When you scan the market for dividend stocks, you’ll certainly notice companies with high yields. But what’s perhaps even more impressive is when companies pay and increase their dividends every year, regardless of what the economy is doing. Consistent dividend increases often coincide with financial health and steady earnings growth.

Emerson Electric (NYSE:EMR), NextEra Energy (NYSE: NO)And Clorox (NYSE: CLX) don’t have dizzyingly high yields. But all three companies are well on their way to continuing their streak of dividend increases for decades to come.

That’s why all three dividend stocks are worth buying now.

Repositioning the company in growth markets will ensure further dividend growth in the future

Lee Samaha (Emerson Electric): After adjusting for stock splits, Emerson Electric has increased its dividend every year since 1956, and its growth potential means there will be plenty more to come.

The industrial company has undergone a transformation in recent years as management steers the company toward a future focused on automation and related markets such as test and measurement, industrial software and smart grid solutions.

The idea is to reposition the company in growth markets that benefit from long-term megatrends such as automation of labor, the electrification of everything, the delocalization of manufacturing (which means greater demand for automation and smart factories), and the digital revolution in manufacturing and processing.

After selling the remaining assets of its climate technology business, acquiring automated test and measurement company NI and completing a transaction that resulted in a 55% stake in an industrial software company Aspen technology (NASDAQ: AZPN)management has positioned the company for future growth.

That growth is likely to occur only after some end markets recover from a slowdown in 2024. For example, investment in factory automation and test and measurement activities is currently weak due to an economic downturn and a withdrawal of investment from industrial customers in production capacity (factory automation) and research and development (test and measurement).

A lower interest rate environment will help in 2025, and the underlying long-term trends discussed above will continue, allowing Emerson Electric to generate the 4% to 7% organic revenue growth that management expects to achieve regardless of the ups and downs of the economic cycle.

With three decades of dividend growth under its belt, NextEra Energy plans to increase its payout even further

Scott Levine (NextEra Energy)): One lesson you may remember from the beginning of your investing journey is that past performance is no guarantee of future results. But it can still be helpful to look at past performance.

Take utility company NextEra Energy, for example. The company has increased its dividend for 30 years in a row, and while there’s no guarantee it will continue to do so for the next 30 years, that’s certainly a good sign. And that’s just the beginning. For those looking to supplement their passive income streams, NextEra Energy stock — along with its 2.5% forward-yield dividend — seems like an attractive option right now.

Conservative investors won’t just find the past 20 years of dividend increases appealing; steady earnings and cash flow growth have supported the dividend. From 2003 to 2023, NextEra Energy has increased its dividend at a compound annual growth rate (CAGR) of 10%. Likewise, adjusted earnings per share (EPS) and operating cash flow have grown at CAGRs of 9% and 8%, respectively, over the same period. Lest investors speculate that this means the dividend increases are putting the company’s finances at risk, consider that the company has averaged a payout ratio of 60.2% over the past 10 years.

All of these accomplishments should give investors confidence that the company will achieve its adjusted EPS guidance of $3.23 to $3.43 for 2024, with a CAGR of 6% to 8% through 2027. Operating cash flow is expected to grow at the same rate or higher. Management expects to increase its dividend at a CAGR of 10% per share to $2.06 in 2024 through 2026.

Shares of NextEra Energy have been trading at a five-year average operating cash flow multiple of 15.6. They are now trading at a discount to about 12.3 times operating cash flow. This stock looks ripe for the picking.

Clorox still has room to run after hitting record high

Daniel Foelber (Clorox): Clorox hit a 52-week high this week, but there’s still reason to believe the consumer staples stock is worth buying right now.

Clorox began paying dividends in 1986. It has increased its dividend every year since then. Despite the increase in its stock price, Clorox still yields 2.9%, which is higher than the average yield of 2.6% in the consumer discretionary sector.

Clorox has soared since its steep sell-off this summer, with the stock now up 24% in just three months. That’s a big move for a tough company like Clorox.

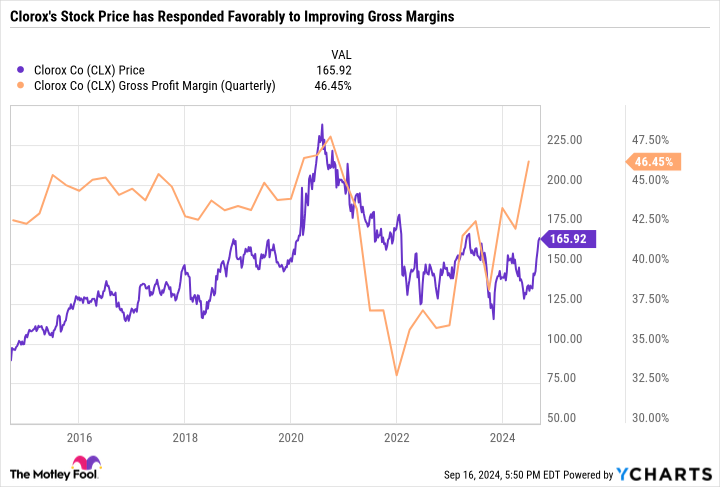

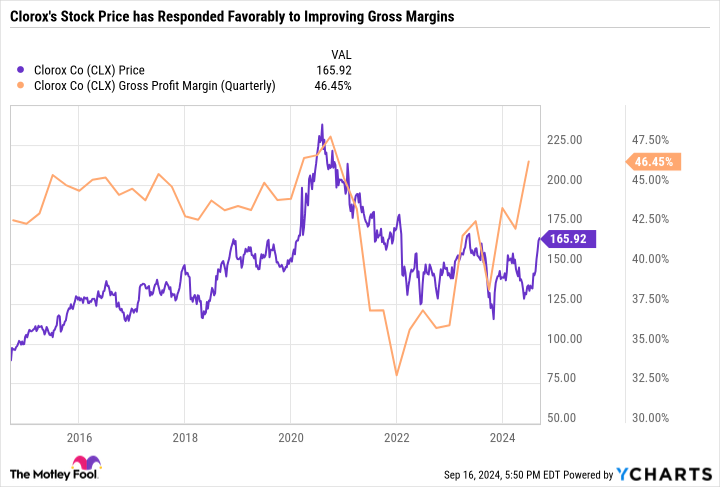

The rebound is likely due to improved gross margins. Clorox’s margins initially rose during the height of the COVID-19 pandemic, but then fell again after Clorox over-relied on consumer demand for cleaning products and hygiene. As the following chart shows, Clorox’s stock price has returned to roughly its pre-pandemic highs, and so have its gross margins.

It took a few years and a few operational blunders, but Clorox has finally found its feet. Management expects gross margins to expand another 100 basis points in fiscal 2025. It also expects $6.55 to $6.80 in adjusted EPS. At the midpoint, that would be an 8% increase from fiscal 2024 and would give Clorox a forward price-to-earnings multiple of 24.9 on an adjusted basis. That’s not dirt cheap, but it’s reasonable if Clorox can continue to deliver high-single-digit earnings growth.

Clorox is known for its flagship cleaning products, but the company owns a variety of brands in categories such as cleaning, home care, wellness, and lifestyle. You might be surprised to learn that Clorox owns Brita, Burt’s Bees, Glad, Hidden Valley, Kingsford, Pine-Sol, and dozens of other brands.

When Clorox is at its peak, it’s a diversified conglomerate with high-margin products that lead or are close to leading their categories. Clorox hasn’t been at that level for a while, but it’s coming back, making now a great time to buy shares of this high-quality dividend stock.

Should You Invest $1,000 in Emerson Electric Now?

Before you buy shares in Emerson Electric, you should consider the following:

The Motley Fool Stock Advisor team of analysts has just identified what they think is the 10 best stocks for investors to buy now… and Emerson Electric wasn’t one of them. The 10 stocks that made the cut could deliver monster returns in the years to come.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $694,743!*

Stock Advisor offers investors an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks each month. The Stock Advisor has service more than quadrupled the return of the S&P 500 since 2002*.

View the 10 stocks »

*Stock Advisor returns as of September 16, 2024

Daniel Foelber has no position in any of the stocks mentioned. Lee Samaha has no position in any of the stocks mentioned. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Emerson Electric and NextEra Energy. The Motley Fool has a disclosure policy.

3 Dividend Stocks You Should Buy Now That Have Increased Their Payouts for At Least 20 Years in a Row was originally published by The Motley Fool