Stock market crashes look intimidating on a chart, as long as we stick to a short time horizon. But the further we zoom out, the more it looks like minor hiccups, as stocks always recover and continue their rise. That’s why investing in stocks with attractive prospects during bear markets is a good idea. There’s hardly a better time to apply half of the most fundamental investment advice: “Buy low.”

But even if we are not in a bear market, buying shares of defeated stocks that have everything to recover is also an excellent move. Let’s look at two such stocks: DexCom (NASDAQ: DXCM) And Roku (NASDAQ: ROKU).

1. DexCom

Shares of DexCom recently fell following its second-quarter financial results. What exactly caused the market to send the company’s shares lower? The diabetes-focused medical device specialist revealed that it did not attract as many new customers as expected.

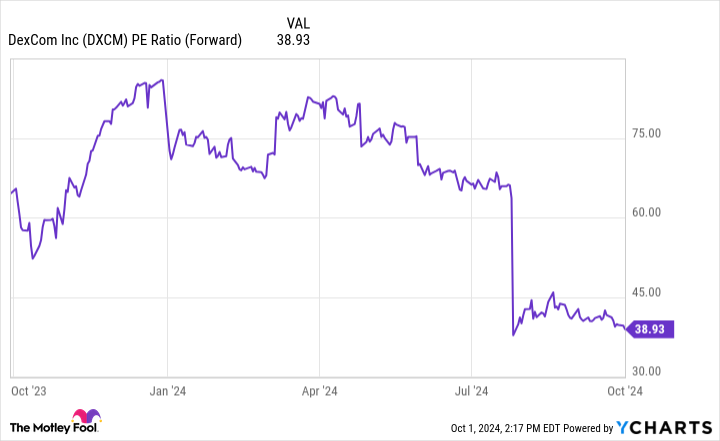

Meanwhile, many consumers took advantage of discounts during the period, which hurt sales. DexCom’s expectations for the third quarter weren’t great either. And given how richly priced stocks are, it’s not shocking to see a small correction. Yet DexCom’s forward price-to-earnings (P/E) ratio is still 39, more than twice the healthcare industry’s average P/E of 19.

Those are arguments against the stock, but what about DexCom’s bull case? Where will the company be in 10 years?

First, it’s important to point out that DexCom is one of the leaders in continuous glucose monitoring (CGM), a technology that has been proven in many studies to improve health outcomes for diabetes patients. Yet there is a huge addressable market here. DexCom’s main competitor, Abbott Laboratoriesestimates that only 1% of the “half a billion adults” worldwide with diabetes have access to CGM technology.

DexCom’s addressable market is much smaller, at least for now. However, there is plenty of fuel for growth, even in countries where it is already active. In the US, the percentage of CGM users is well below that of eligible patients benefiting from third-party coverage.

Furthermore, DexCom is building a competitive advantage. The company’s technology is compatible with other devices and digital health apps, from insulin pens and pumps to smartphones and the Apple Watch. The more users in the ecosystem, the more attractive it becomes for third parties to make their devices compatible with DexCom’s technology – an example of the network effect.

Finally, DexCom is an innovative company that should continue to produce new gemstones. The G7 has been on the American market since last year and is the most accurate CGM available. It also recently launched an over-the-counter CGM option in the US

Despite the recent decline, DexCom’s long-term prospects are exciting. The stock should deliver outsized returns over the next decade, just as it has in the past.

2. Roku

Roku is a leader in streaming; the company’s vast ecosystem spans 83.6 million households. While the financial results haven’t been terrible this year, investors are particularly concerned about a few numbers. Let’s look at two of them.

The first is average revenue per user (ARPU). In the second quarter, Roku’s ARPU was flat at $40.68, even as revenue grew 14% year over year to $968.2 million. The second is Roku’s premise: the company is not profitable. In the second quarter, Roku posted a net loss per share of $0.24, although that was much better than the $0.76 loss per share reported in the same period last year.

Can Roku overcome these two obstacles and deliver solid returns over the next decade? I think the answer is yes. Regarding ARPU, Roku pointed out that it is starting to gain more users in international markets. For now, it’s about scale in these regions, not about generating revenue. However, this should be a major growth driver for Roku.

While the streaming industry continues to make progress, it still accounted for just 41% of television viewing time in the US in August. So there is a huge opportunity. Once Roku becomes better established in these regions, the company’s monetization efforts will increase, leading to stronger ARPU and revenue growth.

And while the red ink on the bottom line may be a problem, most importantly, Roku’s platform segment is profitable. The platform business generates revenue from advertising, operating system licensing agreements and more.

The company is recording sales of its namesake streaming player in its device segment – which is not profitable. Roku is choosing to sell these devices at a loss for good reason. For now, growing the ecosystem is the most important thing. With a large enough user base, monetization opportunities will increase, as will revenue. That’s Roku’s path to profitability, a milestone it should reach well before 2034.

And in the meantime, the company has the resources to realize and deliver outsized returns. I think you would do well to invest in the stock while it is still low.

Should You Invest $1,000 in DexCom Now?

Before purchasing shares in DexCom, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and DexCom wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $752,838!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns September 30, 2024

Prosper Junior Bakiny has positions in Roku. The Motley Fool holds positions in and recommends Abbott Laboratories, Apple, and Roku. The Motley Fool recommends DexCom. The Motley Fool has a disclosure policy.

2 Beat Growth Stocks You Might Regret Not Buying was originally published by The Motley Fool