It’s not easy to find quality stocks trading under $20 per share. While share price isn’t the only indicator of a stock’s value, large companies tend to trade higher over time, so they typically don’t stay as cheap for very long.

However, there are exceptions.

Believe it or not, some potentially big tech companies are trading at attractive prices that can look like bargains in retrospect. SentinelOne (NYSE:S) And Lemonade (NYSE:LMND) stand out as speculative stocks with enough promise to make long-term buyers look like geniuses.

Here’s the pitch for each stock today.

1. SentinelOne: A rising star in AI and cybersecurity

SentinelOne shares continue to fall in price despite continued evidence that the company is going from strength to strength. Cybersecurity is a competitive field, but SentinelOne stands out with its artificial intelligence (AI)-based Singularity platform, which proactively identifies and addresses potential threats. Shares are trading as much as 77% lower from their peak, but this isn’t a dead company. In fact, it’s more the opposite.

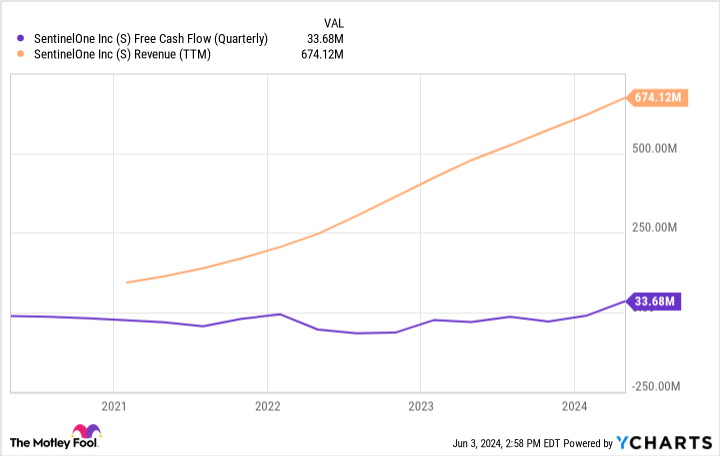

The company recently reported first-quarter results for fiscal 2025 and posted 40% year-over-year revenue growth. Moreover, the company is making huge strides to become a profitable company. SentinelOne achieved significant free cash flow in the first quarter, converting 18% of revenue. Last year? The free cash flow margin was 24% negative in the first quarter. That’s one 42–percentage point jumped in 12 months. Turning cash flow positive will add money to the $1.1 billion pile on the balance sheet and put GAAP earnings next on the agenda.

SentinelOne’s enterprise value at this low share price is just $4.5 billion, with an enterprise value-to-sales ratio of just 5.5. For context: archrival CrowdStrike trades at a much hotter 18 times sales. You could argue that CrowdStrike’s larger size, comparable growth, and better financials come at a premium, but should the gap be that wide? Those who buy SentinelOne can expect good investment returns from it in the long term if it continues to deliver on its potential.

2. Lemonade: the company that reinvents insurance

Lemonade is the new kid on the block in the insurance industry. The company has gotten its foot in the door in a challenging market by doing things differently. Instead of a network of agents for customers to call, Lemonade uses AI-powered chatbots to communicate with customers. You can buy a policy or file a claim with Lemonade in 90 seconds. In addition, Lemonade limits the premiums it earns and donates excess profits to charities. These differences have created a company that users want to do business with.

The company’s customer base is growing rapidly; nearly 2.1 million people are using Lemonade, up 13% year over year in the first quarter. Lemonade is slowly expanding its product offerings, including renters, homeowners, auto, pet and life insurance. Combining customer growth and cross-selling opportunities could drive solid revenue growth for years to come.

In the meantime, Lemonade is also doing better financially. Losses are decreasing as the business grows, and management now expects cash flow to break even by the middle of this year. Meanwhile, Lemonade remains flush with cash; there is still $927 million in cash and investments.

This important milestone is approaching as the stock trades more than 90% below its all-time high. From the chart above, it is clear that Lemonade entered a valuation bubble in 2021. An insurance company should never trade near 15 times book value. Nowadays it is also clear that foam has largely left the stock. Investors have a real opportunity to earn significant investment returns over time as Lemonade grows.

Should you invest $1,000 in SentinelOne now?

Before you buy shares in SentinelOne, consider the following:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and SentinelOne wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $713,416!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 3, 2024

Justin Pope has positions in SentinelOne. The Motley Fool holds and recommends positions in CrowdStrike and Lemonade. The Motley Fool has a disclosure policy.

2 Top Tech Stocks Trading Under $20 a Share was originally published by The Motley Fool