Shares in Microsoft (NASDAQ: MSFT) are up 25% in the past year as investors have grown bullish on the company’s strong position in technology and growing artificial intelligence (AI) business. The growth surpassed Microsoft Apple as the most valuable company in the world, with a market capitalization of more than $3 trillion.

Home to Windows, Office, Xbox, Azure and LinkedIn, Microsoft has built a significant user base and has a powerful grip on technology. However, recent share growth has made it a somewhat expensive option compared to other stocks.

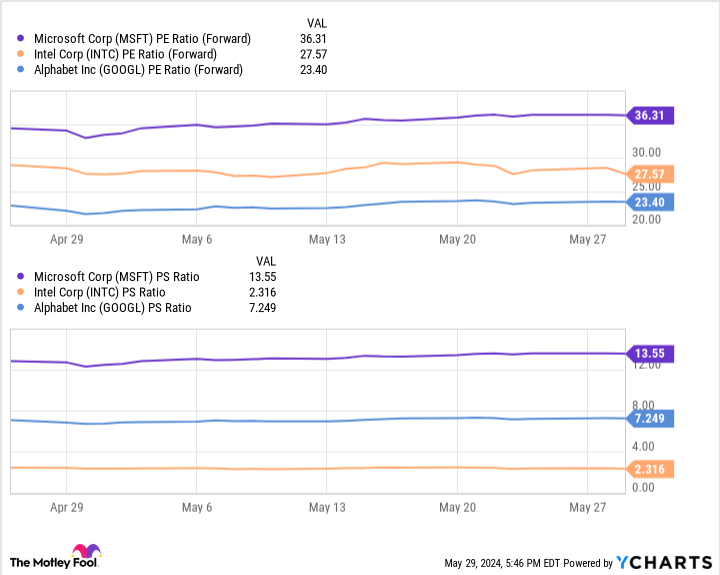

The charts above show that Microsoft has a higher price-to-earnings ratio (P/E) and price-to-sales ratio (P/S) than Intel (NASDAQ: INTC) And Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG), two technology companies with solid prospects. The figures show that Microsoft shares offer the least value of the three companies.

Meanwhile, recent developments indicate that Intel and Alphabet could have the same, if not more, growth potential than the Windows company in the coming years. So consider buying these two tech stocks instead.

1. Intel

Intel hasn’t inspired much investor confidence lately, as its shares are down 47% since 2021. The tech giant has faced multiple setbacks, including a global chip shortage, a market downturn that has slowed consumer spending, and increased competition that has threatened its market share. in central processing units (CPUs) and the end of a lucrative partnership with Apple.

However, recent developments indicate that Intel is starting to turn things around, and it could be worth investing in the company at the start of its restructuring.

In 2023, the chipmaker announced a complete overhaul of its business model, moving to a foundry-first company. This move will pit Intel against organizations such as Taiwanese semiconductor manufacturing and become one of the best chip manufacturers in the world. Intel has plans to build at least four chip factories in the US for now, with recent reports showing construction is on track for two sites that broke ground in 2022.

The focus on manufacturing strengthens Intel’s long-term prospects as increased interest in AI has led to skyrocketing demand for chips. While rivals like it Nvidia And Advanced micro devices specializing in chip design, Intel has the unique opportunity to capitalize on the AI boom by becoming the go-to manufacturer for AI companies.

It will take some time to complete construction of its facilities and recoup the hefty investment, but Intel could enjoy a significant boost in profits thanks to the shift to a foundry model.

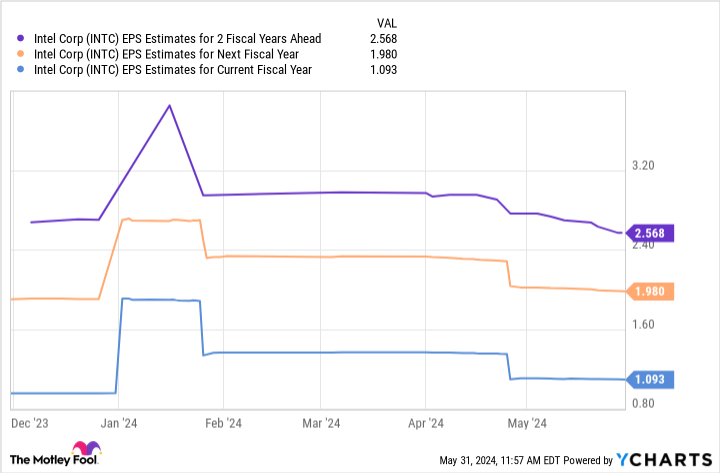

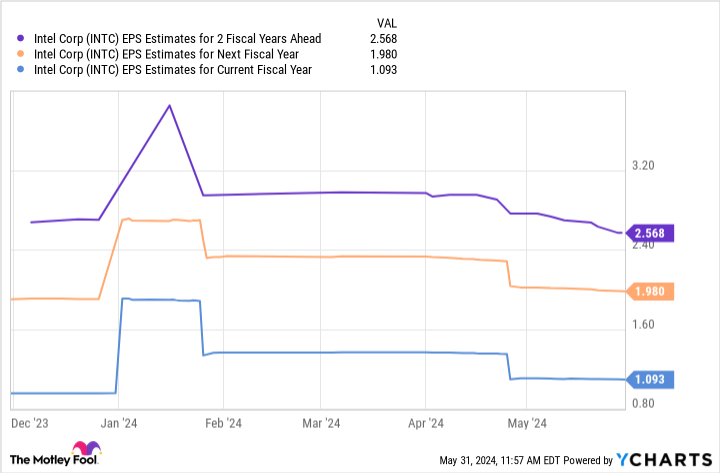

This chart shows that Intel’s earnings are expected to be close to $3 per share over the next two fiscal years. Multiplying that figure by the forward price-to-earnings ratio of 27 puts the stock price at just over $70, predicting stock growth of 133% in fiscal 2026.

Of course, it’s crucial to remember that these estimates are based entirely on analyst projections, which could turn out to be wrong. However, it would still be a worthwhile investment even if Intel achieved half that growth.

2. Alphabet

Alphabet shares are up 206% over the past five years, significantly outperforming Alphabet shares S&P500‘s increase of 87% over the same period. Powerful brands like Android, YouTube, Chrome and Google have seen the company flourish in the technology space, building a loyal user base and a lucrative digital advertising business.

Alphabet’s various products attract billions of users and offer virtually endless advertising opportunities. In the first quarter of 2024, ad sales continued to be the gift that kept on giving, with Google Services revenue up 14% year over year and operating income up 28%.

While ads are currently Alphabet’s bread and butter, its future seems to be AI and its platform, Google Cloud. The cloud service posted 28% year-on-year revenue growth in the first quarter of 2024, while operating income rose 371%. Despite having a smaller cloud market share than Microsoft’s Azure, Google Cloud outperformed its rival in revenue growth by about 7% during the quarter.

Additionally, Alphabet is gradually expanding Google Cloud’s AI capabilities in an effort to keep pace with its competitors. Earlier this year, the company unveiled its most advanced AI model yet, called Gemini. Meanwhile, news broke on May 30 that the tech giant plans to invest $2 billion in Malaysia, developing a new data center and a Google Cloud hub.

Alphabet is on a promising growth trajectory as it continues to expand its digital advertising business and AI capabilities. Its better valued shares make it a no-brainer compared to Microsoft and a screaming buy for anyone looking to invest in technology.

Should You Invest $1,000 in Intel Right Now?

Before you buy shares in Intel, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $704,612!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Alphabet, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls to Intel, long January 2026 $395 calls to Microsoft, short January 2026 $405 calls to Microsoft, and short May 2024 $47 calls to Intel. The Motley Fool has a disclosure policy.

Forget Microsoft: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool