It’s a new month and another great opportunity to add dividend income to your portfolio. Even if the S&P 500 is near all-time highs, there are always deals on the market. This month the energy sector seems particularly attractive to me.

Let’s face it: High-yielding dividend stocks are often a red flag. Reliable 6%, 7%, and 8% yield stocks are hard to find. High yields often mean the market has noticed problems and is demanding more income to offset those risks.

But there are exceptions. Two high-yield pipeline stocks stood out as table-beating bargains for July. Here’s why you can trust them to deliver the goods.

A dividend payment at a fair price

Energy transfer (NYSE: ET) is critical to North America’s energy picture. The company operates an extensive network of storage facilities and more than 125,000 miles of pipelines that transport oil, natural gas and refined products across the country.

It connects key exploration regions, such as the Permian Basin, to ports that send raw materials to more than 80 countries. Pipelines are like toll roads: they make money based on the volume of materials that flow through their pipelines.

About 90% of Energy Transfer’s revenues come from fee-based contracts, making it more predictable than oil and gas companies that rely on commodity prices.

Most companies pay corporate income tax before they distribute dividends to their shareholders. Shareholders then have to pay taxes on their dividends, which essentially means that the company’s profits are taxed twice.

Energy Transfer is a master limited partnership (MLP), a business structure that does not pay corporate income taxes. MLPs are pass-through entities; they distribute their profits (MLP for dividends) to unitholders (MLP for shareholders), who pay taxes based on the number of units they own and their individual income tax rate. This makes Energy Transfer more tax efficient, while the larger distributions help compensate unitholders for bearing the tax burden.

Energy Transfer’s distribution yields 7.8% return and is sustainable because costs are just over half of cash flow.

It’s become harder to call the stock cheap after it rose nearly 30% in the past year. Still, despite the run, the stock’s valuation is only slightly above its long-term average. Management is targeting 3% to 5% annual distribution growth, suggesting the company will grow at a similar pace.

A mid-single-digit multiple on operating cash flow is reasonable for a company growing at that rate. Add in the nearly 8% yield and investors can expect an annual total return of between 10% and 13%. That makes Energy Transfer a potential buy.

This pipeline giant is for sale.

Enbridge (NYSE: ENB) is equally important to the North American energy sector. The company’s assets transport oil, gas and other products throughout Canada and the United States. It helps connect Canada’s oil sands to ports across the continent.

Enbridge’s business also includes natural gas utilities and renewable energy generation. That diversification has helped it weather tough times and keep putting money in shareholders’ pockets. The company has raised its dividend for 28 years in a row.

While not a master limited partnership, Enbridge still offers a generous dividend. The stock yields 7.5% at current prices. The company’s ability to increase its dividend during COVID and the 2008-2009 financial crisis should give investors confidence in the payout.

Enbridge also has an investment grade credit rating and a manageable dividend payout ratio of 66%, meaning the dividend is fundamentally solid.

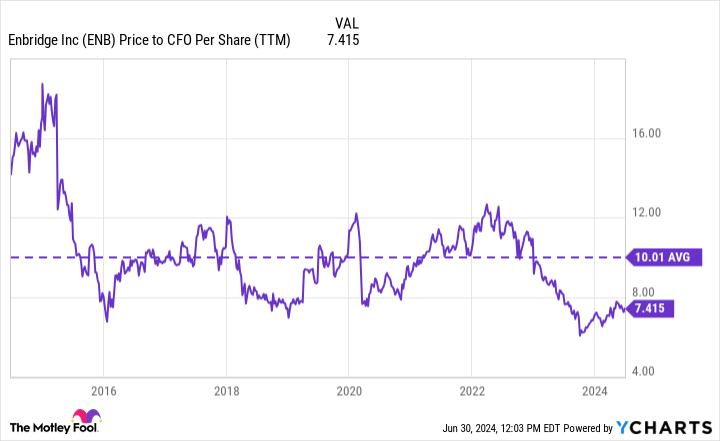

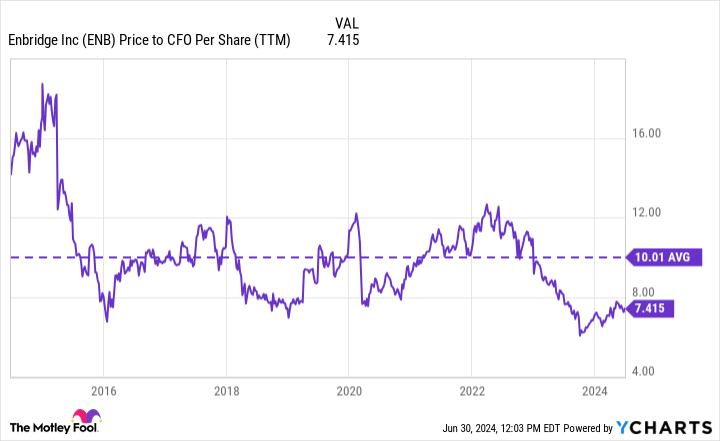

Enbridge shares haven’t followed Energy Transfer, falling slightly over the past 12 months. The good news is that the stock is still available to buy. Enbridge has traded at an average of 10 times operating cash flow over the past decade. Today, it’s trading well below that, at 7.4 times.

North America is expected to remain a major energy exporter, which should ensure that there’s enough flow through Enbridge’s pipelines to fuel long-term growth. Analysts expect the company’s distributable cash flow to grow by more than 6% next year. It seems likely that the stock price will eventually follow suit. Investors can collect a hefty dividend in the meantime.

Should You Invest $1,000 in Energy Transfer Now?

Before buying Energy Transfer stock, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $751,670!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of July 2, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Enbridge. The Motley Fool has a disclosure policy.

2 Dividend Stocks to Buy in Bulk in July was originally published by The Motley Fool