The Nasdaq Composite (NASDAQINDEX: ^IXIC) In December 2022, about seventeen months ago, the market entered a new bull market and has since risen 68%. But history says more gains are in store for the tech-heavy index. The Nasdaq has returned an average of 215% during bull markets since 1990, achieving these gains over an average period of 40 months.

In other words, if the current bull market aligns exactly with the historical average, the index will rise another 147% over the next two years. Frankly, that implies a somewhat unrealistic annualized return of 57%. But patient investors still have reason to believe the Nasdaq will head higher.

The index has risen 16.1% per year over the past decade, crushing the index S&P500‘s annual return of 12.9%, and similar results are possible in the coming years. To benefit from that upward momentum, investors should consider buying small positions Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) And CrowdStrike (NASDAQ: CRWD). This is why.

1. Alphabet

Alphabet has two main growth engines: digital advertising and cloud computing. Google’s subsidiary is the largest ad tech company in the world due to its ability to engage consumers and collect data. With six products reaching two billion users every month (think Google Search, Chrome and YouTube), the company can efficiently capture data that helps advertisers build more successful campaigns.

Similarly, Google Cloud Platform (GCP) is the third largest provider of cloud infrastructure and platform services. While the company is lagging behind Amazon Web services and Microsoft Azure has gained more than a percentage point of market share over the past year, and that trend could continue as companies invest in artificial intelligence (AI). Granted, Microsoft has so far outsmarted its competitors when it comes to generative AI, but Google has long been a leader in AI research and its technological prowess should not be underestimated.

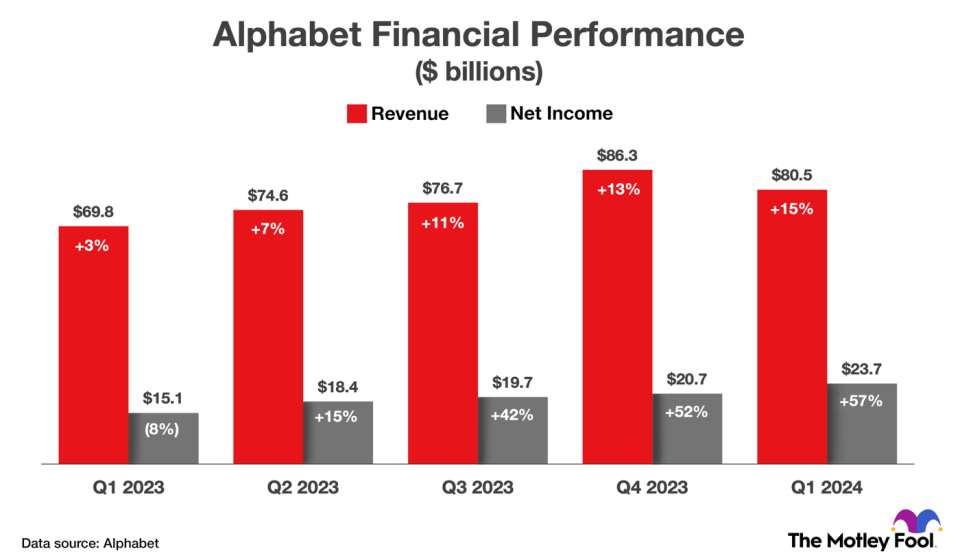

In the first quarter, Alphabet reported its fourth consecutive acceleration in sales and revenue growth, as shown in the chart below. Revenue rose 15% to $80.5 billion thanks to particularly strong growth in Google Cloud, the segment that includes cloud computing services and office productivity software. Meanwhile, GAAP net income rose 57% to $23.7 billion, helped by a continued focus on cost control.

Wall Street analysts estimate that Alphabet will grow earnings per share 17% annually over the next three to five years. That forecast makes the current valuation of 26.8 times earnings seem reasonable, despite being a premium to the three-year average of 24.6 times earnings. Based on that valuation, I think Alphabet can outperform the Nasdaq Composite over the next five years, as it has over the past five years.

2. CrowdStrike

CrowdStrike offers more than twenty cybersecurity products through a single platform. The company is a leader in endpoint security software and managed detection and response (MDR) services, but the platform targets multiple end markets and CrowdStrike is gaining market share in several of them, including cloud security, identity protection and security information, and event management. (SIEM).

CEO George Kurtz attributes that success to superior artificial intelligence capabilities and unique engineering that makes his platform the “easiest and fastest cybersecurity technology to deploy.” Additionally, companies are increasingly interested in reducing costs by consolidating on a single platform, especially one with a reputation for industry-leading threat detection, such as CrowdStrike’s Falcon platform.

CrowdStrike reported strong financial results in the fourth quarter. Revenue rose 33% to $845 million and non-GAAP net income rose 102% to $0.95 per diluted share. In the press release, Kurtz said, “Customers are supportive of our single-platform approach.” He also noted that companies are standardizing on Falcon for its cloud security, identity protection and LogScale next-gen SIEM solutions.

Management also noted strong momentum with new products, including IT automation software (Falcon for IT) and generative AI assistant (Charlotte AI). Falcon for IT is important because it expands CrowdStrike’s addressable market into the security-adjacent realm of observability by addressing use cases such as compliance and performance monitoring. Similarly, Charlotte AI allows the company to respond to the demand for automation.

Going forward, CrowdStrike has several tailwinds. First, cyber attacks are becoming increasingly sophisticated. Second, many companies still buy 60+ point products, and half are still using older antivirus software, which fails to detect 39% of malicious software. As a result, deploying effective cybersecurity solutions (especially platforms that consolidate products) has become an IT budget priority.

With that in mind, Wall Street expects CrowdStrike to grow revenue 29% annually over the next five years. That consensus estimate makes the current valuation of 28 times sales seem reasonable. CrowdStrike has more than doubled the return of the Nasdaq Composite over the past three years, and I believe it can outperform its current valuation over the next five years.

Should you invest €1,000 in Alphabet now?

Before you buy shares in Alphabet, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Alphabet wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennevine has positions in Amazon and CrowdStrike. The Motley Fool holds positions in and recommends Alphabet, Amazon, CrowdStrike and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

History Says the Nasdaq Might Rise: Two Top Growth Stocks to Buy Now for the Bull Market was originally published by The Motley Fool