Technology stocks are on the move this year, fueling the economy Nasdaq Composite‘s growth of 13% since January. Investors have become optimistic about the enormous potential of artificial intelligence (AI) and its ability to strengthen sectors across the technology sector. Industries such as cloud computing, chip manufacturing, data centers, autonomous vehicles, consumer products and more have been boosted by AI and will likely continue to expand for years to come.

The technology industry has a reputation for making consistent profits over many years, making it an excellent place to start whether you are new to the stock market or a seasoned investor looking for new opportunities. Technology companies tend to benefit from reliable demand for hardware and software upgrades, with the sector almost never stagnant from year to year.

In fact the Technology sector Nasdaq-100 The index is up 409% over the past decade, despite the COVID-19 pandemic and a market downturn in 2022. Meanwhile, the rise of AI and other industries suggests that technology still has plenty to offer new investors in the coming years.

So here are two leading tech stocks to buy in 2024 and beyond.

1. Advanced micro devices

As a leading chipmaker Advanced micro devices (NASDAQ: AMD) has a powerful position in technology. The company supplies its hardware to companies across the industry, with its chips powering custom PCs, laptops, cloud platforms, video game consoles and more. Many of your own devices probably use AMD chips, but you might not even know it.

For example, in 2020, AMD became the exclusive supplier of chips for two of the world’s most popular consoles, Sony‘s PlayStation 5 and Microsoft‘s Xbox Series X|S. These companies have sold nearly 80 million units since the launch of their respective consoles, illustrating how lucrative the partnerships are for AMD.

However, all eyes were focused on the chipmaker’s growing position in the field of AI in the past year. AMD is a challenge Nvidia‘s leading position in the industry with competitive graphics processing units (GPUs), the chips needed to build AI models. AMD launched its line of MI300X AI GPUs last December and its efforts appear to be paying off.

In the first quarter of 2024, AMD’s revenue rose 2% year over year, beating Wall Street estimates by $20 million. It wasn’t significant growth, but the performance of key segments shows the company is moving in the right direction. During the quarter, a spike in GPU sales drove data center segment revenue up 80% year over year.

Additionally, AMD’s customer segment saw an 85% increase in revenue, driven by an increase in sales of central processing units (CPUs).

AMD still has a lot of work to do as it tries to steal market share from Nvidia and expand its AI PC division. However, the company has exciting long-term prospects. Meanwhile, AMD’s price-to-earnings ratio has fallen 75% over the past six months, suggesting its shares have actually increased in value. Given its powerful position in the technology sector, AMD stock is worth considering in 2024 and beyond.

2. Amazon

Amazon (NASDAQ: AMZN) is easily one of the most attractive ways to invest in technology, thanks to its diverse business model. The company may be best known for its online shopping site, but it has grown into so much more over the years. In addition to having the largest market share in e-commerce (by a wide margin), Amazon is the biggest name in cloud computing with Amazon Web Services (AWS); has delved into video streaming, messaging and space satellites; and is now fully focused on AI.

In fact, Amazon’s reach is so vast that it dominates markets it never aspired to, such as the nation’s largest video game retailer with a 44% market share, ahead of competitors. GameStop And Apple‘s App Store/Arcade.

Amazon’s e-commerce segment remains a highly profitable business. In the first quarter of 2024, sales in the North American and International divisions increased 12% and 10% year-over-year. Meanwhile, operating income for both retail segments reached a combined $6 billion, a significant improvement from the $349 million in losses reported the year before.

Still, AWS is the best reason to invest in Amazon. The cloud platform delivered a 17% year-over-year revenue increase in the first quarter of 2024, while operating income rose 84% to more than $9 billion. AWS gives Amazon a promising role in AI, with the company gradually expanding its library of AI cloud services and investing in new data centers around the world.

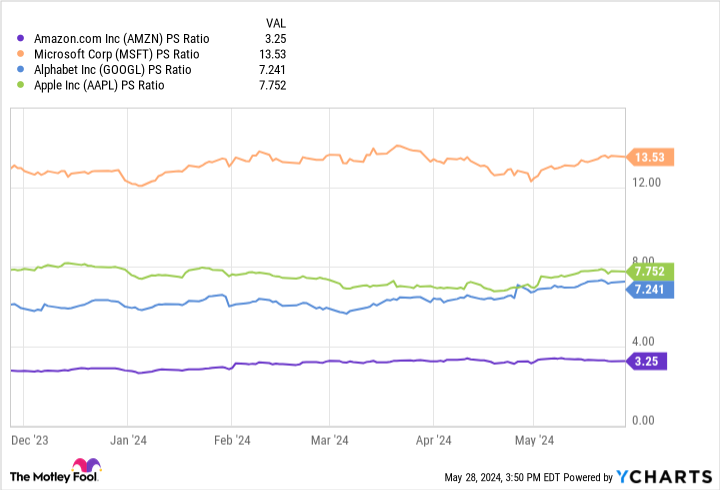

Additionally, this chart shows that Amazon has the lowest price-to-sales ratio among some of its biggest competitors in technology and AI. The numbers indicate that Amazon’s stock could be trading at a bargain compared to its rivals, making 2024 an excellent time to buy.

Should you invest €1,000 in advanced micro-devices now?

Consider the following before buying shares in Advanced Micro Devices:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 28, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

2 Leading Tech Stocks to Buy in 2024 and Beyond was originally published by The Motley Fool