For the past century, Wall Street has been a virtually unstoppable wealth creator for patient investors. While other asset classes have helped build nominal wealth, such as oil, gold, bonds and housing, none come close to the average annualized returns over the past hundred years that stocks have brought to the table.

With thousands of publicly traded companies and exchange-traded funds to choose from, there is an investment strategy to fit the goals and risk tolerance of virtually any investor. But of these myriad strategies, few can match the juicy returns that come from buying and holding high-quality dividend stocks for an extended period of time.

Last year, Hartford Funds investment researchers released a detailed report (“The Power of Dividends: Past, Present, and Future”) that examined the many ways in which dividend-paying companies have outperformed non-paying companies over the long term.

In collaboration with Ned Davis Research, recently updated data from this report shows that dividend-paying companies have more than doubled the annual average return of publicly traded companies that do not pay dividends over the past 50 years (1973-2023): 9.17% versus 4. 27%. Moreover, dividend payers were on average 6% less volatile than the S&P500while non-payers were 18% more volatile.

Perhaps the best thing about investing in dividend stocks is that there’s always value to be found, even as Wall Street’s major stock indexes reach new all-time highs. The real challenge is deciding which dividend stocks to invest in, because not all dividend payers are created equal.

Companies with the ability to increase their dividend payments year on year are typically proven, consistently profitable and able to provide transparent long-term growth prospects. In other words, these are exactly the kinds of companies that we expect to increase in value over the long term.

Right now, there are two great ultra-high-yield dividend stocks — “ultra-high-yield” stocks have yields four or more times those of the S&P 500s — that are working on an annual base payout increase of at least 25 years are ripe for the picking of opportunistic income seekers.

Real estate income: return of 6.04%

The first high-octane dividend stock with an extensive range of rising annual base payouts that is now begging to be bought, it is the leading company among retail real estate investment trusts (REITs), Real estate income (NYSE:O).

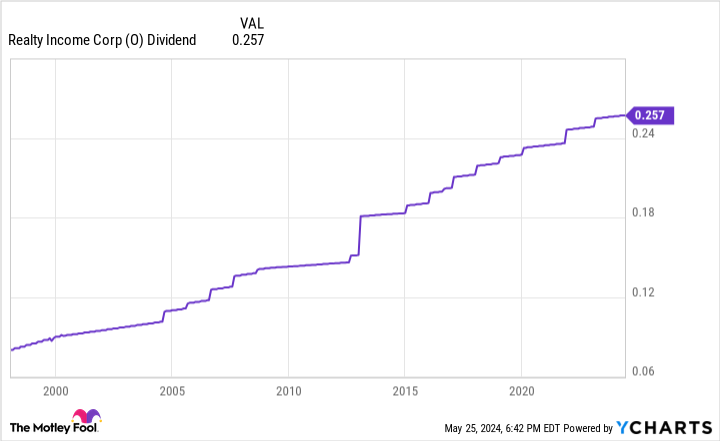

Less than two weeks ago, Realty Income declared its 647th consecutive loss monthly dividend and has increased its payout in each of the past 107 quarters (that’s almost 27 years). Based on the newly announced monthly distribution of $0.2625 per share, Realty Income’s dividend yield has once again crossed the 6% mark.

The main reason the last two years have been challenging for Realty Income stock is the Federal Reserve’s aggressive monetary policy. The steepest rate hike cycle in four decades pushed short-term government bond yields to around 5%. Treasury bills essentially offer no risk to investors, so they have been more attractive than higher-yielding REITs in recent quarters.

But at some point, the value proposition of REITs begins to exceed this risk/reward scenario – and I’m confident we’ve reached that point with this leading retail REIT.

Following the completion of the acquisition of Spirit Realty Capital in January, Realty Income closed the first quarter with 15,485 commercial properties (CRE) in its portfolio. It estimates that about 90% of the total rent it receives from these CRE properties can withstand an economic downturn and the pressures of e-commerce.

The secret? Realty Income rents prominently to independent retailers that sell basic needs goods or provide basic needs services. Supermarkets, convenience stores, dollar stores, hardware stores, drug stores and auto service locations represent nearly 42% of annualized contractual rent. These are companies that will generate predictable cash flow in almost any economic climate.

The real benefit of renting to high-quality, independent businesses in the basic needs sector is that you don’t have to worry about finding new tenants or getting paid. Since the turn of this century, the average S&P 500 REIT has had a respectable occupancy rate of 94.2%. Realty Income’s average occupancy rate is 98.2% over the past 23 years and changing. It’s easy to increase the company’s dividend for 107 consecutive quarters if tenants generate predictable cash flow and pay their bills.

In addition to its high-quality CRE retail portfolio, Realty Income has expanded into new vertical markets. It has made two deals in the gaming industry in the past two years, purchasing Spirit Realty Capital to diversify its revenue stream and forming a joint venture with Digital real estate trust to develop build-to-suit data centers for lease. Yesthis means that Realty Income can benefit from the artificial intelligence (AI) revolution in the long term.

Best of all, Realty Income stock is cheaper than it has been in more than a decade. Realty Income’s 11.6 multiple to forward-year cash flow as of May 24 represents a 33% discount to the average multiple to cash flow of the past five years.

Enterprise Products Partners: 7.3% return

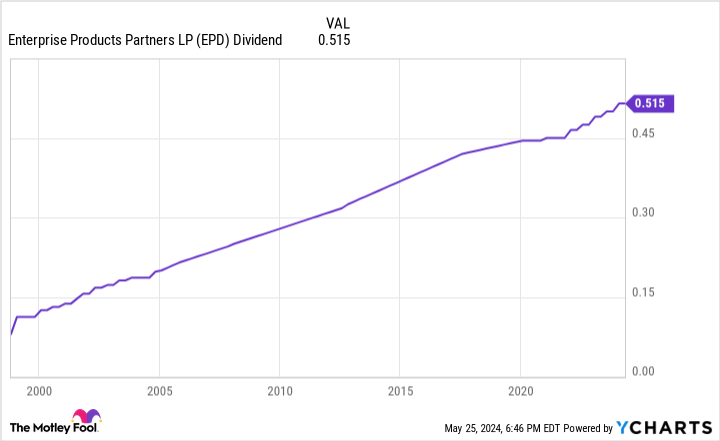

The second ultra-high yield dividend stock to see 25 years of payout growth is energy giant Partners for business products (NYSE:EPD). Enterprise pays its dividend quarterly and has increased its annual base distribution since becoming a publicly traded company in July 1998. The forward yield, based on the current payout, is an S&P 500-smashing 7.3%, and has returned a total of $53.2 billion. to its investors, including buybacks, since the IPO.

To be fair, oil and gas stocks won’t be for everyone. The fossil fuel industry is seen by some investors as a “sin” industry.

Moreover, the historic decline in demand for crude oil and natural gas four years ago, during the early stages of the COVID-19 pandemic, is still fresh in the minds of many investors. Drilling companies were definitely in trouble when crude oil futures briefly collapsed negative $40 a barrel.

But if you can overcome this recency bias and have no qualms about investing in the U.S. fossil fuel industry, Enterprise Products Partners has the necessary tools to make patient income seekers significantly richer.

The reason Enterprise has been such a phenomenal investment for so long is because it’s not a drill. It is a crucial energy intermediary for the US fossil fuel industry. It operates more than 50,000 miles of transmission pipelines, 26 fractionation facilities, and can store 14 billion cubic feet of natural gas and more than 300 million barrels of petroleum/refined liquids.

The great thing about being one of North America’s largest midstream operators is that we can enter into long-term, fixed-fee contracts with drillers. Most of the company’s contracts have a fixed fee, eliminating spot price volatility. The ability to transparently and accurately forecast cash flow a year or more in advance gives Enterprise Products Partners’ management team the confidence to increase distribution, undertake new projects and make profit-enhancing acquisitions.

As for major projects, the company has greenlit nearly $7 billion in spending. Most of these projects, which aim to expand the company’s natural gas liquids (NGLs) segment, are expected to be operational before the end of 2025. Capital expenditures should fall by $1 billion (or more) by 2026, likely leading to even faster projects. profit growth.

Meanwhile, a steady diet of add-on acquisitions has expanded the reach of Enterprise’s pipelines and fattened its cash flow. Three months ago, Enterprise Products Partners agreed to pay $375 million to Western Midstream Partners for the remaining 20% interest in the 620,000 barrel per day Whitethorn pipeline that it did not already own, as well as the remaining 25 equity interest % in two NGL fractionators that it did not own. There are plenty of incentives for Enterprise to add pipeline and NGL interests in the future.

Enterprise Products Partners should also clearly benefit from reduced capital expenditures by major energy companies following the worst of the COVID-19 pandemic. Years of reduced spending have limited the global supply of oil and helped its spot price rise. A higher sustained crude oil price will likely encourage more domestic drilling and help Enterprise win more lucrative contracts.

Enterprise Products Partners looks like a bargain at about seven times full-year cash flow and just under 10 times full-year earnings.

Should you invest €1,000 in real estate income now?

Consider the following before purchasing shares in Realty Income:

The Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

Sean Williams has no position in any of the stocks mentioned. The Motley Fool holds and recommends Digital Realty Trust and Realty Income. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has a disclosure policy.

Time to Strike: 2 Ultra-High Yield Dividend Stocks with 25-Year Payout Boost That Are Screaming Buys Right Now Originally published by The Motley Fool