Oil and gas prices are historically volatile, which makes investing in the sector difficult. However, global energy demand continues to rise, and years of underinvestment and other geopolitical factors could keep oil and gas prices high for years to come.

You can take a number of different approaches if you want to add energy exposure to your portfolio. Perhaps you want reliable income through consistently growing dividend payments. Or perhaps you want to capitalize on potential long-term increases in oil and gas prices. If so, here are two simple energy stocks to add to your portfolio today.

1. ExxonMobil

ExxonMobil (NYSE:XOM) is one of the largest oil and gas companies in the world. Its long track record of increasing dividend payouts makes it attractive to investors looking for a steady income.

As an integrated oil and gas company, ExxonMobil is active across the entire value chain of the oil and gas industry. This includes the exploration and extraction of oil and natural gas (upstream activities), transportation and storage (midstream), and refining and distribution of oil and gas (downstream activities); ExxonMobil does it all.

By spreading its activities across the value chain, ExxonMobil’s operations are more resilient to changing oil and gas prices. The upstream business benefits from higher oil and gas prices and can drive significant growth if prices rise.

For example, in 2022, as oil prices rose following Russia’s invasion of Ukraine, ExxonMobil’s upstream profits rose from $15.7 billion to $36.5 billion. However, these profits can be incredibly volatile. Last year, as prices stabilized, ExxonMobil’s upstream profits fell nearly 42% to $21.3 billion.

Here the midstream and downstream activities provide stability. Transporting and refining oil and gas can offset fluctuations in the price of oil and gas. This is because the refinery activities benefit from lower oil prices (due to lower input costs).

The oil market could remain “extremely tight” according to hedge fund Citadel (as reported by the Financial Times). That’s because the Organization of the Petroleum Exporting Countries (OPEC+), which has cut production to boost global oil output, has regained control of oil markets. The organization is cutting production by 5.86 million barrels per day, or 5.7% of global demand, and recently extended its production cuts well into 2025.

ExxonMobil has increased its dividend payout for 41 years in a row. The company used the increase from a few years ago to strengthen its balance sheet and increase capital returns for shareholders. With energy demand rising and oil prices potentially rising due to production cuts, ExxonMobil is a solid, stable energy company to invest in for the long term.

2. Western petroleum

Western petroleum (NYSE:OXY) is mainly active in the upstream, exploring and producing oil and gas, but also engages in midstream activities, which make up the rest of the business.

The company made a big splash in 2019 when it acquired Anadarko Petroleum in a deal worth $55 billion. With the help of Berkshire Hathaway, Occidental defeated Chevron to acquire the company and strengthen its position in the oil-rich Permian Basin. However, the timing turned out to be quite bad as shutdowns caused by the global pandemic caused oil and gas prices to collapse.

The company weathered the challenges and was able to strengthen its financial position following the increase in oil and gas prices. In 2022, it generated record net income of $12.5 billion and free cash flow of $13.6 billion. It used its windfall to pay down $10 billion in debt and redeem 15% of Berkshire’s preferred stock. Both moves reduced annual costs by $520 million.

Occidental’s operations are not as diverse as ExxonMobil’s. Because it relies on upstream activities, the company is more vulnerable to falling oil and gas prices. When oil prices stabilized last year, net income fell by almost 70% to $3.7 billion.

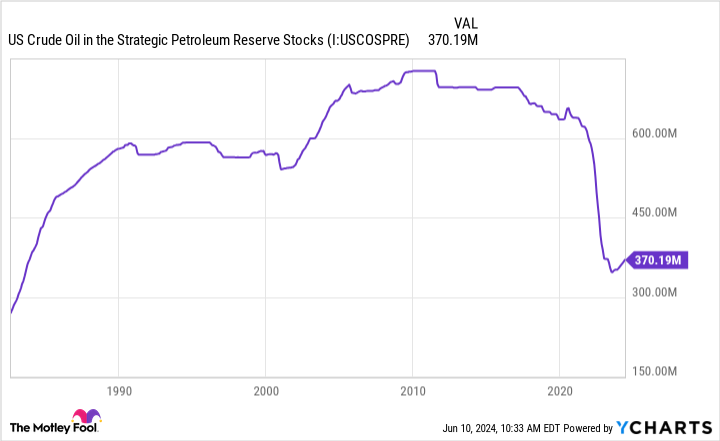

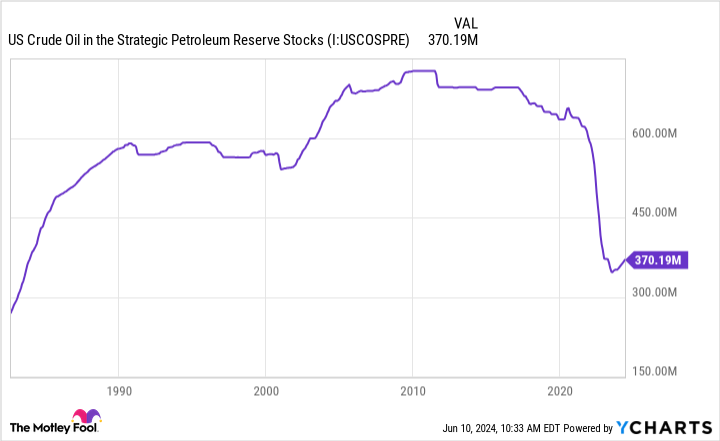

However, the above-mentioned production cuts by OPEC+, coupled with replenishing strategic reserves, could keep oil prices high. In an interview with CNBC, Occidental CEO Vicki Hollub noted that the world is not replacing crude oil reserves fast enough. Strikingly, the Strategic Petroleum Reserve (SPR), which is maintained by the US Department of Energy (DOE), has fallen to its lowest level in forty years. As the US replenishes its reserves, it could maintain a floor for oil prices.

On a longer time horizon, Occidental is investing heavily in direct air capture technology, which will allow it to capture carbon dioxide from the air to store underground or use to create clean transportation fuels.

This technology, known as carbon capture and sequestration (CCUS), could grow into a huge market as companies strive to reduce their carbon footprint. Hollub said CCUS could grow into a $3 trillion to $5 trillion global market.

Occidental relies heavily on upstream operations and high oil and gas prices to generate strong cash flows. However, if you’re bullish on oil prices and want to capitalize on the potentially colossal opportunity of CCUS as companies reduce their carbon footprints, Occidental is an excellent energy stock to invest in today.

Should You Invest $1,000 in ExxonMobil Now?

Consider the following before buying shares in ExxonMobil:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $740,886!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Courtney Carlsen has positions in ExxonMobil and Occidental Petroleum. The Motley Fool holds positions in and recommends Berkshire Hathaway. The Motley Fool recommends Occidental Petroleum. The Motley Fool has a disclosure policy.

2 No-Brainer Energy Stocks to Buy Now for Under $500 was originally published by The Motley Fool