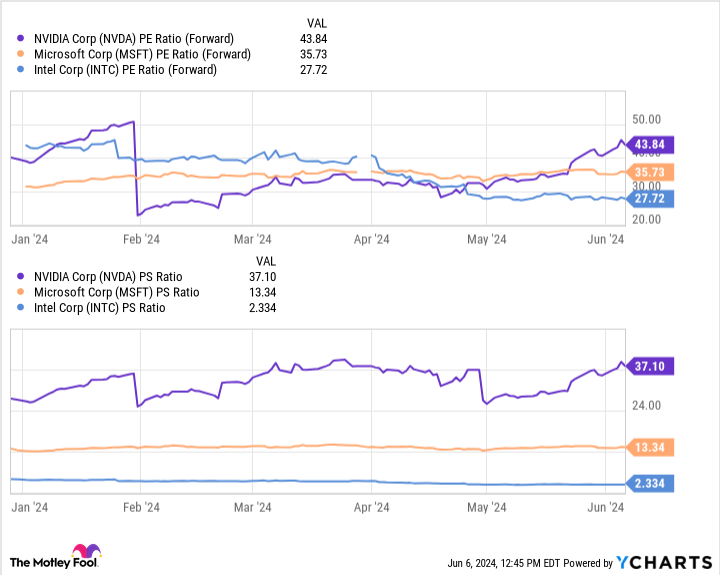

This chart uses price-to-earnings (P/E) and price-to-sales ratios to show that Nvidia stock offers less value than two other AI companies. Intel (NASDAQ: INTC) And Microsoft (NASDAQ: MSFT). As a result, if you’re looking for a way to invest in the burgeoning AI market, it may be worth considering one of these options over Nvidia to get the most bang for your buck.

So forget Nvidia and consider investing in one of these AI stocks now.

1. Intel

At the Computex technology conference in Taipei on June 4, Intel CEO Pat Gelsinger said, “We want to build everyone’s chips, everyone’s AI chips. We want them to be built using America’s factories.”

Gelsinger’s comments come at a time when the company is restructuring its entire operations around manufacturing. Intel announced last year it would switch to a foundry model in an effort to regain its position as the world’s largest chipmaker after being overtaken by Taiwanese semiconductor manufacturing And Samsung since 2017.

Intel’s plan includes building at least four factories in the US and will take advantage of President Biden’s CHIPS Act, an initiative designed to expand US manufacturing capabilities. Intel will receive $8.5 billion to help expand its foundry, more than Samsung or TSMC.

Over the past year, Intel has competed fiercely with Nvidia and Advanced micro devices at A.I. They all have AI accelerators on the market and are aiming to attract new customers. However, Intel’s foundry model could set the company apart from its rivals. While Nvidia and AMD focus on design, Intel could see significant gains in the coming years as demand for chips grows and Intel becomes the top US manufacturer.

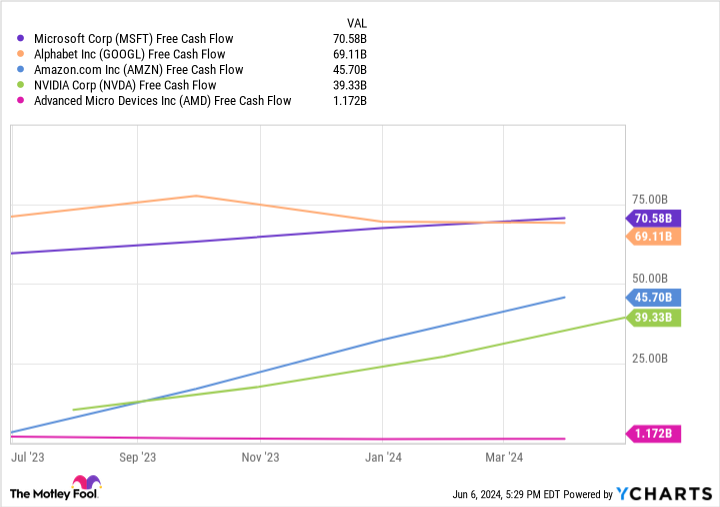

Intel still has a long way to go before it dominates AI. However, free cash flow rose by $2 billion from January to May, suggesting business is moving in the right direction. As a result, Intel stock is worth considering right now.

2.Microsoft

Microsoft’s stock trades at 36 times earnings, so it’s far from the biggest bargain on Wall Street. However, it is a better value than Nvidia and could have more growth potential in AI in the long term, thanks to its huge user base.

Homegrown brands such as Windows, Office, Xbox, Azure and LinkedIn attract billions of users and have made Microsoft a household name worldwide. Thousands of businesses rely on the company’s offerings for productivity, giving it nearly endless opportunities to showcase its AI products.

Additionally, Microsoft has access to some of the most advanced AI models. The company is the largest investor in ChatGPT developer OpenAI, giving it exclusive access to much of its AI technology. Over the past year, Microsoft has used OpenAI’s products to introduce new AI features to its product lineup, including integrating parts of ChatGPT into its search engine Bing, expanding its AI services on Azure, and introducing generative features into its Office productivity suite.

The power of Microsoft’s products and OpenAI’s technology could prove to be a powerful combination, making it the go-to solution for consumers and businesses looking to improve their workflow with AI.

Microsoft stock may be trading at a premium, but it is without a doubt one of AI’s most reliable investment options. Microsoft is outperforming many AI-driven companies in terms of free cash flow, suggesting it could be best equipped to expand in the sector. Meanwhile, the company’s shares are up 237% over the past five years, significantly outperforming the company’s stock. S&P500‘s 89% increase.

Microsoft announced its earnings results for the third quarter of 2024 (ending in March) on April 25. Revenue rose 17% year over year, exceeding analyst expectations by more than $1 billion. The company posted solid gains in its productivity and cloud segments, pointing to positive AI growth.

Microsoft has promising prospects that you won’t want to miss and are worth considering over Nvidia in June.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 calls of $45 on Intel, long January 2026 calls of $395 on Microsoft, short August 2024 calls of $35 on Intel, and short calls in January 2026 from $405 on Microsoft. The Motley Fool has a disclosure policy.

Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool