Stocks have been a wealth-creating machine for investors over the long term. While other asset classes have delivered positive nominal returns for patient investors, including gold, oil, housing and government bonds, none have come close to the total annualized returns that stocks have generated over the past century.

While innovation is a key growth driver on Wall Street, dividend investing has fueled this long-term outperformance.

Last year, investment advisory firm Hartford Funds released a report examining the ins and outs of how superior dividend stocks have been over long periods of time, compared to publicly traded companies that offer no payout. In collaboration with Ned Davis Research, the Hartford Funds report (“The Power of Dividends: Past, Present, and Future”) found that dividend-paying stocks more than doubled the annualized return of non-paying stocks – 9.17% versus 4 .27% – over the past 50 years (1973-2023).

The great thing about dividend investing is that there are always great deals to be found. One of the best places to find obvious income bargains hidden in plain sight is within the benchmark S&P500 (SNPINDEX: ^GSPC).

The S&P 500 consists of 500 of the largest, proven multinational companies traded on U.S. exchanges. About 80% of these 500 companies pay regular dividends to their shareholders. Companies that pay a consistent dividend tend to be profitable on a recurring basis and can offer transparent long-term growth prospects.

But no two dividend stocks are created the same. The S&P 500 is made up of just over a dozen ultra-high yield dividend stocks, that is, companies with yields at least four times higher than the S&P 500’s 1.335% yield. Two of these ultra-high yield S&P 500 Dividend Stocks are nothing right now less than screaming purchases.

Time to strike: Pfizer (5.87% return)

The first high-octane S&P 500 dividend stock begging to be bought by opportunistic income seekers is none other than a pharmaceutical giant Pfizer (NYSE:PFE).

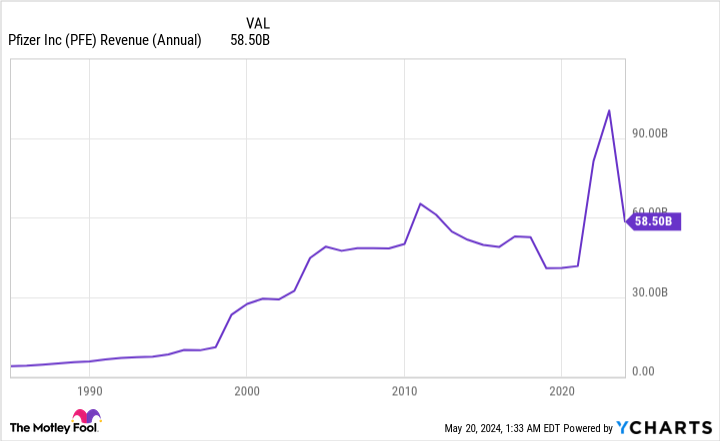

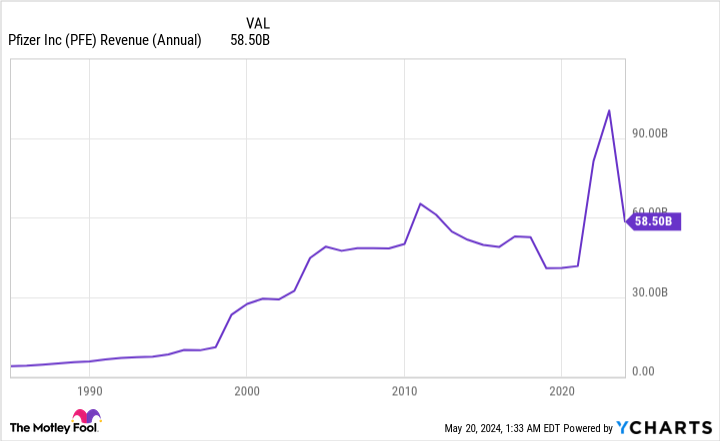

In late April, Pfizer shares hit a ten-year low of around $25 per share, marking a 59% decline from the all-time high reached during the COVID-19 pandemic in December 2021. This steep decline came after a period of tremendous operational success for the company.

During the pandemic, Pfizer was one of a very small number of drug developers to successfully develop a COVID-19 vaccine (known as Comirnaty) as well as an oral therapy (known as Paxlovid) to reduce the severity of COVID-19 symptoms . . The combined revenue of Comirnaty and Paxlovid has fallen from a peak of more than $56 billion in 2022 to an estimated $8 billion this year. Having to absorb a retracement of $48 billion in COVID-19 sales did not sit well with Wall Street and investors.

But if income seekers dig beneath the surface and look at Pfizer’s entire portfolio and pipeline of new drugs, they’ll find a company that has strengthened itself significantly since the start of the decade.

For example, Pfizer’s extensive drug portfolio, with the exception of its duo of COVID-19 therapies, has continued to grow. After delivering 7% operating revenue growth (excl. COVID therapies) in 2023, the company’s COVID excluded therapies grew 11% at constant exchange rates during the quarter ended March.

To add to the above, many of Pfizer’s key therapies are breaking new ceilings. Sales of the blood-thinning drug Eliquis surpassed $2 billion in the March quarter, while the Vyndaqel product family saw operating sales growth of 66% to $1.14 billion at the start of the year.

Another thing investors should keep in mind is that Pfizer completed a $43 billion acquisition of cancer drug developer Seagen in December. While this acquisition is expected to have a negative impact on current year earnings per share (EPS), cost synergies, coupled with a vastly expanded oncology pipeline, should be meaningfully accretive to the company’s earnings per share (EPS) in the coming years Pfizer. The short-sightedness of select investors gives patient income seekers an incredible opportunity to grab Pfizer stock cheaply.

Speaking of “cheap,” Pfizer’s stock trades at about 10 times full-year earnings. This represents a 19% discount on average profits over the past five years.

The icing on the cake is that Pfizer has confirmed that its dividend, which is approaching a yield of almost 6%, is completely safe. According to Chief Financial Officer David Denton, “Our No. 1 priority from a capital allocation perspective is supporting and growing our dividend over time – and that is not at risk.”

Time to Strike: Walgreens Boots Alliance (5.5% Yield)

The second ultra-high-yield S&P 500 dividend stock that income seekers can now confidently jump into is the defeated pharmacy chain Walgreens Boots Alliance (NASDAQ: WBA).

While Pfizer has been a victim of its own success, Walgreens stock is absolutely reeling from its own failures. While not a comprehensive list, Walgreens is struggling with:

-

Increasing competition in the field of online pharmacies from, among others Amazon.

-

A challenging retail environment not helped by increased shrinkage (i.e. theft) in some of its stores.

-

The costly launch and expansion of the healthcare business, which resulted in a $5.8 billion write-down in the second fiscal quarter (ended February 29, 2024).

-

Ongoing legal challenges, including its role in the opioid crisis.

-

A near halving of the dividend from $0.48/quarter to $0.25/quarter to start the current calendar year.

In other words, there are tangible reasons why Walgreens Boots Alliance is down 81% since the stock hit an all-time high in 2015. The good news is that there appears to be light at the end of the tunnel for patient investors.

The biggest and most needed change for Walgreens is that it appointed Tim Wentworth as its new CEO in October. Wentworth has decades of healthcare experience and previously served as CEO of Express Scripts, the largest pharmacy benefits manager in the US. Previous CEO Rosalind Brewer had no background in healthcare, which ultimately proved to be a disadvantage for the company. While Wentworth’s approach may cause temporary growing pains, he understands how to right the ship in the long run.

Another exciting change for Walgreens is the aforementioned shift into healthcare services. While it’s a bit late in building out its healthcare business, the investment in and partnership with VillageMD should prove profitable in the coming years.

The distinguishing feature here is that Walgreens operates full-service health clinics. While most pharmacy chains can’t do more than administer a vaccine or treat a sniffle, VillageMD’s clinics located in Walgreens stores have doctors on site. Building a base of loyal patients should steadily expand this new revenue stream for Walgreens.

Walgreens Boots Alliance also hasn’t been shy about spending money on various digital growth initiatives. It is leaning on digitalization to improve the efficiency of its supply chain and strengthen its direct-to-consumer segment. While Walgreens will continue to generate most of its revenue from its brick-and-mortar locations, increasing its online sales and making things more convenient for consumers is an easy way to increase its organic growth.

Cost savings also play a role. After achieving a cumulative reduction in annual operating costs of $2 billion by the end of fiscal 2021, the company is now targeting $4.1 billion in total annual cost savings by the end of the current fiscal year. This should boost the company’s margins, as well as earnings per share.

The final piece of the puzzle is that Walgreens Boots Alliance is dirt cheap. Shares can be added by opportunistic investors for less than six times next year’s earnings. This is a 28% discount to the average annual multiple over the past five years, and a great deal with a 5.5% dividend yield in tow.

Should you invest €1,000 in Pfizer now?

Consider the following before buying shares in Pfizer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Pfizer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $566,624!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns May 13, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Amazon and Walgreens Boots Alliance. The Motley Fool has and recommends positions in Amazon and Pfizer. The Motley Fool has a disclosure policy.

Time to Pounce: 2 Ultra-High Yield S&P 500 Dividend Stocks to Buy Screaming Now was originally published by The Motley Fool