Artificial intelligence (AI) is a complex and fast-growing technology sector, with investors seeking the right exposure to AI in their portfolios. One thing is clear: advanced computer chips have de facto become the building blocks of AI. They are needed (in large quantities) to enable these powerful AI operations.

When it comes to picking AI stocks, there have been some clear winners, as well as some stocks that haven’t caught fire as you might expect. AI is still in the early stages of its story, which means there are still many uncertainties, but also plenty of opportunities to find stocks that will leverage the need for AI to outperform over time.

Here are three AI stocks that investors should consider buying and holding because of the strong AI tailwinds expected to benefit them.

1. Nvidia: This chip leader continues to defy expectations

AI chip powerhouse Nvidia (NASDAQ: NVDA) isn’t the most creative choice for this list, but the numbers matter most, and Nvidia has them in abundance. Nvidia’s advanced graphics processing units (GPUs) and AI-focused software stack have emerged as the go-to option for major tech companies investing billions of dollars in building data centers that can handle AI computing needs. Some analysts estimate that Nvidia has as much as 90% of the AI chip market.

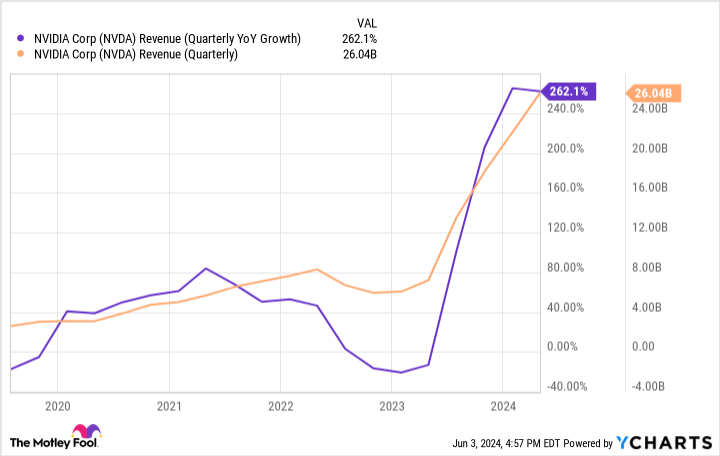

To underline this, let’s look at how Nivida’s revenue has grown over the past 18 months:

Nvidia’s $22.6 billion in data center revenue in the first quarter is almost as much as the company generated in total revenue for the entire fiscal year 2023 (ending January 29, 2023). That’s a huge increase in just 24 months. And the stock price has followed; The shares are up 585% in the past three years.

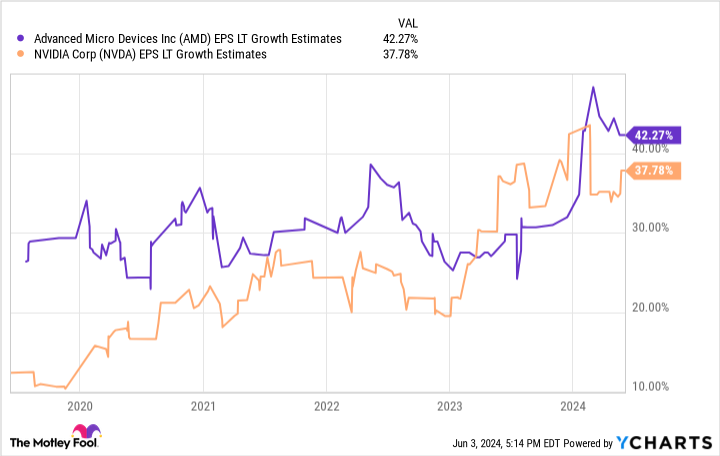

However, the show may not be over yet. CEO Jensen Huang said he believes AI will require another $2 trillion in data center spending, which could mean Nvidia can enjoy these tailwinds for years to come. The stock today trades at a price-to-earnings ratio of 42. That’s very attractive if Nvidia can meet analyst estimates, which call for annual earnings growth of 38% over the next three to five years.

2. AMD: Second place doesn’t seem that bad

Assuming AI becomes as big a problem as it seems, the biggest risk for a company like Nvidia is ceding market share of AI chips to competitors. Who is most likely to challenge Nvidia? Look no further than Advanced micro devices (NASDAQ: AMD)or AMD. It may not seem like a worthy opponent: The chip company made $2.3 billion in data center sales in the first quarter, a fraction of Nvidia’s. However, these numbers rose 80% year-over-year, which is showing signs of life, mainly due to demand for AMD’s MI300 accelerator chips, which compete with Nvidia.

AMD also has a footprint outside of data centers. Personal computers with AI, for example, could provide a significant growth opportunity. AMD’s Ryzen 8000 series processor chips fueled an 85% year-over-year increase in AMD’s first quarter in the client segment. The great thing about AMD is that it doesn’t have to knock Nvidia off the mountain to perform well for investors. The company could grow like wildfire thanks to AI. Analysts believe AMD’s revenues may grow 42% annually over the next three to five years exceed Nvidia’s net growth!

Meanwhile, AMD, with a market cap of $263 billion, is just a fraction of Nvidia’s size. The stock trades at a price-to-earnings ratio of 49, which is excellent value for AMD if it can meet analyst expectations.

You could argue that there are even more upsides if AMD can meaningfully challenge Nvidia’s AI chip dominance in the coming years. AMD may be in second place today, but if all goes well, it could be a top investment.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The two best artificial intelligence (AI) stocks to buy in 2024 originally published by The Motley Fool