Intel (NASDAQ: INTC) has become a stock to watch in recent months. The company’s hyper-focus on artificial intelligence (AI) and chip manufacturing may have portended a bright future for the company.

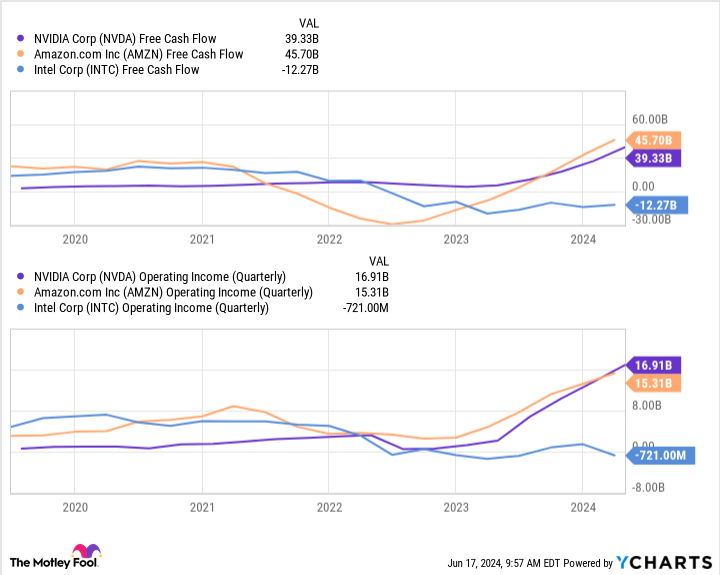

However, with negative free cash flow of $12 billion – along with quarterly revenue and operating income down 35% and 112% respectively since 2021 – it may take many years for Intel to regain a leading position in the technology sector.

While Intel remains an excellent buy for those with time, investors with fewer years until retirement can consider alternative companies with more money in the bank to invest in their future.

The diagram above shows it Nvidia (NASDAQ: NVDA) And Amazon (NASDAQ: AMZN) potentially swimming in money compared to Intel. Both companies have experienced strong financial growth over the past five years, indicating they could be better equipped to expand their reach in technology faster than Intel. As a result, Nvidia and Amazon are potentially more reliable investments in the short term.

So forget about Intel for now and consider buying these two tech stocks instead.

1. Nvidia

Nvidia’s business has exploded over the past decade, with its stock growing 27,000%. The company has benefited from rising demand for graphics processing units (GPUs), the chips needed for intensive computing tasks such as training AI models, running video games, video editing, cryptocurrency mining and more.

Nvidia’s success has made it one of the most valuable companies in the world and the first chipmaker to achieve a market capitalization of more than $3 trillion. The company’s chips have helped it secure lucrative positions in multiple technology sectors. It has become best known for its dominant role in AI, beating rivals such as Intel and Intel Advanced micro devices in terms of market share.

But the company has also been supplying its chips to cloud platforms, video game consoles such as the Nintendo Switch, self-driving cars, and custom computers that many consumers use to run powerful gaming PCs.

As a result, Nvidia has technology growth catalysts that will likely grow its business for years to come. According to Grand View Research, the AI market reached $196 billion last year and is expanding at a pace that would see this figure reach nearly $2 trillion by the end of the decade. And that’s just one growth opportunity.

Nvidia also has an automotive segment, which includes revenue from selling its chips to the self-driving car market. This sector is forecast to have a compound annual growth rate of 13% through 2030, which would triple its value from the 2021 figure.

The shares are up 206% in the last twelve months, but still appear nowhere near their ceiling thanks to significant potential in technology. A 10-for-1 stock split earlier this month has made the shares more accessible. Meanwhile, its price-to-earnings-growth ratio is less than one, suggesting that Nvidia stock could be trading at a bargain and is worth considering over Intel at the moment.

2. Amazon

Like Nvidia, Amazon has expanded into multiple areas of tech and seemingly can do no wrong. The company is the biggest name in e-commerce with its online shopping site. Recent quarterly earnings show that Amazon also has a burgeoning digital advertising business through its Prime Video streaming service and is home to a highly profitable cloud platform, Amazon Web Services (AWS).

The company is on a growth trajectory that is too good to pass up. In the first quarter of 2024, the company proved that its retail business (which represents 80% of sales) continues to perform strongly, with sales between the North American and International segments increasing 12% year over year.

The brightest point of the quarter, however, was AWS, which posted year-over-year revenue growth of 17% while operating income nearly doubled to over $9 billion (outperforming the entire retail business). The cloud platform has quickly become the most profitable part of the business and is not ready yet as it invests heavily in an AI expansion.

Amazon’s stock has exploded over the past year, but likely has a lot more to offer investors as the company continues to develop and tap into its massive cash reserves. The stock’s price-to-sales ratio currently hovers around 3, making it a better value than many of its rivals and potentially worth buying over Intel.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $801,365!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dani Cook has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Advanced Micro Devices, Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends Intel and Nintendo and recommends the following options: long January 2025 $45 calls to Intel, long January 2026 $395 calls to Microsoft, short August 2024 $35 calls to Intel, and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

Forget Intel: 2 Tech Stocks to Buy Instead was originally published by The Motley Fool