Over the past year, increased interest in artificial intelligence (AI) has put a spotlight on several tech stocks that could make big gains as the industry evolves. Chipmaker Advanced micro devices (NASDAQ: AMD) has seen its shares rise 150% since the start of 2023, largely driven by investor enthusiasm for AI. AMD’s second-largest market share in graphics processing units (GPUs) has Wall Street bullish as similar offerings from Nvidia have flown off the shelves en masse due to increased demand for the powerful chips.

However, mediocre quarterly results, alongside a rising stock price, have sent AMD’s stock tumbling. The company’s business hasn’t seen enough return on its investment in AI, suggesting there could be better options to support the rapidly growing industry.

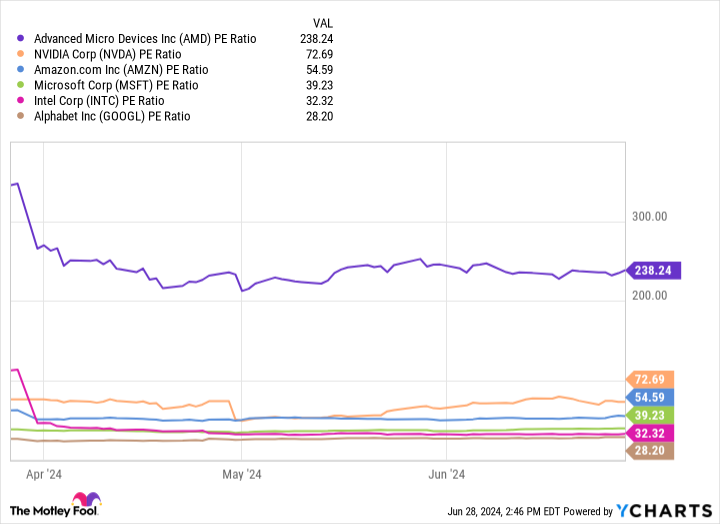

This chart uses price-to-earnings (P/E) ratios to compare the valuations of some of the most prominent names in AI. AMD’s stock is by far the worst value, with a P/E of 238. However, two companies stand out as bargains relative to their peers: Intel (NASDAQ: INTC) And Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG).

These companies are engaged in growing activities in the field of AI, which can yield a lot of profit in the long run. One company invests in the production of AI chips and the other company is growing rapidly in AI software.

So forget about AMD in 2024 and consider buying one of these AI stocks instead.

1. Intel: Realizing growth in multiple areas of its business

Intel investors have had a tough time of it in recent years, with the stock down 35% since 2019. The company was once the biggest name in the chip market, dominating production and boasting a lucrative partnership with Apple as the leading chip supplier for its Macs. However, Intel’s struggles to keep up with competitors like AMD and Nvidia caused it to fall behind and lose market share.

Still, sometimes the best test of a company is how it responds to challenges, and recent developments suggest that Intel could come back strong in the coming years. The chipmaker has increased its market share of central processing units (CPUs) for three straight quarters. Since the fourth quarter of 2023, Intel’s CPU share has risen from 61% to 64%, while AMD’s has fallen from 36% to 33%.

Additionally, Intel’s recent earnings highlight the gradual improvements. In Q1 2024, the company’s revenue rose 9% year-over-year to $13 billion. The company benefited from a 31% increase in customer revenue, representing a spike in consumer sales. Meanwhile, the data center and AI segment posted 5% revenue growth, with operating income of $184 million after the company reported a loss of $69 million the year before.

Intel is restructuring all parts of its business to prioritize long-term profit growth. The company is refocusing its business model on AI and manufacturing, with plans to build at least four factories in the U.S. and more abroad. Intel wants to become the country’s leading AI chipmaker, which could allow it to capitalize on surging demand for GPUs across the industry.

Given the positive growth signals and attractive share price, Intel stock is worth considering over AMD stock in 2024.

2. Alphabet: The Most Valuable Way to Invest in AI Software

Alphabet is home to some of the most widely recognized brands thanks to products like Android, YouTube and Google’s many offerings. Alphabet’s success has made it the world’s fourth most valuable company, with a market cap of over $2 trillion.

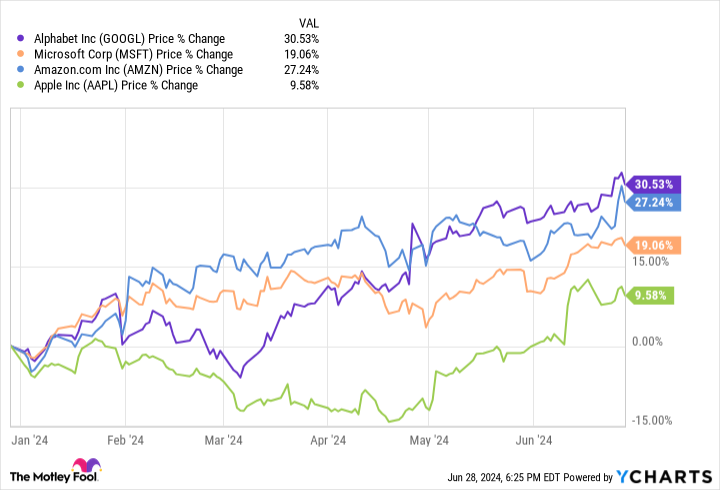

The tech giant has proven itself to be one of the most reliable long-term investments. This year alone, Alphabet has outpaced many of its rivals in share growth (as seen in the chart above). Yet it has the lowest P/E of these companies, indicating that it’s trading at the best value. Alphabet also has the lowest share price of these tech companies, potentially making its stock the most accessible.

Besides trading at a bargain price, Alphabet has significant potential in AI. The company was an early investor in the industry, first introducing AI to its search engine in 2001. The tech giant then became an AI-first company in 2016, well ahead of many of its rivals. Its Google DeepMind AI research subsidiary is powering the company’s innovation.

Meanwhile, Alphabet’s recently launched AI model, Gemini, could strengthen its overall position in the sector by introducing generative upgrades across its product lineup.

Alphabet likely has a bright future in the tech sector and is simply too good to pass up at its current price, making it a good buy in 2024 and a better option than AMD.

Should You Invest $1,000 in Intel Now?

Before you buy Intel stock, here’s what to consider:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of June 24, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft and Nvidia. The Motley Fool recommends Intel and recommends the following options: long Jan 2025 $45 calls on Intel, long Jan 2026 $395 calls on Microsoft, short Aug 2024 $35 calls on Intel and short Jan 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Forget AMD in 2024: 2 Artificial Intelligence (AI) Stocks You Should Buy Instead was originally published by The Motley Fool