Vanguard is one of the largest investment advisors and asset managers in the world. Due to its size, the company can charge very low costs for financial products. The Vanguard Growth ETF (NYSEMKT: VUG) has $235 billion in net assets and charges an annual expense ratio of 0.04% – which equates to $94 million in fees paid to Vanguard. But for an individual investing $20,000 in the exchange-traded fund (ETF), that’s only $8 in annual fees. It’s a win-win for Vanguard and investors.

The ETF has gained more than 20% so far this year and a mind-numbing 135% over the past five years, and continues to beat the competition. S&P500 And Nasdaq Composite. Here’s why it’s worth buying now.

Simple yet effective

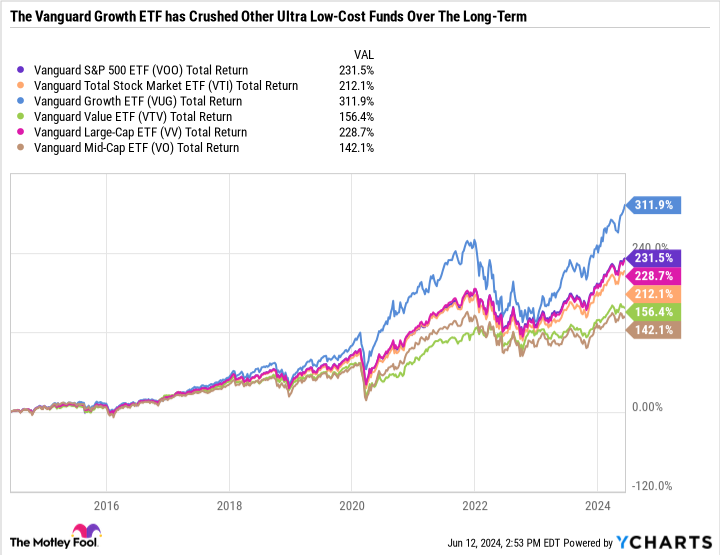

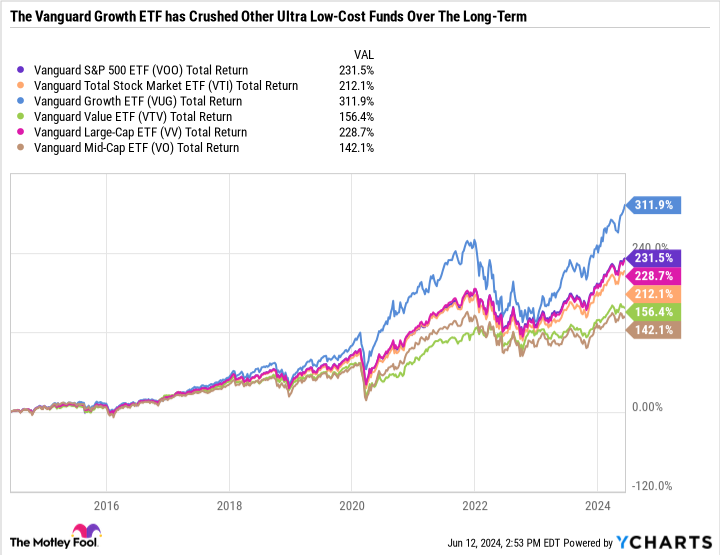

Vanguard offers 86 ETFs. Some focus on stocks, while others focus on bonds, government bonds and a variety of other products. But only two equity funds have an expense ratio of 0.03% Vanguard S&P 500 ETF (NYSEMKT:VOO) and the Vanguard Total Stock Market Fund (NYSEMKT: VTI). Only four equity funds have an expense ratio of 0.04%. The Vanguard Growth ETF is one of them, and the others are the Vanguard Value ETF (NYSEMKT: VTV), Vanguard Large Cap ETF (NYSEMKT: VV)and the Vanguard Mid-Cap ETF.

The biggest advantage of these ultra-cheap funds is their simplicity. Of these six funds, the Vanguard Growth ETF has performed the best (by far) this year, over the past three years, five years and ten years. It has been one of the easiest, hands-off ways to beat the market. And there is reason to believe this trend could continue.

Betting on the best ideas

Growth companies tend to be more volatile than value- and income-oriented companies because their valuations are based on earnings could be produce in the future instead of what they make now. Investors are often willing to pay for a promising company. But if things don’t work out and there’s no solid foundation, the hot air evaporates and could lead to a steep sell-off.

Companies with high-quality earnings growth and a premium valuation can generate outsized profits in the stock market.

Apple, Microsoft, Nvidia, Amazon, AlphabetAnd Metaplatforms they all have excellent balance sheets and highly efficient business models. But they also have plenty of opportunities to deploy capital for innovative ideas. In other words, they have the proven qualities that investors look for in a blue chip company and the upside potential that a premium valuation can demand.

By comparison, there are only so many products a consumer goods company likes Procter & Gamble can develop or acquire before it becomes careless. And there’s only so much innovation in new detergent or toothpaste formulas before that expenditure could be better used elsewhere. That’s why so many established companies pay dividends.

As you peruse the list of S&P 500 companies, you’ll find plenty of stodgy, low-growth companies with cheap valuations because they’re losing out to the competition, poorly managed, or simply don’t have the opportunities needed for market-beating earnings growth. . The largest growth companies combine size with opportunity. This is why many top growth companies either don’t pay dividends or prefer to buy back shares.

Capital reinvested directly in the business or indirectly through buybacks creates a snowball effect, with earnings per share increasing due to higher net income and a lower number of shares. If a company continues to allocate capital well and manage operations efficiently, it will become virtually unstoppable in the long run.

Taking the good and the bad

There are plenty of underperforming growth stocks in the Vanguard Growth ETF. Some are in an innovation surplus, while others are losing their competitive advantage. Some growth stocks are popular and expensive; others are cheap and out of favor. The advantage of a product like the Vanguard Growth ETF is diversification into different market sectors.

The profits of new, innovative companies can make up for the underperformance or losses of incumbents who lose their place. In other words: the Vanguard Growth ETF has many losers, but also many winners. And since no one knows which growth companies will outperform the market and which will underperform, casting a wide net can be a winning strategy.

At its simplest, the Vanguard Growth ETF is a bet on the continued growth of the US economy, rather than a bet on a select few companies that are doing very well.

The most effective approach might be to combine a passive strategy like a Vanguard ETF with individual stock positions. This way you can draw extra attention to your ideas with the utmost conviction without completely missing the boat on certain themes. If you weren’t paying attention to the growth of megacaps or artificial intelligence themes, it would have been very difficult to beat the market over the past year and a half.

Automation of your investment strategy

Building wealth over time is as much about developing savings habits as it is about making wise investments. It can be helpful to have some evergreen individual companies or ETFs that you can plug new savings into if you don’t have a high-conviction idea.

It’s especially difficult to deploy new capital when stock prices are falling all around you. During those periods, the Vanguard Growth ETF can be particularly effective because it is diversified and not vulnerable to the same company-specific risks that can be amplified during a full-blown recession. For example, growth stocks were hit hard in 2022. But if you bought the Vanguard Growth ETF at the end of that year, you would be up 74% since then.

This is another example of why investing and holding stocks during periods of long-term volatility prevails.

Should You Invest $1,000 in Vanguard Index Funds – Vanguard Growth ETF Now?

Consider the following before purchasing shares in Vanguard Index Funds – Vanguard Growth ETF:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Vanguard Index Funds – Vanguard Growth ETF wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $808,105!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns June 10, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool holds and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Vanguard Index Funds-Vanguard Growth ETF, Vanguard Index Funds-Vanguard Total Stock Market ETF, Vanguard Index Funds-Vanguard Value ETF, and Vanguard S&P 500ETF. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

$20,000 in this Vanguard ETF carries only an $8 annual fee, and has beaten the S&P 500 and Nasdaq Composite in 2024. Originally published by The Motley Fool