The technology market has created many millionaires over the years. In fact, investment magnate Warren Buffett’s holding company, Berkshire Hathaway, has dedicated more than 40% of its portfolio to the industry. Meanwhile, Berkshire’s value rose at an estimated compound annual growth rate (CAGR) of 18% from 1965 to 2023, outperforming S&P500annual return of approximately 10%.

Of course, past growth does not always guarantee future profits. However, advances in emerging markets such as artificial intelligence (AI), cloud computing, e-commerce and more suggest that technology has much more to offer investors in the long term. The AI market itself is expected to grow at a CAGR of 37% until at least 2030, which would bring spending to almost $2 trillion.

So it’s not too late to consider buying these two millionaire tech stocks this month.

1. Intel

Intel (NASDAQ: INTC) was once a leader in the chip market, best known for its dominance in central processing units (CPUs) – which are critical to computing tasks. While the company has maintained a majority market share in CPUs, an AI boom has shifted demand for chips. Graphics processing units (GPUs) have become crucial to the technology market due to their ability to handle the intensive workloads associated with training AI models, rendering video games, and mining cryptocurrency.

The changes in the industry are putting Intel in the background as the GPU leader Nvidia enjoyed rising profits and stock growth. However, Intel has focused its business on AI and could see big gains in the coming years. In April, the company unveiled AI-enabled

In addition to new product designs, Intel is vastly expanding its chip manufacturing activities. The company is trying to generate revenue by making chips for other companies, which will help it secure a lucrative position in AI. The move could allow Intel to capitalize on rising chip demand across the industry, even producing chips for its competitors.

Of course, production is expensive, and it will take some time before Intel sees a return on its hefty investment. However, plans to prioritize opening factories in the US could help attract some of the tech sector’s most prominent players as customers.

Intel’s stock trades at about 28 times its forward earnings, making it a significantly better value than fellow chipmakers Nvidia and Advanced micro devices. And with solid growth opportunities in technology, Intel is a company that can make you a millionaire with the right investment.

2. Amazon

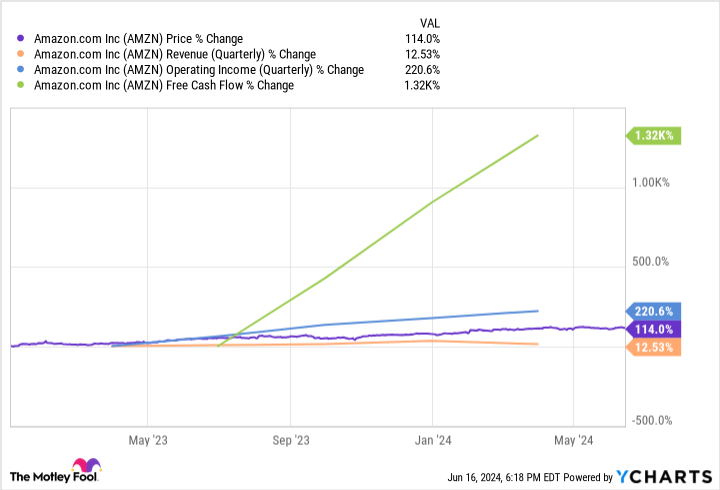

After a great year of growth, it’s hard not to be optimistic Amazon (NASDAQ: AMZN). The company has risen by almost all accounts since the start of 2023, as seen in the chart below.

Amazon has experienced tremendous growth in terms of its stock price, quarterly revenue, operating income, and free cash flow. And yet its price-to-sales ratio of around 3 suggests it remains a bargain.

The company has benefited from an impressive turnaround in its e-commerce business after an economic downturn led to sharp declines in 2022. Inflation relief and strategic cost-cutting measures have paid off for Amazon, illustrating its ability to successfully navigate tough market conditions.

In the first quarter of 2024 (ending in March), Amazon’s revenues rose 13%, outperforming Wall Street estimates by $750 million. The retail segments achieved comparable sales growth between 10% and 12%. Meanwhile, operating income between the North American and International divisions reached a combined $6 billion, a significant improvement over the $349 million in losses the company incurred last year.

Amazon has become a household name worldwide thanks to its success in online retail. While it remains a promising part of the company’s business, Amazon’s role in cloud computing makes the stock a potential millionaire maker. The tech giant’s cloud platform, Amazon Web Services (AWS), posted a 17% year-over-year revenue increase in its latest quarter. Meanwhile, operating income nearly doubled to over $9 billion, outperforming the profits of Amazon’s entire retail business.

AWS is investing billions in expanding its AI offering and has the money to continue doing so in the future. The company has become one of the biggest threats in the emerging AI market, likely driving profits for years to come.

As a result, Amazon stock is a no-brainer and could make you a millionaire as the company continues to thrive in e-commerce and develop its position in AI.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $830,777!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Amazon, and Berkshire Hathaway. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel and short August 2024 $35 calls to Intel. The Motley Fool has a disclosure policy.

2 Millionaire-Maker Technology Stocks to Consider in June was originally published by The Motley Fool