Sentiment about shares can change significantly, especially over a five-year period. This applies to both the artificial intelligence (AI) industry and AI-powered stocks. As technology has advanced, many AI stocks have fallen out of favor, while others have risen to prominence.

Looking ahead five years, no one knows for sure which AI stocks will emerge as market leaders. Nevertheless, some stocks are likely to continue to play an important role in the AI industry for years to come, and three Motley Fool analysts think investors will likely reach 2029 feeling happy that they bought these companies.

Ready to the world’s need for greater cybersecurity

Jake Lerch (CrowdStrike): My choice is CrowdStrike (NASDAQ: CRWD)a leading provider of cybersecurity solutions with a proven track record in the industry.

Part of the reason CrowdStrike is a prime buy-and-hold candidate is the overall growth of the cybersecurity market. In short, cybercrime is everywhere and organizations now face enormous risks if they fail to secure their digital assets. Casino operators have seen their slot machines hacked, their billing systems compromised, and pipeline operators have seen their infrastructure shut down.

This presents a significant opportunity for companies like CrowdStrike as demand for cybersecurity solutions is poised to soar. Statista estimates that the global cybersecurity market will grow to over $500 billion by 2030, up from approximately $300 billion in 2022, indicating the potential for substantial growth in the sector.

As the overall market grows, CrowdStrike is leveraging its competitive advantages within the industry. The company operates a subscription-based model and sells access to its Falcon platform and several cloud-based, AI-powered security modules designed to protect endpoints, networks and data.

CrowdStrike is a one-stop shop and it’s clear that its customers love what it has to offer. As CEO George Kurtz put it, “Customers prefer our single-platform approach. … CrowdStrike is the preferred cybersecurity consolidator, the preferred innovator, and the preferred platform to stop breaches.”

As a result, CrowdStrike delivers exceptional financial results. In its most recent quarter (the three months ended January 31), CrowdStrike reported annual recurring revenue of $3.4 billion, up 34% from a year earlier. In addition, CrowdStrike was profitable for the fourth quarter in a row. This marks an important milestone in the company’s life cycle as regular profits have become the norm.

Finally, analysts expect CrowdStrike to grow revenue 30% this year and 27% next year. In summary, CrowdStrike remains an emerging company in a rapidly growing industry. Growth-oriented investors should take note; this shares seem poised for a bright future.

Buy this SaaS stock on the heels of its stellar quarter

Justin Pope (monday.com): My choice is monday.com (NASDAQ: MNDY), and it’s pretty obvious when you consider all the basics here. The company is firing on all cylinders, as evidenced by first-quarter earnings that were so good that Wall Street sent shares up about 20% on the news. What made investors so excited? The bottom line is that a company grows both its customers and its profits quickly.

Monday.com is a SaaS company that sells cloud-based software on a subscription model. The product is simple: it’s a collaboration platform that allows company employees to manage projects and collaborate on work tasks. The company calls itself a workplace OS, short for operating system.

The idea is that one or two people will start using the software, and the software will spread throughout the company as it becomes popular. That’s why Monday.com has an amazing 114% net revenue retention for customers with at least 10 users. In addition, the number of customers spending at least $50,000 annually grew 48% in the first quarter to more than 2,400.

Monday.com does this while posting record highs in cash flow and non-GAAP earnings of $0.61 per share, beating analyst estimates by $0.21. This company still boasts a modest market cap of $11 billion, which will provide investors with great returns if Monday.com eventually becomes a major player in the enterprise software space.

Monday.com does everything right, making the stock worth further investigation by long-term investors. Those who look five years ahead could have a gem in their hands today.

This AI pioneer isn’t going anywhere

Will Healy (Alphabet): Although it’s surprising how quickly investors have soured on the AI prospects Alphabet (NASDAQ: GOOGL) (NASDAQ: GOOG) This past year I opted for the Google parent. The company has long been dominant in search and first integrated AI into its search tool in 2001. Since then, it has applied AI to all its applications and products, declaring itself an ‘AI first’ company in 2016.

Nevertheless, the rise of OpenAI’s ChatGPT appeared to have caught Alphabet off guard. The search tool faced a meaningful competitive threat for the first time in years Microsoft‘s Bing partnered with ChatGPT.

Furthermore, when Alphabet responded with its generative AI product Gemini, users gave it mixed reviews. Although it recently rolled out AI-native search to all users for the first time, investors seem more optimistic about the AI of other megatech companies such as Microsoft or Amazon.

Despite missteps, however, it is probably premature to rule out Alphabet. In addition to its extensive experience in the AI field, Alphabet invests a lot in research. Of the companies Alphabet owns, it has merged subsidiaries into Google DeepMind, which takes a multidisciplinary approach to developing AI applications.

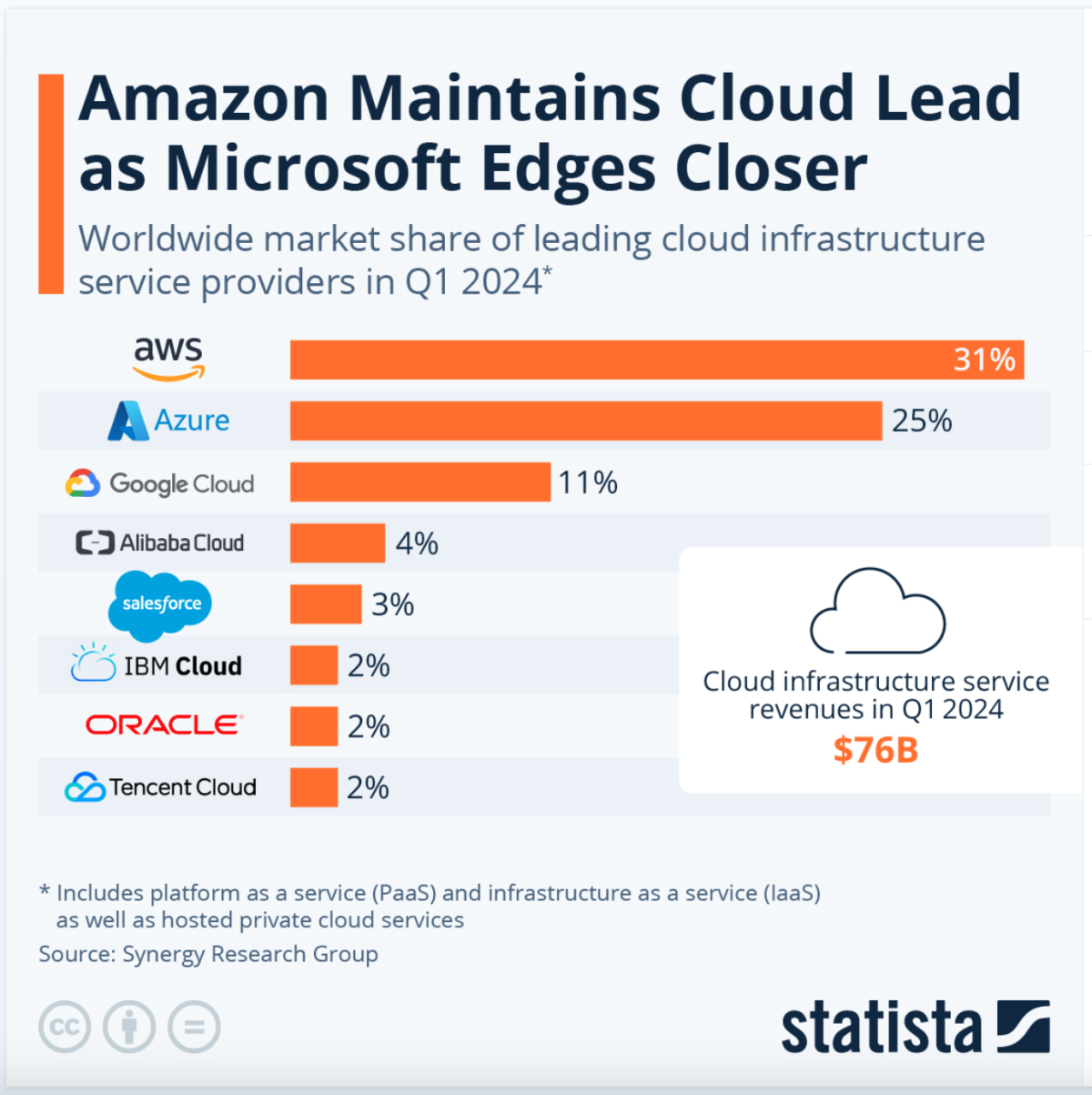

Moreover, Google Cloud, which uses and supports AI applications, is one of the fastest growing segments. In the first quarter of 2024, sales rose 28%, compared to 15% for the company as a whole. It has also grown to become the third largest cloud provider.

Moreover, Alphabet has enormous resources to back DeepMind and Google Cloud or acquire other companies. At the end of the first quarter, the company claimed $108 billion in liquidity, an amount unmatched by almost all of its potential competitors.

Incredibly, the cash pile could continue to rise. In the first quarter alone, Alphabet generated nearly $17 billion in free cash flow, and for all of 2023, that free cash flow was more than $69 billion. This, together with existing AI technologies, gives Alphabet tremendous freedom of choice as it strives to remain a leader in AI and related industries.

Where you can invest $1,000 now

If our analyst team has a stock tip, it could be worth listening to. The newsletter they have been publishing for twenty years, Motley Fool stock advisorhas more than tripled the market.*

They just revealed what they believe to be the 10 best stocks for investors to buy now… and CrowdStrike made the list — but there are nine other stocks you might be overlooking.

View the 10 stocks

*Stock Advisor returns May 13, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jake Lerch has positions in Alphabet, Amazon and CrowdStrike. Justin Pope has positions in Monday.com. Will Healy holds positions in CrowdStrike. The Motley Fool holds positions in and recommends Alphabet, Amazon, CrowdStrike, Microsoft and Monday.com. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has a disclosure policy.

3 Artificial Intelligence Stocks You’ll Be Glad You Bought in Five Years Originally published by The Motley Fool